“Recurring billing” might sound scary to your customers, and you need to understand that. Recurring billing has the ring of a credit card scam or some interminable spiral of debt. Don’t forget: There are few things people protect more aggressively than their money.

This puts marketers in a tough position. One the one hand, we know that recurring billing is a powerful strategy. It gives businesses higher revenue and more loyalty, according to a MasterCard survey.

But not all customers are eager to latch on to your recurring billing program.

Why? Because of fear, and because of popular financial advice. Some financial experts even advise completely getting rid of cards, which nearly destroys any possibility of recurring billing.

No credit cards means no recurring billing.

No credit cards means no recurring billing.

Some of the common financial advice goes like this: “Don’t put monthly bills on auto debit.”

Consumers often get this type of financial advice.

Consumers often get this type of financial advice.

Customers hear horror stories of people whose life savings were completely destroyed by an automatic bill paying gone awry. They decide to avoid it at all costs.

That’s why recurring billing is a challenging sell to some customers. Is it possible to start a recurring billing program that won’t scare people away?

The answer is yes, absolutely. I’m going to share with you nine techniques for doing so, no matter if you’re setting up recurring billing for physical or digital products.

[Tweet “How Not to Scare Customers with Recurring Billing”]

1. Educate your customers.

This first method is broad and far-reaching. Its implications and applications are broad enough to cover a variety techniques and methods.

The best way to fight fear is with knowledge. The knowledge that you provide through your content marketing or email marketing effort will help to dismantle walls of resistance built through fear.

Here are some of the ways to educate users on the advantages of recurring billing:

- It’s convenient.

- It reduces the risk of identity theft.

- It eliminates hassle.

- It makes things more convenient.

- It saves time.

- It’s easy.

- It’s safe.

How do you educate your users? It happens through consistent and intentional content marketing.

Beyond just the customary reminders about billing itself, you can broaden your customer “education” to include content on the advantages of your service as a whole. For example, explain how specifically the subscription model is the best way for them to purchase.

If you sell shaving supplies, then explain how often shaving blades need to be replaced. If you sell socks, show how easily socks wear out. If you sell snacks, coach your customers on how often they need to eat snacks for optimal health

KidStir provides a list of reasons why you might want to subscribe to their service. Their reasons reinforce the subscription billing model without referring to it explicitly.

The process is relatively simple. All you need to do is explain to customers that a subscription model makes sense for the particular product they are purchasing.

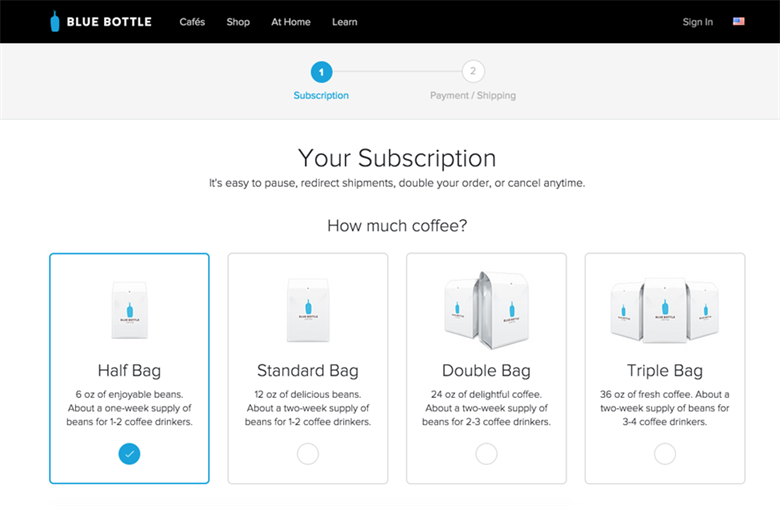

What about coffee? BlueBottle shows how a subscription model makes sense. Plus, they give exact measurements regarding the package size, how long a supply will last, and how many coffee drinkers it’s good for.

Taster’s Club, a whiskey subscription service, takes their education to a whole new level. They automatically enroll customers in a Whiskey 101 course. Not only do you get your monthly bottle, but you get lots of information, too.

Inform customers as often as possible about the advantages of subscription billing for your particular product or service.

2. Set recurring billing as the only way to purchase your product or service.

The best way to funnel users into your recurring billing program is to make it the only way. When recurring billing is the only way, it leaves no doubt in the customer’s mind that this is how they should proceed. Fewer choices mean easier choices.

[Tweet “”Fewer choices mean easier choices.” @NeilPatel”]

Notice how Dollar Shave Club does this. The final step of their signup process is to enter billing information. There is no other way to go than through a monthly subscription:

Giving the customer only one way to sign up increases their confidence that recurring billing is the right way. Providing a choice makes the decision more difficult. If you give them a choice between recurring vs. non-recurring, skeptical customers are more likely to choose what they perceive as the “safe” alternative — non-recurring billing.

ManPacks calls their recurring billing service “auto-ship.” This term change eliminates the “automatic payment” phrase, which can be an alarm signal. Auto-ship is automatic, and customers are reminded of each delivery.

Simplify things for yourself, and reduce the skepticism of the customer by setting recurring billing as the only choice.

3. Add testimonials.

Testimonials are a critical part of improving conversions. Testimonials are also directly linked to the success of a recurring billing program. If you’re skeptical of the validity of testimonials, read this case study.

A potentially fearful customer reads a testimonial, gains the confidence he needs to make the purchase, and follows through with recurring billing.

ManPacks features a testimonial, which provides subtle reminders about the recurring aspect of the service:

4. Make it easy to sign up.

When you make it easy to sign up, you’re doing both yourself and the customer a big favor. You get the benefits of a quick, fluid conversion funnel. The customer, for her part, is rewarded by having little to no cognitive friction in the signup process.

When a customer senses that the signup process is laborious or complicated, he becomes sensitive to risk. Long forms — reminiscent of a passport application or IRS form — signal to the user that he is doing something too serious.

Urthbox uses rich visuals and animation to make their signup process very easy. Here’s the pathway to checkout:

First, you select a box:

Next, you select your billing plan.

The health options come next:

Then, you’re ready to pay:

The entire process could have been a lot more complicated. After all, you are making decisions regarding size preference, quantity, frequency, allergen precautions, taste preferences, and other issues. Urthbox simplified the process, making the signup experience friction free.

5. Make it easy for customers to cancel at any time.

Users need some reassurance that they can cancel at any time. Lincoln Murphy addresses SaaS companies when he tells them to “make it easy to cancel.” When he implemented this easy-to-cancel technique with GetResponse, they experienced a 15% reduction in cancellations:

BTW, what I’m going to tell you got GetResponse an almost instant 15% drop in cancellations pretty much overnight. This is powerful stuff.

The cancellation button shouldn’t be hidden in some deep page. Provide customers with the easiest possible solution to cancelling. It is a good idea to inform them of the cancellation policy up front. Simply knowing that it’s easy to cancel makes them more likely to give recurring billing a try.

Here’s the cancel information for BlueBottle:

KiwiCrate, which offers a variety of different subscription puts the “cancel anytime” phrase under each of their choices:

KidStir, a monthly cooking kit for kids, provides the “cancel anytime” verbiage directly on the join page.

DoodleBug sends “busy bags” for kids every month. Their signup page provides an easy reminder regarding cancellation:

Customers who decide to cancel are sometimes in panic mode. Either they realize that they have gone way too long in their subscription or are running out of money.

Whatever the case, if they feel like they can’t cancel, they might do something drastic — lawsuits, a social media frenzy. You don’t need that kind of mess on your hands.

Provide customers with an explanation on how to cancel their account, and make sure that you share this information publicly. In other words, cancellation information shouldn’t be gated in a members-only section of the site.

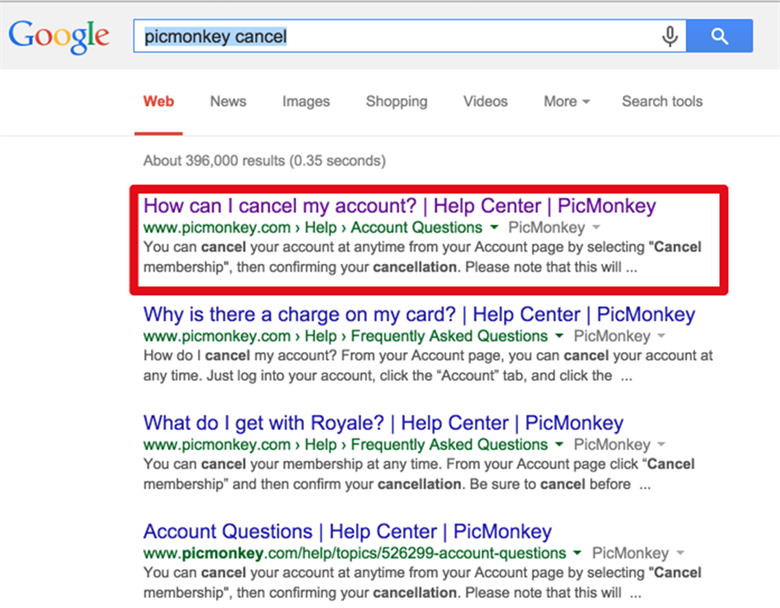

Why is this important? A customer who wants to cancel might just Google their query instead of logging in to their member dashboard.

A good example of this is Picmonkey. If you Google “picmonkey cancel,” you get a page that explains how to go about ending your membership:

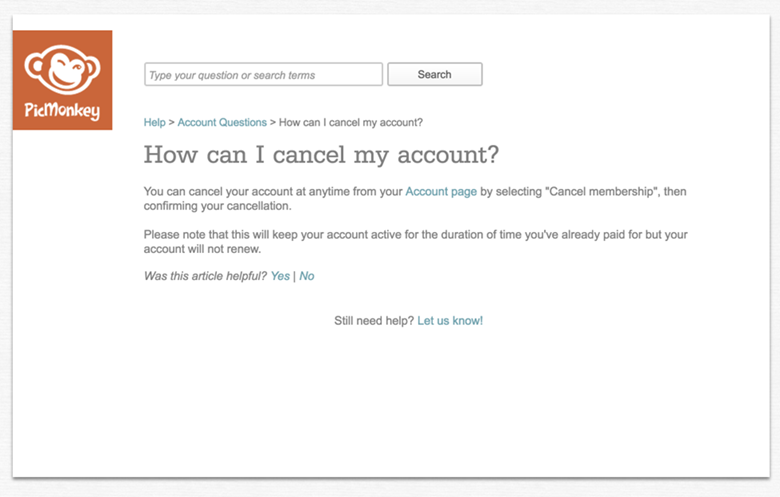

Clicking that result brings you to this page:

6. Make sure your statements and process are branded or your business identity is clearly stated.

Whenever you send a statement or monthly reminder, make sure that you provide clear information as to the identity of your company.

Remember, a customer signed up for a service from your company, not from some dunning management service or accounting department.

MasterCard’s white paper on recurring billing provides this advice:

It can be as simple as Automatic Bill Pay, or a name that also incorporates your brand image. A brand name says the program is a customer benefit, not merely an accounting function.

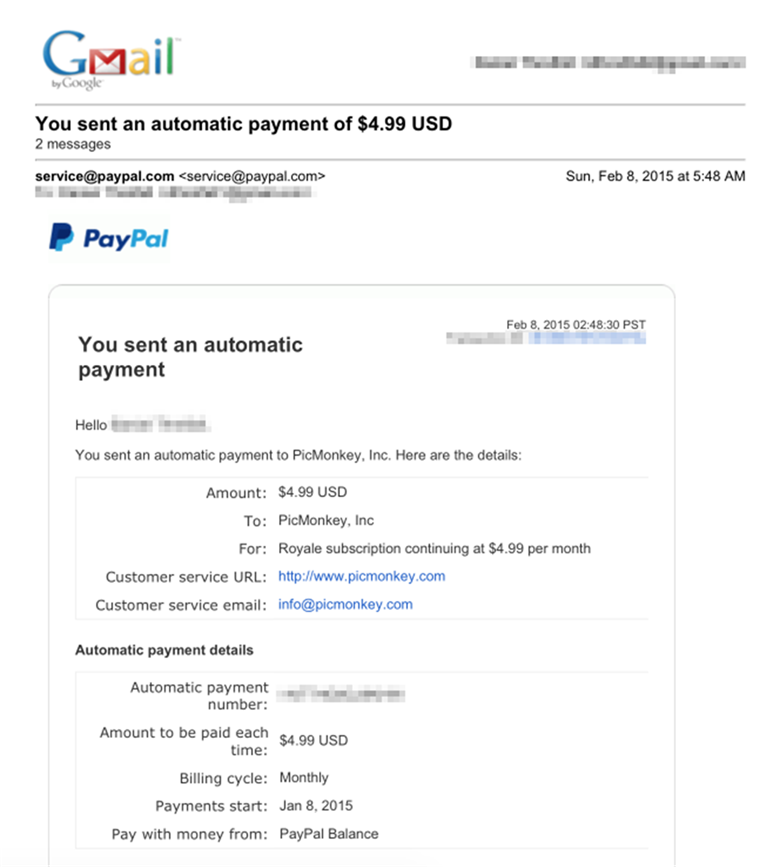

If you use a PayPal as the payment method, you have fewer options for customization. However, you can still feature your company name in the automatic payment notice. Here’s a bill reminder from PicMonkey. It’s PayPal branded, but the company name is featured in the information:

7. Bills must be for a consistent amount.

In a consumer survey on recurring billing, researchers found that 89% of the customers considered consistency to be an important factor in recurring billing.

Basically, customers don’t want to get charged a penny more than they signed up for. Even in the area of shipping charges — something that should be standard — customers view it as a major turnoff.

In one survey, 76% of customers rated shipping charges as their number one turnoff in ecommerce transactions. You may not have shipping charges, but are there any extra potential charges that a customer might see on their bill? If so, you need to make this extremely clear.

8. Remind them about security.

Security is a big deal for most people. With predictions of even more security upheaval, it takes a lot of careful persuasion to get someone to share their credit card information online.

How do you do it? Provide security signals. Simple techniques such as HTTPs, and security symbols can help to improve trust.

Baymard’s survey discovered that the Norton seal is one of the primary checkout security seals.

Your users may not have a technical knowledge of encryption techniques or secure sockets layers, but they do know when a site looks and feels trustworthy. Here’s how Baymard explains it:

It’s not the actual security of your page that matters the most to users as they have little to no technical understanding of TLS/SSL encryption or even how forms are submitted. Rather it is the perceived security that’s of importance to this vast majority of users.

Using terms like “SSL” may help to improve their trust, even if they don’t fully understand it.

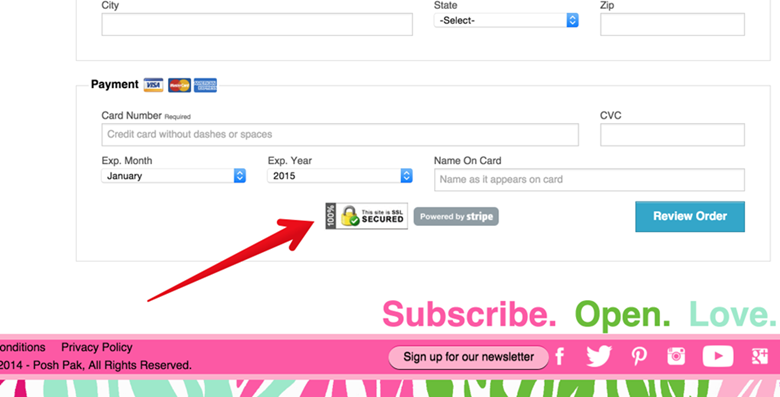

Here’s how PoshPak, a monthly subscription box, adds a security reminder:

Their checkout page also includes a security seal.

According to the data, 57% of customers think that lack of security is a “top ecommerce major turnoff.” Make sure you’re protecting your customers with as much security as you can.

9. Provide an itemized statement for each bill.

If the customer gets billed each month without some sort of reminder, it can be scary. Maybe they forgot that they signed up. Maybe they did it when they were drunk. Maybe it happened so long ago that they forgot altogether. Maybe their domestic partner did it. Maybe a thief did it!

Whatever the case, you want to provide the courtesy of regular information to the customer regarding their purchase. This is as simple as a monthly statement or reminder.

As mentioned above, be sure to send a branded invoice. Try to adopt a friendly tone. People aren’t usually thrilled about parting with their money, or reminders thereof.

ConclusionEach of the above provides ways to assure customers that recurring billing isn’t so scary after all. But want to know the panacea solution? It’s this: Know your customers.

The better you know your customers, the more effective you’ll become at understanding their needs and serving them. Everything depends on it. Knowing what trust signals to use, the type of testimonials to feature, the style of reassurance to offer — all of this depends on a deep knowledge of your customers.

The more you learn about your customers, the better you’ll deliver the kind of no-scare solution for recurring billing.

What is your experience with persuading users into recurring billing?