Choosing to launch an LLC in Oregon provides personal liability protection and tax benefits for your new business. The process is very straightforward, it only takes a few minutes, and it will save a lot of stress down the road.

To ensure everything works out just right for you, here’s a step-by-step guide to help you start an LLC in Oregon.

The Best LLC Services for Starting an LLC in Oregon

Save yourself a trip to the Oregon Secretary of State by completing all the important paperwork online. These are the LLC services we recommend:

- ZenBusiness – Best for Most

- Incfile – Best Range of LLC services

- LegalZoom – Best for Speaking with Attorneys

- Inc Authority – Best for Skipping Service Fees

- BizFilings – Best for Choosing the Right Entity Type

These companies can provide registered agents services and help you decide if an LLC is the best business formation for you.

Why Starting an LLC in Oregon Is Worth It

If you’re an Oregon-based entrepreneur, the fastest and easiest way to start your business is by creating an LLC.

An LLC is a business entity comprising one or more members who own the business. If all the LLC formalities are followed diligently, each LLC member gets personal liability protection that protects them from the company’s debts and obligations.

So if your business ever gets sued, your car, bank balance, and other personal assets will remain protected.

Additionally, the process of filing, managing, and compliance is pretty quick and convenient. There are not many regulations or administrative procedures to worry about, allowing you to focus on running your business.

Easy tax filing and potential advantages for tax treatment are other benefits.

Oregon LLC business owners or managers who take profits out of the company only have to pay self-employment tax known as FICA, Social Security, or Medicare tax. Plus, the annual fee is also pretty nominal. No other taxes are imposed on owners.

The Investment Needed to Start an LLC in Oregon

All Oregon business owners have to pay the main cost of forming an LLC, which is $100. This is needed to file the company’s Articles of Organization online with the Oregon Secretary of State.

Oregon has also made it compulsory for LLC owners to file an annual report with the Secretary of State. You can submit this form and pay the $100 annual report fee through the Oregon Secretary of State website. This is due each year by the date on which the LLC was formed.

Here’s a list of other LLC optional costs to consider:

- LLC name reservation — $100

- DBA (Doing Business As) name — $50

- Certified document copies — $15

- Certificate of existence — $10

Oregon also requires agency owners to appoint a registered agent.

Assuming you decide to use a third-party registered agent service to keep your company in compliance, you’ll have to shell out some money for it. The good news is some companies, like Rocket Lawyer, are excellent third-party registered agent services. Many business formation services provide registered agent services free for the first year, but then you’ll have to pay $100 to $150 per year on average.

Yes, you can be your own registered agent. But hiring someone else at a nominal fee is much better, considering you’ll be more at peace.

If you already have an LLC registered in another state and want to expand your business into Oregon, you’ll have to register your LLC as a foreign LLC in Oregon by paying $275.

Then your business might need to pay for applicable federal, state, and local permits and licenses to operate legally in Oregon.

5 Steps to Start an LLC in Oregon

Now, let’s take a look at what you need to do to get your business up and running in the state of Oregon.

Step 1: Name Your LLC

Under Oregon law, all LLCs operating in the state should have a business name that includes the words “limited liability company” or the abbreviation LLC or L.L.C. Without approval, the name can’t contain restricted words or phrases, such as bank, attorney, or university.

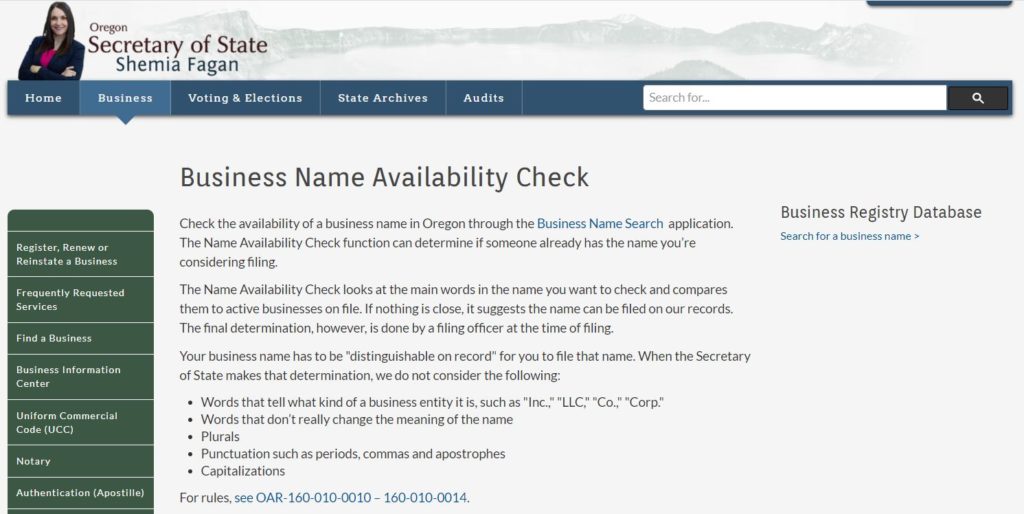

At the same time, your LLC’s name must be distinguishable from other business entities already operating in Oregon. You can check name availability by visiting the Oregon State of Secretary business name database.

Make sure your business name is catchy and memorable and fits your industry and brand.

Step 2: Appoint a Registered Agent

Once you select a name for your company, the next thing on your agenda is appointing a registered agent in Oregon.

As mentioned, Oregon has made it mandatory for LLCs to designate a registered agent for the company. A registered agent will act as your point of contact with the state government and receive important legal notices and updates from the Oregon Secretary of State on the company’s behalf.

This person can be any individual or business entity if they have a physical address in the state (not a PO box) and meet other Oregon requirements. Moreover, they need to work in-state and be available for contact between 9 AM to 5 PM every day.

Technically, you can be your own Oregon registered agent, but the cons far outweigh the pros. Here are a couple of reasons why you might want to reconsider being your own registered agent:

- You won’t have any freedom to leave the office since the registered agent has to be present at the office during all regular business hours.

- The registered agent’s address is part of the public record, so if you have a home-based business, you’d be publicizing your home address.

- If you change your office address, you have to refile forms and pay additional filing fees. But if you work with an outside agent service, you can change your registered agent address as needed without having to refile registered agent paperwork.

We highly recommend using Rocket Lawyer. It offers excellent registered agent services that make complying with state laws easier in Oregon. Additionally, it stores all your legal notices online, which gives you on-the-go access without compromising security.

All Rocket Lawyer registered agents are highly experienced and have served thousands of growing businesses in the past. They are available in all 50 states and will scan and email you any important documents and legal notices.

Step 3: File Your Oregon Articles of Organization

At this stage, you’ve completed two critical tasks: naming your business and appointing a registered agent.

All that’s left to make your company official is filing your Articles of Organization through the Oregon Secretary of State website.

Many people find filing official government documents intimidating. However, in Oregon, the process is fairly straightforward—provided you have the right guidance.

You’ll need the following information to fill in and submit the Articles of Organization form:

- Your LLC’s full name, including the LLC designator you’ve selected

- Your LLC duration. This will be “perpetual” if you do not have an end date in mind. Otherwise, simply specify the date when the LLC will dissolve.

- Your LLC’s principal office address

- Your registered agent’s full legal name and operating address in Oregon. You can also designate a secondary address if their mailing address differs from their operating address (but both should be in-state).

- Your LLC management structure, i.e., whether it’ll be member-managed or manager-managed

- The type of industry your company falls into

- Whether you’re forming a benefit company (a company whose purpose is to create a positive impact on society and the environment)

- Names and addresses of all the LLC’s members (owners) and any managers as they apply to your company

- Name and address of one member or manager who’ll have direct knowledge and understanding of the company’s operations

- Organizer signatures

You will also need to pay a filing fee, which you can submit along with the form online. If online filing doesn’t sound appealing, you can mail the form and filing fee to the following address:

Oregon Secretary of State

Corporation Division

255 Capitol St. NE, Suite 151

Salem, OR 97310-1327

Once you get the approved physical paperwork back from the Oregon Secretary of State, your company will now be recognized legally as a business entity in the state. Congrats!

Be sure to store the documents safely along with your other critical documents, such as your operating agreement, contracts, member certificates, and so on.

Step 4: Create an Operating Agreement

Full Disclosure: Creating an operating agreement is not required by Oregon law, but it’s a recommended practice since it clearly lays out how your LLC is managed, along with certain operational procedures you intend to follow.

These agreements can be particularly useful for LLCs with multiple members to outline voting structures and profit management, which will help avoid misunderstandings down the line.

Even for single-member LLCs, an operating agreement can be very vital.

It’ll protect your business if you’re ever incapacitated and unable to manage your company by ensuring the company continues operating as you‘ve outlined. In its absence, your company will be run according to state law, which could be a poor management strategy for your company’s bottom line.

Keep in mind that you can always add more based on your requirements, but here’s a list of information an operating agreement should generally include:

- LLC’s name and principal address

- Duration of the LLC

- Name and address of the registered agent

- Information about the Articles of Organization

- Purpose of the business

- Members and their contribution

- The way profits and losses will be divided

- Procedure for admitting new members, as well as outgoing members

- Management of the LLC

- Indemnification and liability clauses

- Dissolution procedures

If you’re unsure how to draft an effective operating agreement for your LLC, take a look at our guide to creating one.

Step 5: Fulfil Your Tax and Other Regulatory Requirements

Additional thoughts and regulatory requirements may apply to your LLC, which is why you need to ensure all your bases are covered.

Typically, these requirements include getting an EIN, obtaining business licenses, and registering with the Department of Revenue (DoR). Let’s take a more detailed look.

- Getting an EIN: Your Employer Identification Number or EIN is a nine-digit number assigned by the Internal Revenue Service to identify your LLC for tax purposes. You can obtain this either through mail or online through the IRS. An EIN is crucial for filing and managing taxes at the state and federal level, opening a business bank account, and hiring employees.

- Obtaining Business Licenses: Depending on the type of business and applicable laws, your LLC may be required to obtain other state and business licenses. For more details, you can do a quick search on the Oregon License Directory.

- Registering With the Department of Revenue: If you have employees, you’ll have to register with the Oregon Department of Revenue (DoR). For more information, you can contact the Secretary of State’s office.

- Filing Annual Reports: Oregon LLC and foreign LLCs have to file an annual report with the Oregon Secretary of State. LLC annual reports are due for the year in which they are filed and must be received by the office of the Secretary of State before your company‘s anniversary date. Otherwise, you’ll find yourself paying a late fee. You’ll have to file a report online through the Oregon Business Registry. Keep in mind the annual report filing fee is $100 for domestic LLCs and $275 for foreign LLCs.

Next Steps

Now that we’ve discussed how to start an LLC in Oregon, it’s action time!

If you’re feeling intimidated or facing any difficulty, you can consider hiring an online legal service to get access to real-world attorneys. This will help simplify LLC formation and registration processes. What’s more, most of these services offer a money-back guarantee, assuring you of your peace of mind.

And don’t forget to maintain your LLC moving forward to keep it up to date.