We sat down with our very own accountant to create this post when researching this topic. We want to give you a true insider look into what accounting software should provide for your business. QuickBooks Online is the clear winner and the best for most people. It’s considered the gold standard for accounting software and comes with the most robust set of features. Spend more time running your business and less time manually tracking your finances while still reducing potential accounting errors.

The Best Accounting Software for Most

QuickBooks

Best for Most

QuickBooks Online is the most popular accounting software on the market. And it comes with a ton of features, including inventory management, invoicing, advanced reporting, automatic mileage tracking, expense categorization, automatic sales tax calculations, and more.

QuickBooks Online is cloud-based. It removes the difficulties of managing your own finances. It’s a virtual accountant when you need it without the price that comes with hiring one full-time or keeping a firm on retainer. Plus, it’s as beginner-friendly as accounting software can be.

There are numerous plans to choose from, starting at just $3.50 per month. That makes it one of the most affordable options out there, even for the smallest of businesses. But, as you’ll see, the software doesn’t skimp on useful features one bit.

The Best Accounting Software Options to Consider

- QuickBooks Online – Best for most

- Zoho Books – Best for service providers who want custom reporting

- Xero – Best for essential accounting features at a low price

- Wave – Best for businesses with no budget

- FreshBooks – Best for freelancers who want to get paid faster

- Sage – Best for small businesses that need essential features

When It Make Sense to Invest In Accountingf Software

If you are tired of fiddling around with spreadsheets, formulas, or bouncing between a gazillion tabs in your browser, it’s time you considered accounting software.

It simplifies all of your finances in a way that’s more efficient, giving you back your sanity and time. You can stop worrying about if you missed anything last quarter.

You might be the best at working with Excel and Google Sheets. But do you want to be?

Or, would you rather hit a few buttons and run a yearly report that itemizes all of your expenses, organizes your invoices, and reconciles all of your accounts?

You can also set up reminders for sending invoices and to remind clients that it’s time to pay you for the work you did.

Plus, you can get reassurance that your bookkeeping processes meet local, state, and federal regulations.

Overall, if you have to be your own accountant, bookkeeper, and financial analyst, shouldn’t it be easy?

And if you already have an accountant, bookkeeper or specialist, this software makes it simple to add them to the mix.

You control what they see and what they don’t. Just give them access, sit back, and enjoy how your accounting software better enables your financial team to do their work.

Let them run the reports, reconcile accounts, and consolidate your transactions into easy-to-read PDFs. Turn tax season from “oh no” to “we got this”.

#1 – QuickBooks Online — The Best Accounting Software for Most

QuickBooks

Best for Most

QuickBooks is the most popular accounting software on the market. And it comes with a ton of features, including inventory management, invoicing, advanced reporting, automatic mileage tracking, expense categorization, automatic sales tax calculations, and more.

Overall: 4.2/5

When it comes to easy accounting software, QuickBooks Online scores the best on this list. It’s beginner-friendly in every way.

Plus, as your business grows, there are other plans you can take advantage of as things become more complex.

QuickBooks Online has been around for 20 years—since 2001. It’s incredibly popular.

They have relationships with just about every financial institution. We looked and couldn’t find a single integration they lacked.

In fact, QuickBooks scored the highest on our list in almost every category we tested for. Let’s dive into the details:

- Ease of use: 5/5

- Syncing and reconciliation: 4/5

- Visibility into your books: 5/5

- Mobile app: 5/5

- Invoicing and billing: 3/5

- Pricing: 1/5

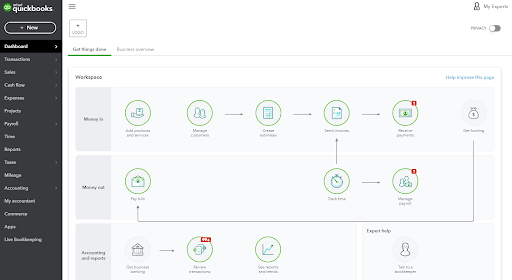

Ease of use: 5/5 – Setup is super easy because QuickBooks Online walks you through everything.

You have the option to explore the software with a guided tour or get started on your own.

When getting started, QuickBooks Online gently holds you by the hand as you go through the most important actionable steps, like linking your accounts, setting up invoices, and adding contacts.

You don’t have to guess about anything. From start to finish, you have QuickBooks Online guiding you.

What stands out about the process is you get a diagram of the setup process so you can see what comes next.

The circles with red notifications mean you have tasks to complete for that area.

If you hover over the item, you can see what it means. And if you want to go to that area of the dashboard, just click the circle and you’re instantly teleported there.

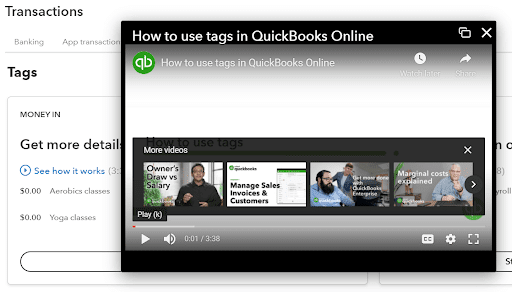

QuickBooks Online also makes using the software easier than most. It does a great job of teaching you little tidbits over time, giving you enough detail to use the software to its full potential without bombarding you with suggestions.

There are built-in video guides and tutorials on every screen. You don’t have to leave the software to learn—just click and they’ll pop up over the interface.

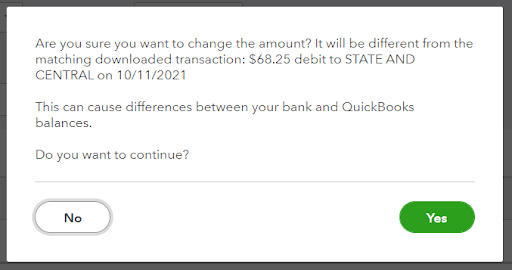

QuickBooks also eliminates errors that you might not have recognized you’ve made.

The software’s discrepancy and error notifications stop you from making mistakes and warn you about errors that require further attention.

This is hugely helpful if you manually make changes to transactions or when balances don’t match during reconciliation.

One last thing to mention is how simple they make getting in touch with the right level of customer support. There are three ways to get help when you need it.

You can use the 24/7 live chat for basic questions or pop over to the community forum for best practices and tips.

Or, if you need more in-depth issues resolved, you can request a call back at a time convenient for you so you’re not sitting around waiting on hold for a rep.

Overall, we could spend a month giving you all the little details of how simple QuickBooks makes managing your finances, but we think you get the point. Now, what about syncing your accounts?

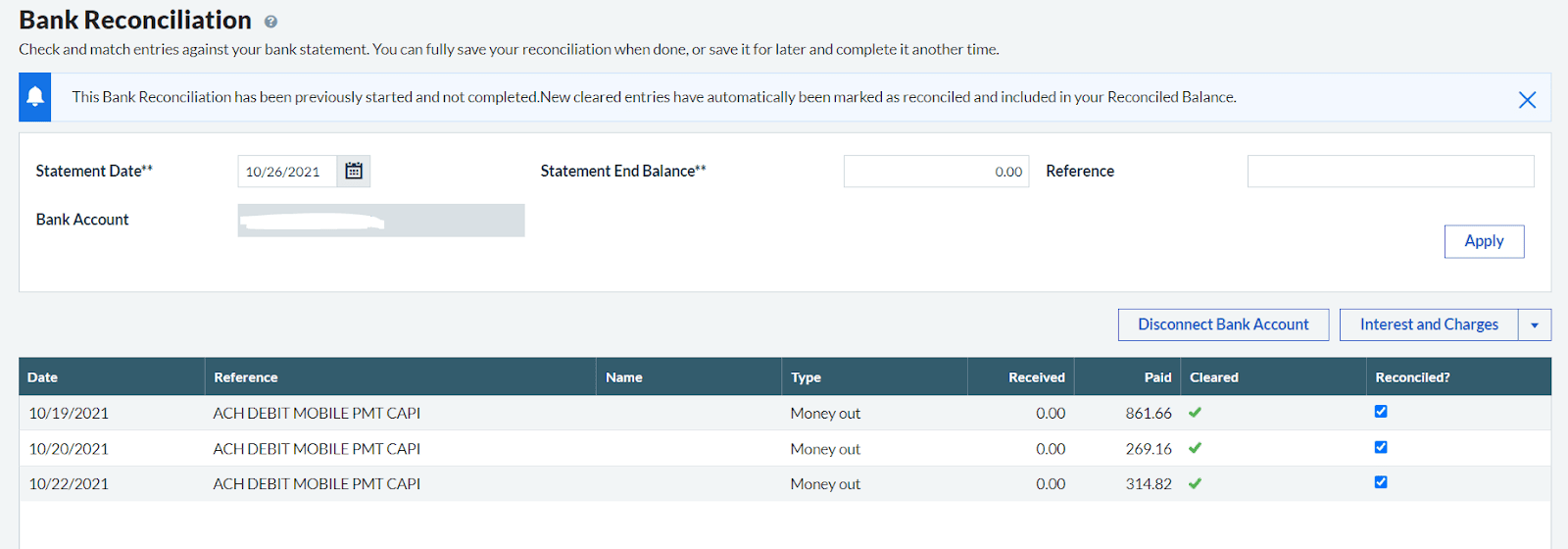

Syncing and reconciliation: 4/5 – QuickBooks offers the most functionality for syncing and reconciliation out of all the providers we tested.

One thing to note, however, is that new transactions aren’t automatically brought into QuickBooks Online.

There’s a button you have to click to refresh your bank feed when you’re ready to bring in recent transactions.

With that said, there’s a whole lot more to love.

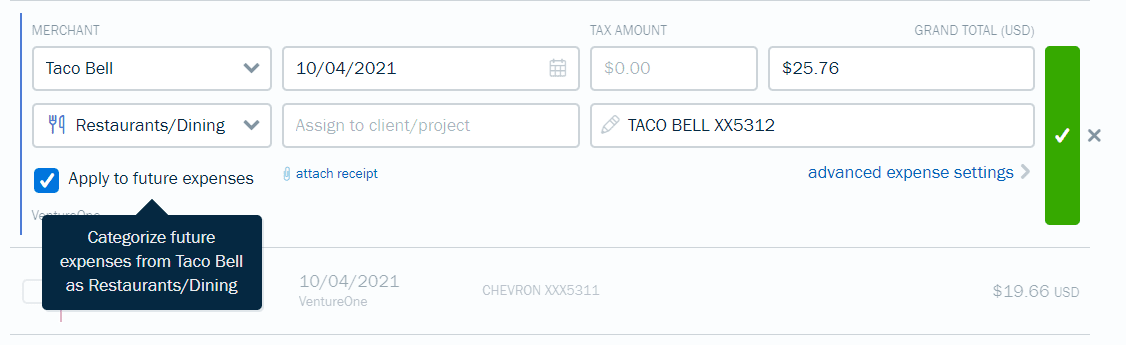

QuickBooks offers smart AI categorization, which takes keywords and uses them to organize transactions. It learns over time from your transactions and any categorization you do on your own.

You’ll never have to worry if your transactions end up in the right area again. We had to sift through about 150 transactions and this feature really helped speed up the process.

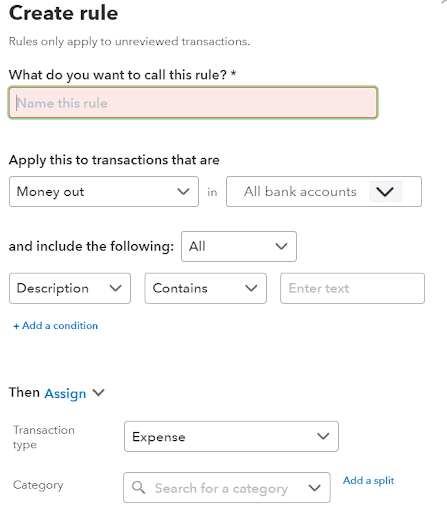

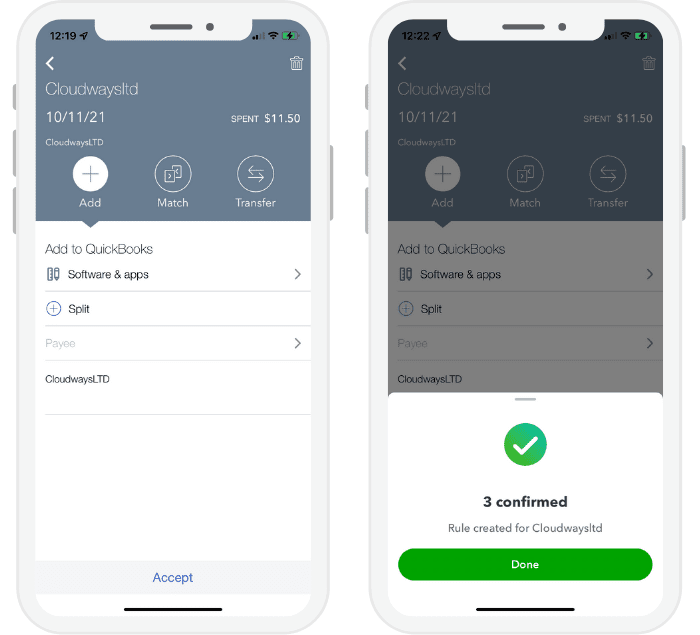

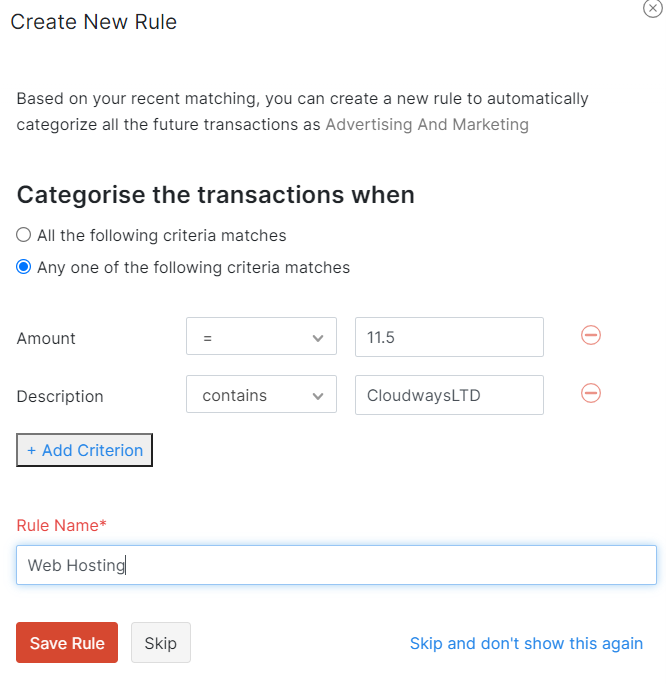

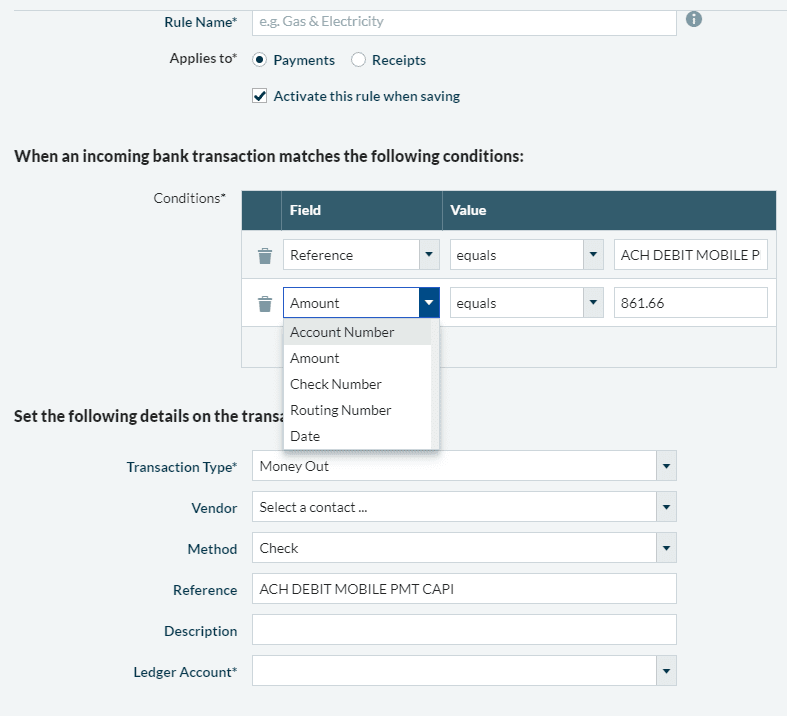

You can also set up custom rules for importing transactions so you don’t ever have to fill in any extra information after pulling something in.

After you create a rule, it’ll automatically apply to any new transactions that happen in the future, which can help streamline your reporting.

Create as many rules as you like and apply them to anything from incoming and outgoing funds and which bank accounts it should apply to to transaction types and categories, such as contractor expenses, advertising, insurance, and more.

One thing QuickBooks doesn’t do is reconcile and categorize your transactions at the same time. It’s totally separate. So, when it’s time to reconcile, you’ll need to go to a different area of the dashboard.

Take care of all the categorization up front, then check for discrepancies between your balance and the transactions listed.

Beyond that, it’s a cinch to look at and confirm transactions in bulk and scan receipts to extract data from them.

What’s really cool is that QuickBooks Online goes one step further with receipt scanning. You can pull info from the receipt to create a new expense in the system and match it to the right transaction from your bank when it comes in, or and just attach the receipt to an existing transaction.

When we tested this feature, we did so twice. Once with a mobile receipt and another time with a PDF receipt. Both worked seamlessly.

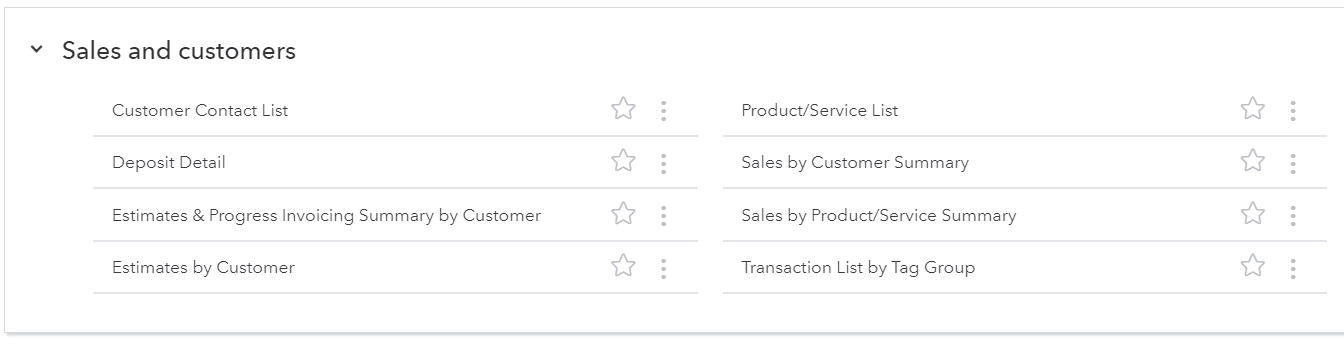

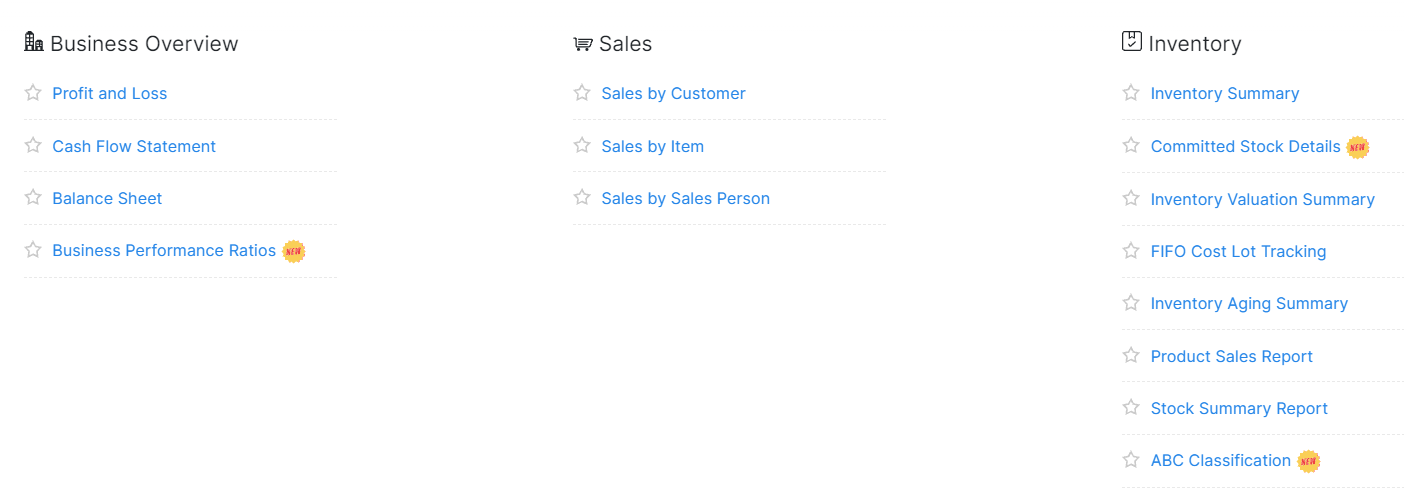

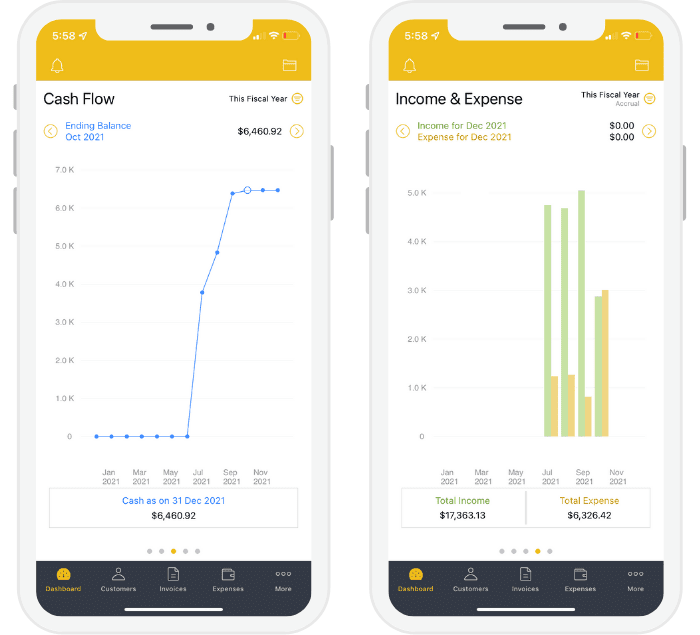

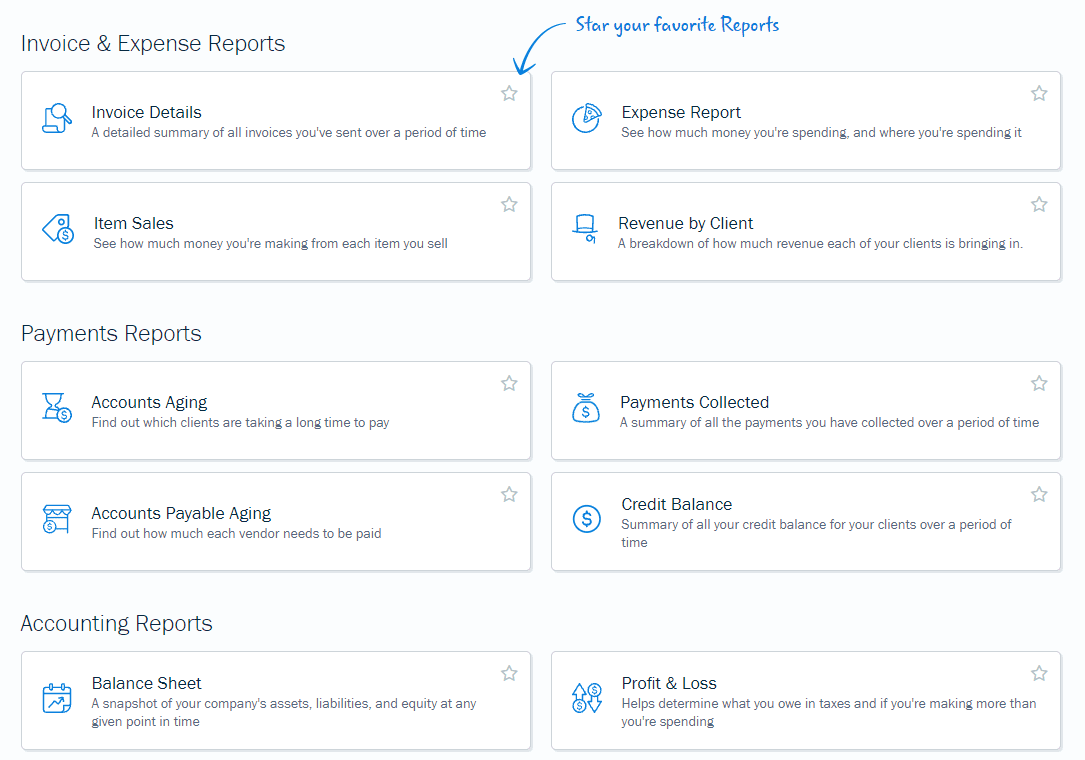

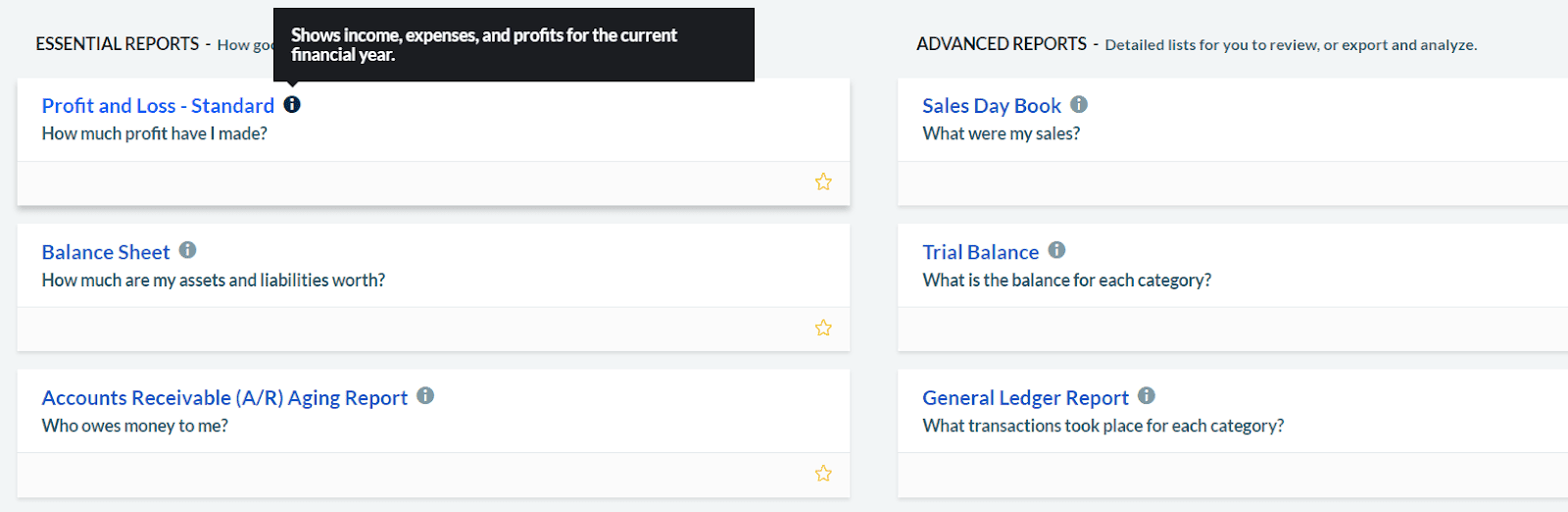

Visibility into your books: 5/5 – Quickbooks Online gives you crystal-clear visibility into your financial performance, with enough customization to get deep insight into the things that matter most to your business.

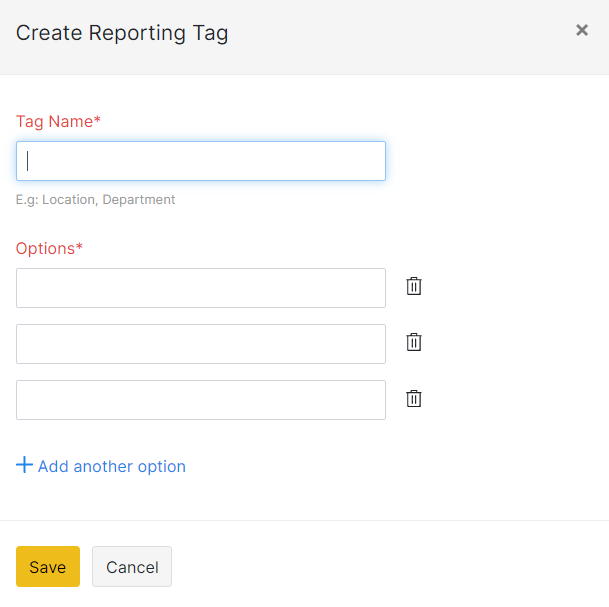

For one, you can use custom transaction tags to add granular detail without actually affecting your books. Separate expenses and income by entity, for example, if you’re running a few different shingles under one umbrella.

QuickBooks also gives you guidance on how to use reports and what they mean. It really helps you understand how you can use them.

This gives you the high-level overview without wasting time running a report you don’t need.

The entry-level plan comes with more than 30 reports, including profit and loss by customer, open invoices, sales by product or service, and sales by customer just to name a few.

All in all, QuickBooks does an excellent job providing pre-built reports that are actually useful and allowing you to customize them as needed.

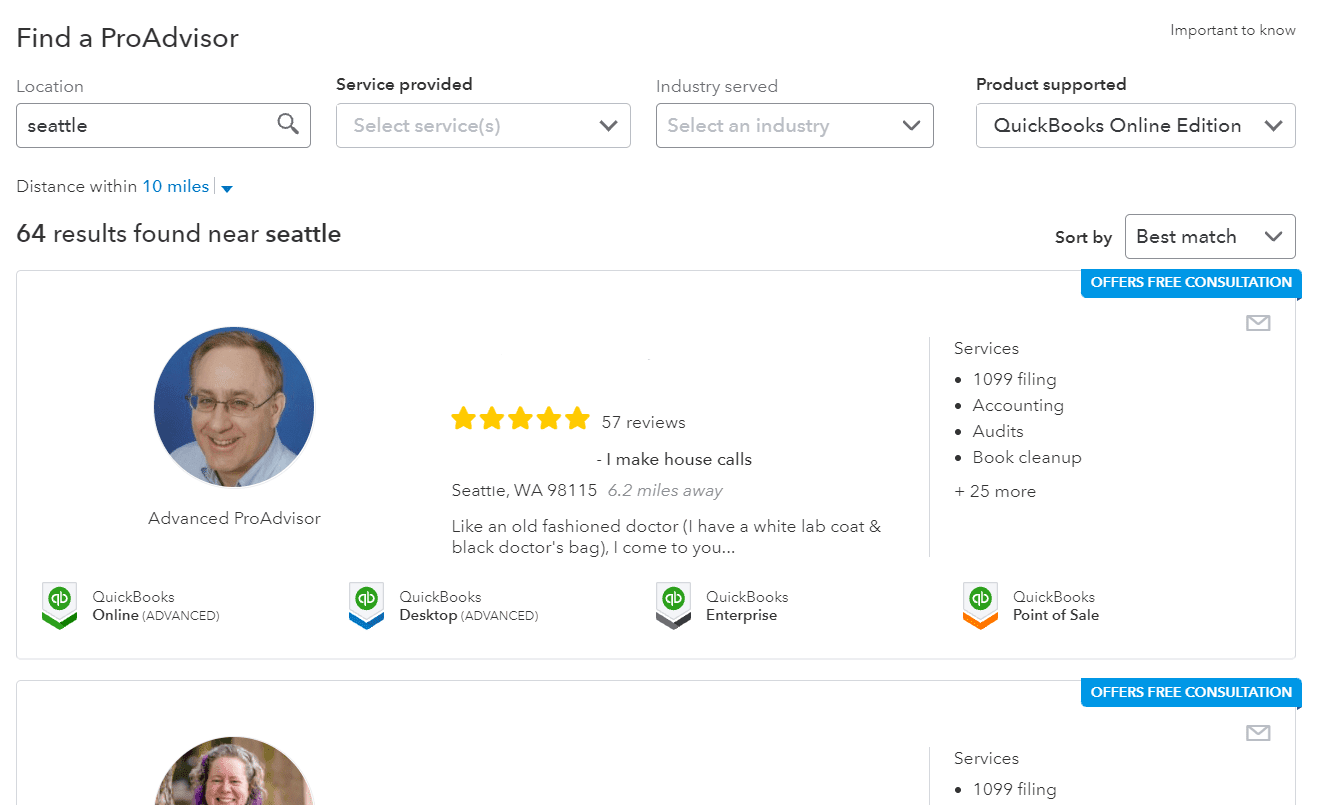

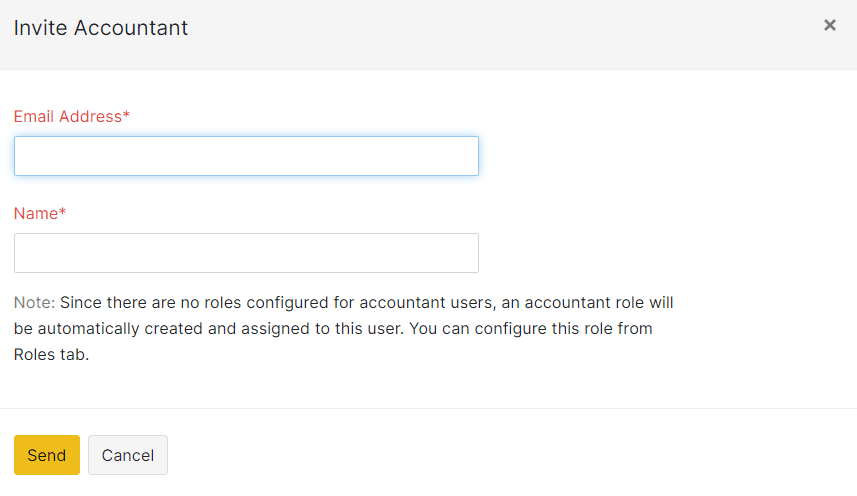

Plus, it’s easy to bring your accountant, bookkeeper, or tax specialist into the platform. You can invite up to two separate firms.

And, if you’re looking for one, QuickBooks makes them easy to find by giving you access to a comprehensive directory of finance pros, who have all been vetted.

So, if you’re growing at the rate where you can’t be bothered to balance your books yourself anymore, you can stay with QuickBooks and add a financial professional to your team.

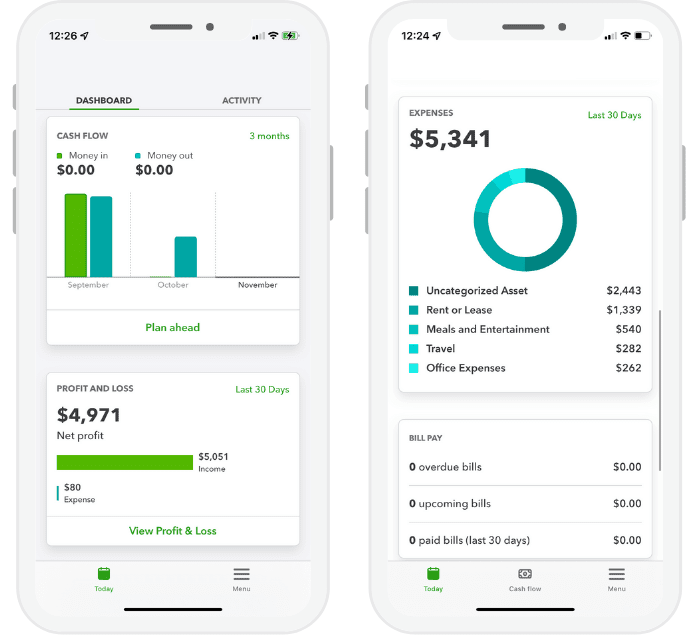

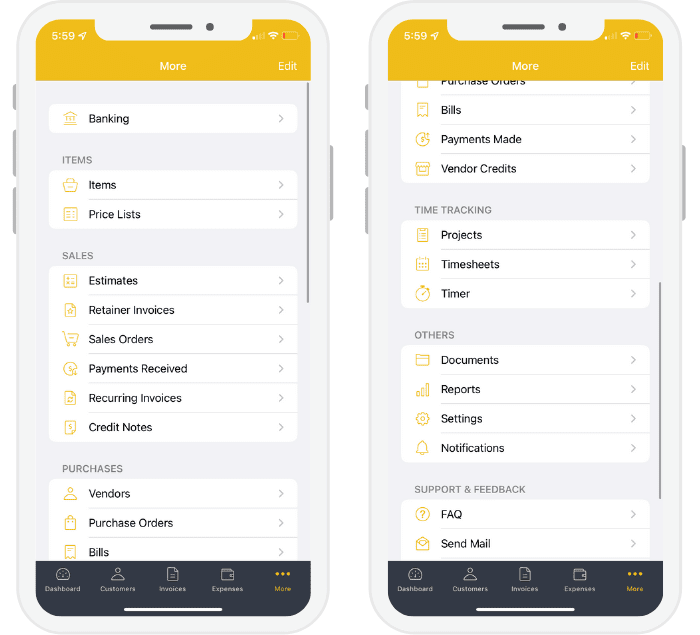

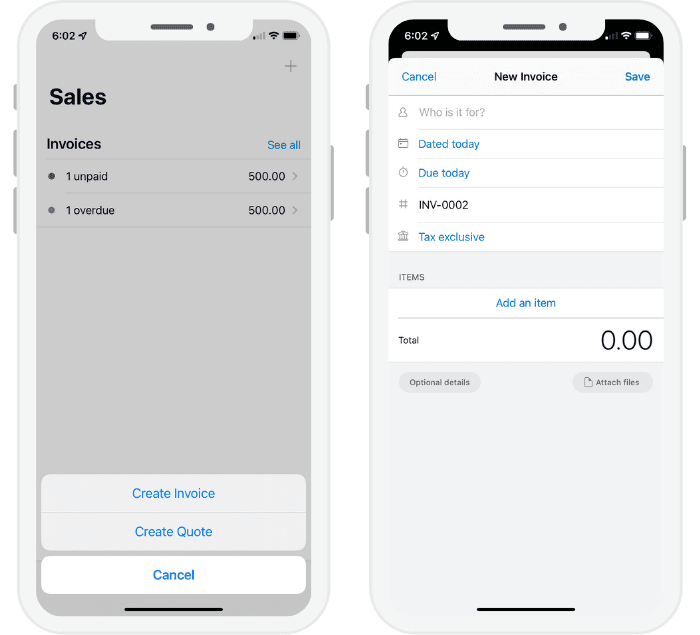

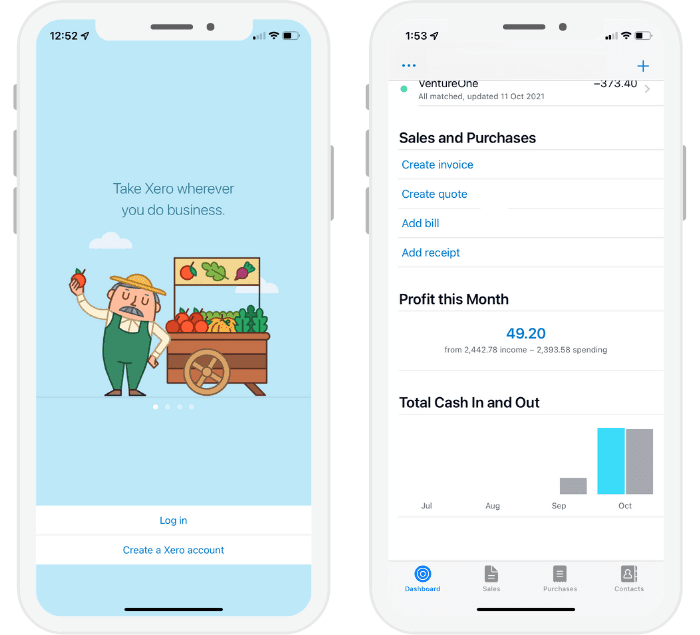

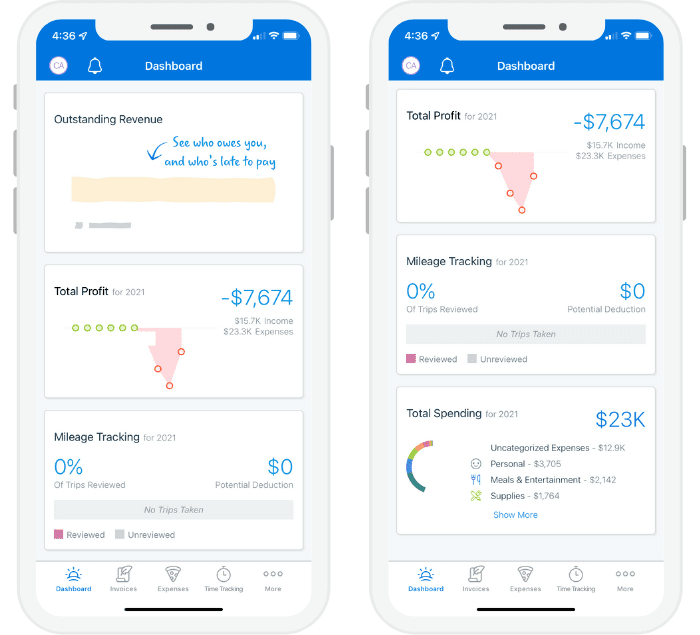

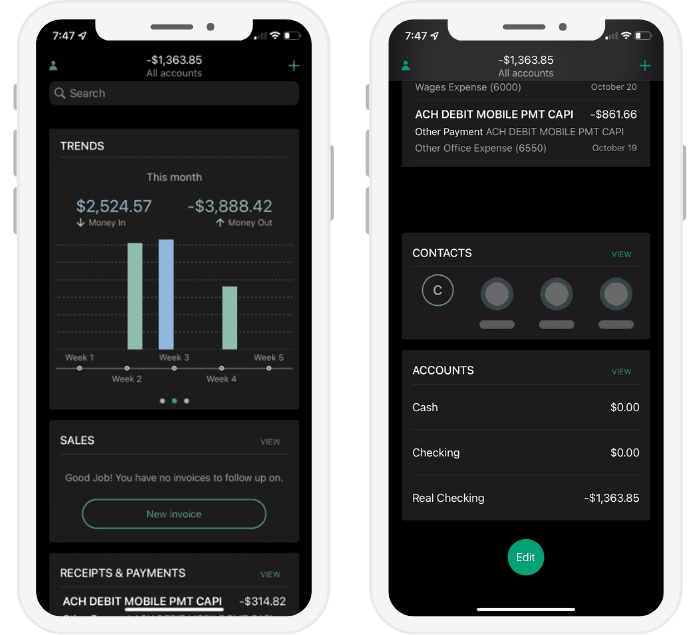

Mobile app: 5/5 – This is the most comprehensive, well-designed mobile app provided by any of the accounting software options we looked at.

QuickBooks has been perfecting it for years. It’s great for when you’re on the go, working in the field, or if you want to take a peek at profit-and-loss reports while you wait for your croissant at your local bakery.

The QuickBooks mobile app does everything the web version does and can handle all of these tasks we tested for:

- Automatic mileage tracking

- Categorize transactions

- Set up products and services

- Create quotes

- Upload receipts

- Manage your bills

- View overall financial health and trends

- View reports

- Sync automatically with the web browser

Some providers have you download additional apps to do all this. But, with QuickBooks, all this functionality is included within one app.

Below, you can see how easy it is to add custom rules in the mobile app:

You also get great visibility into your business’ overall health. See cash flow, profit, loss, expenses, and more at a glance.

This is just a sliver of what the QuickBooks app can do. Have some fun playing with it—you’ll be amazed.

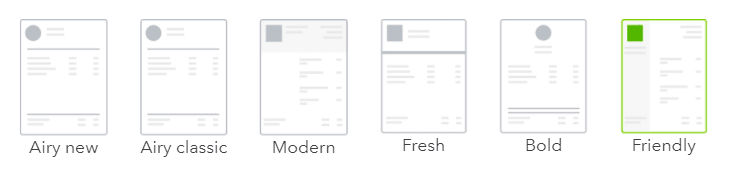

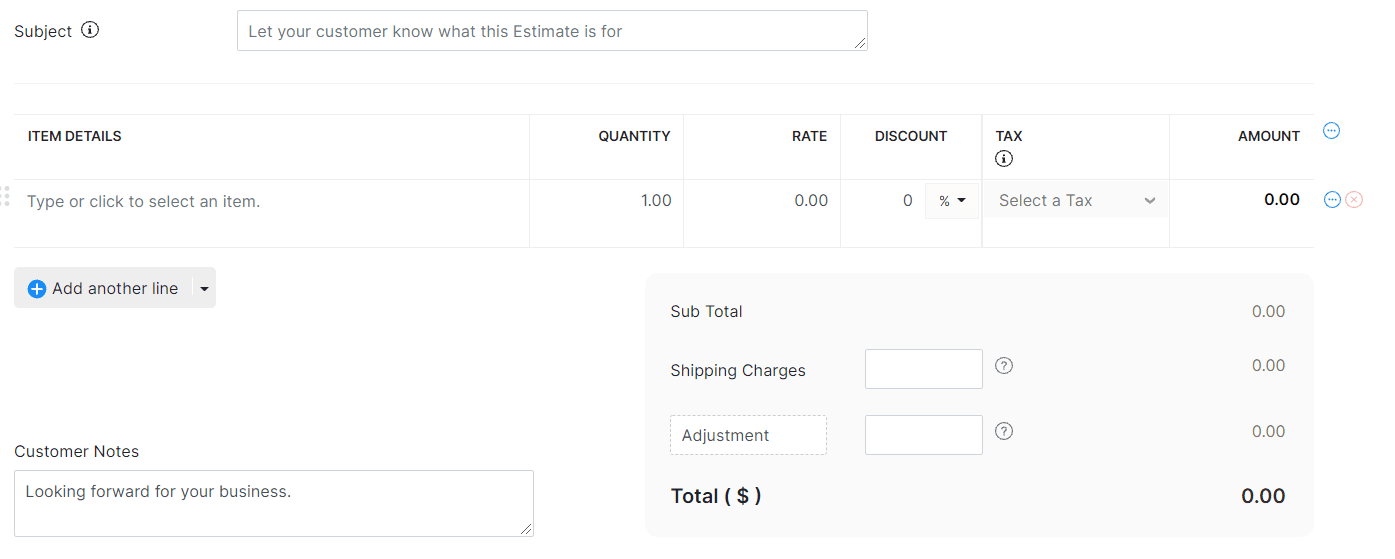

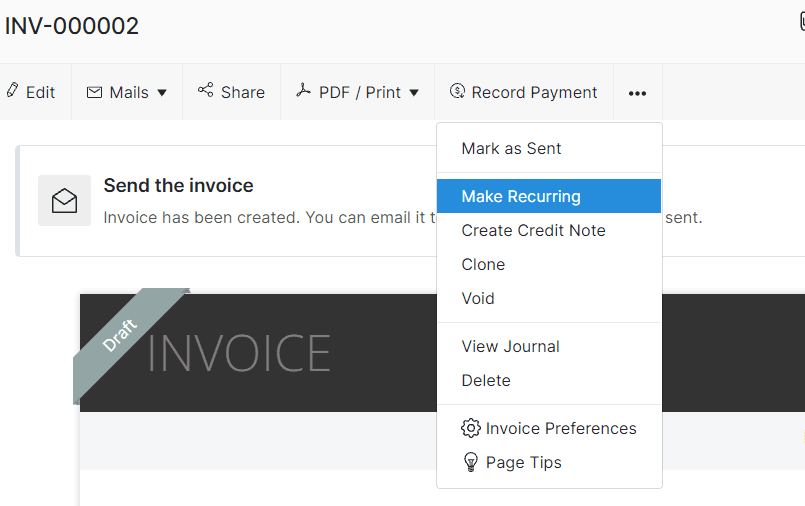

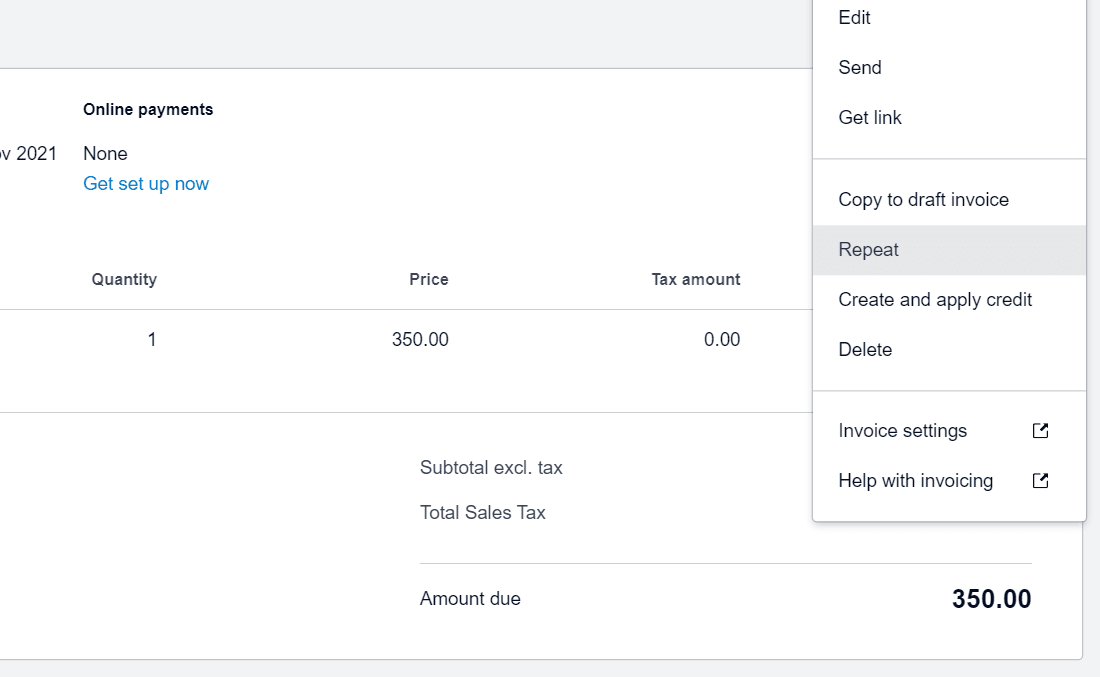

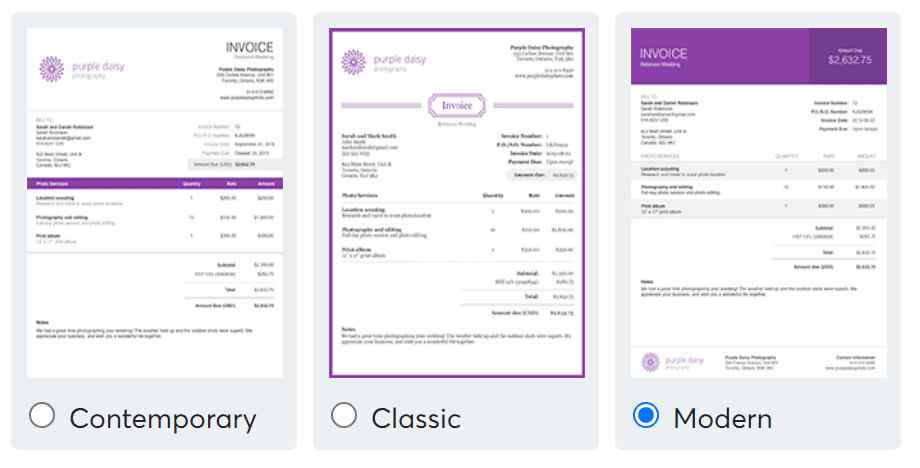

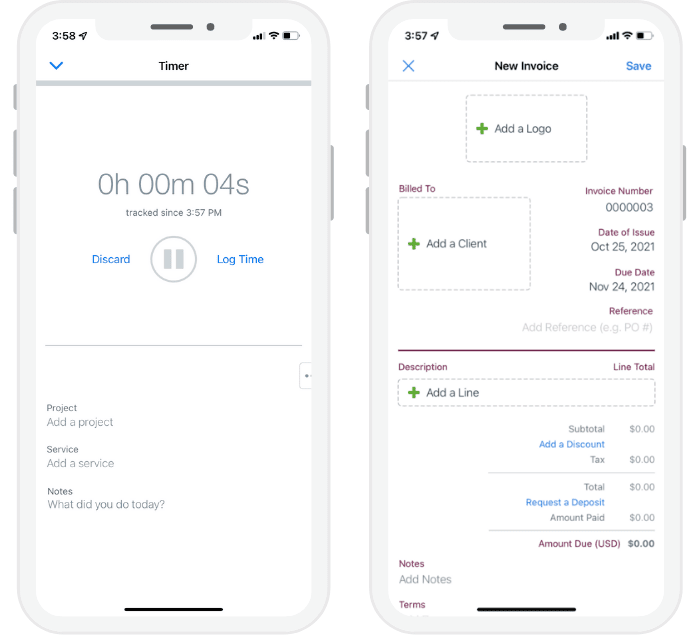

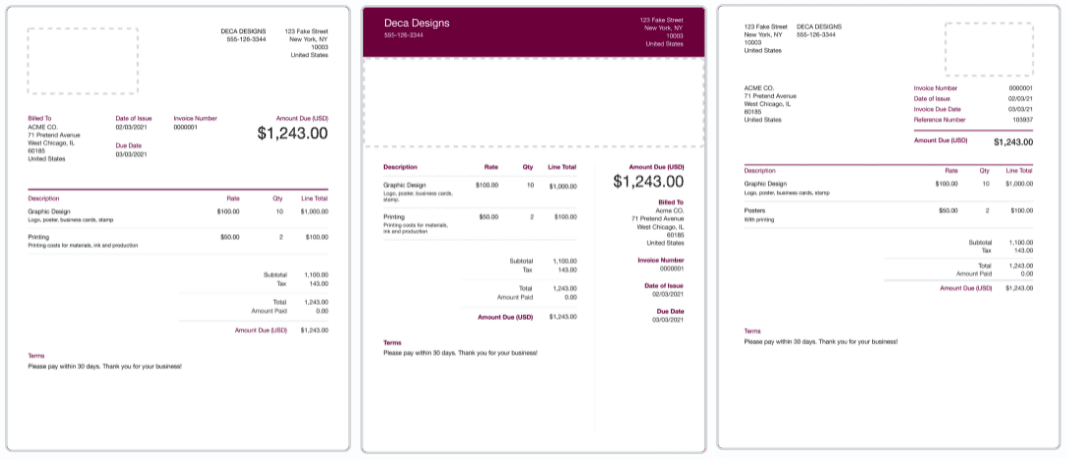

Invoicing and billing: 3/5 – Here’s the first testing category where QuickBooks Online is simply average as opposed to above average or excellent.

The entry-level plan is missing recurring invoices and bill management. So, you won’t be able to automatically bill clients monthly or forecast outgoing payments by adding bills that are due at a later date—unless you upgrade your plan.

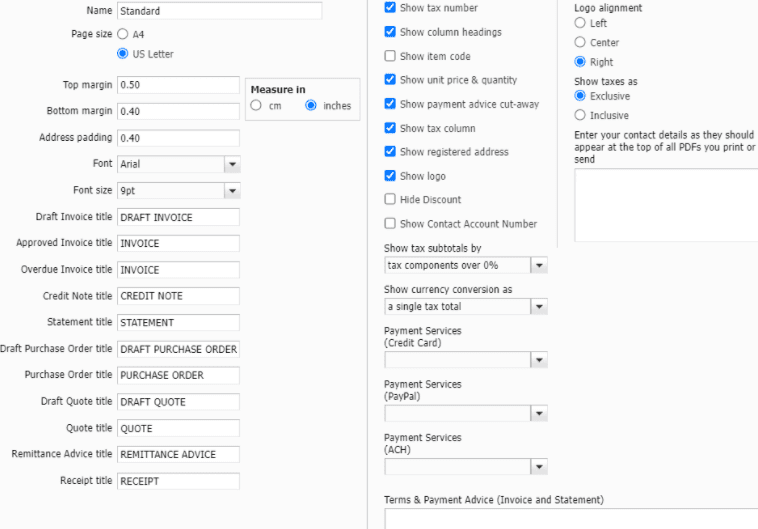

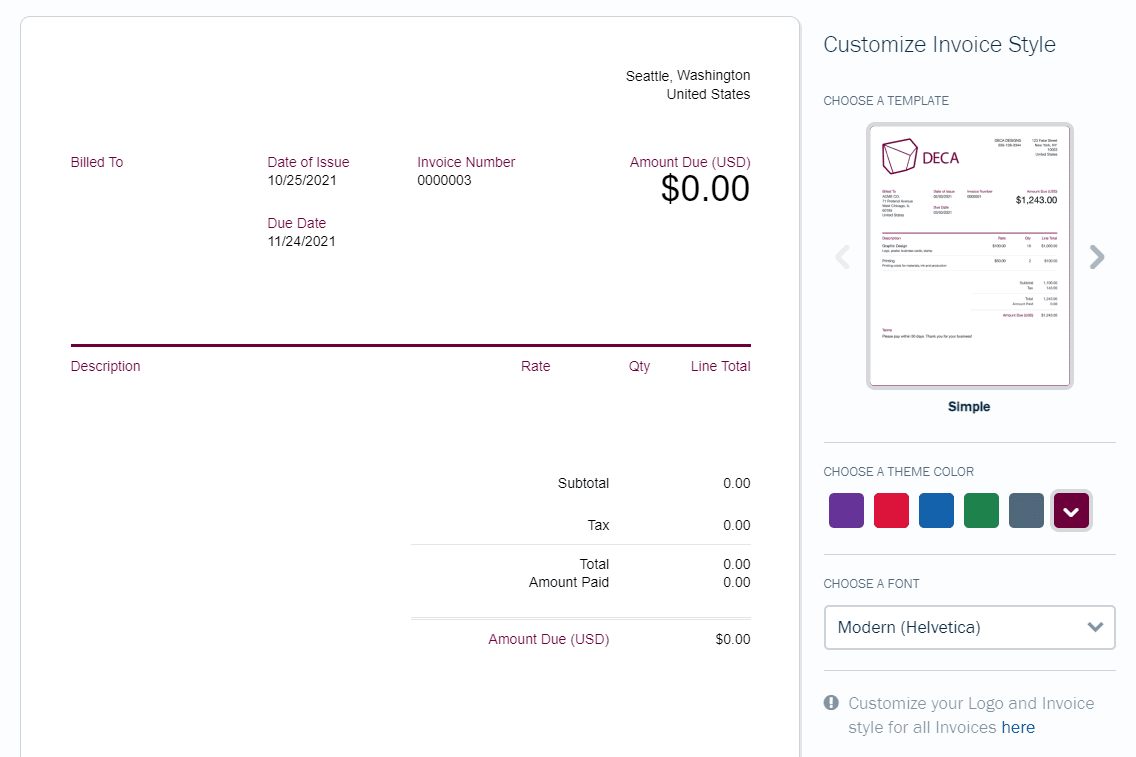

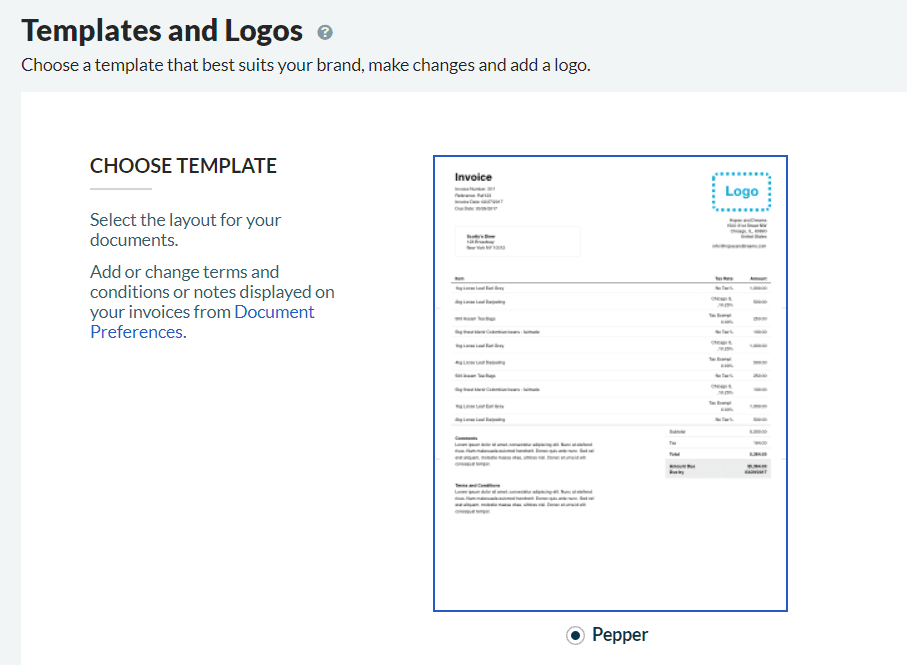

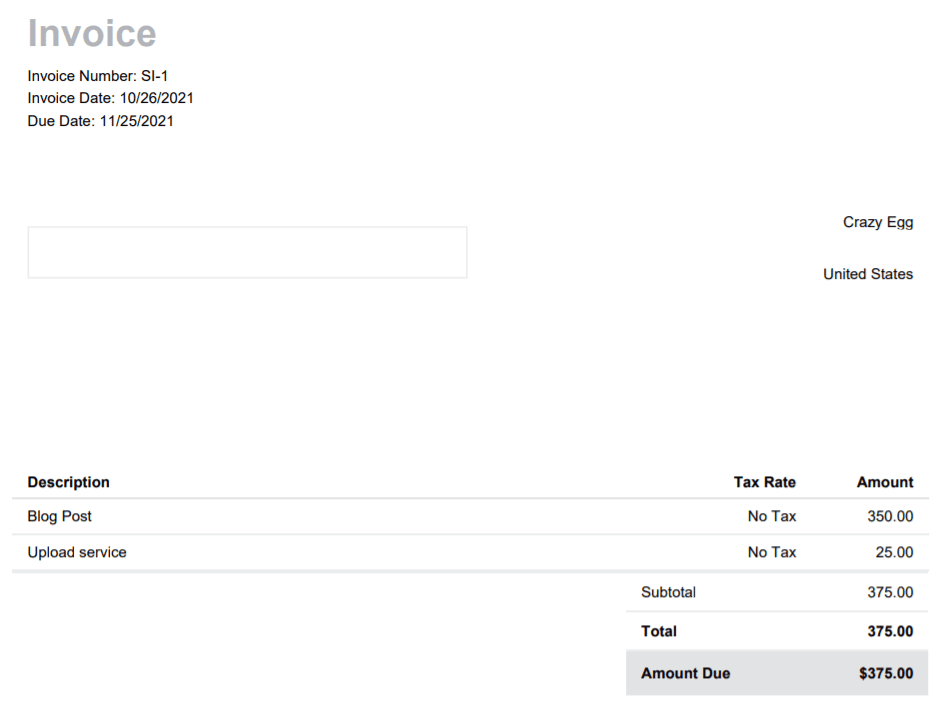

What you do get, though, is solid invoice customization with six templates.

With any of those templates, you can add your logo, change colors, choose different fonts, and more. Make as many custom templates as you’d like.

Plus, you can edit and customize the emails that go out with your invoices.

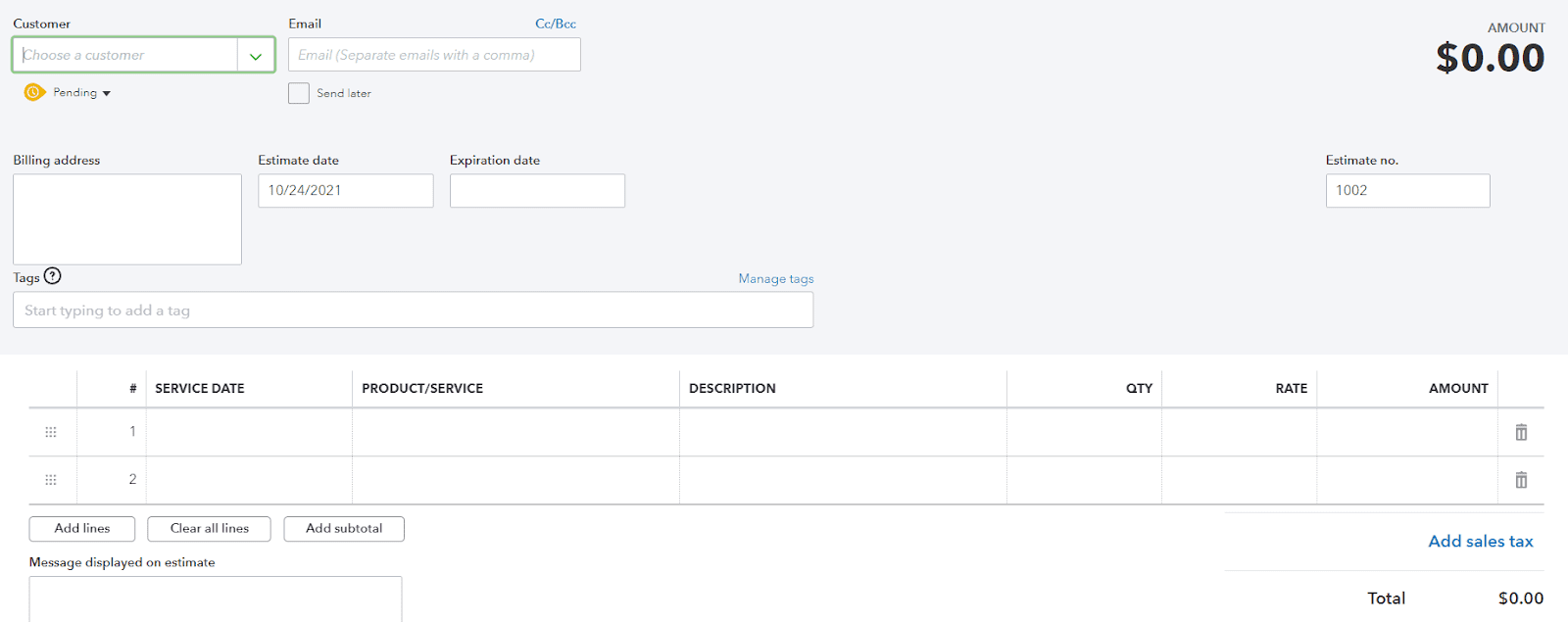

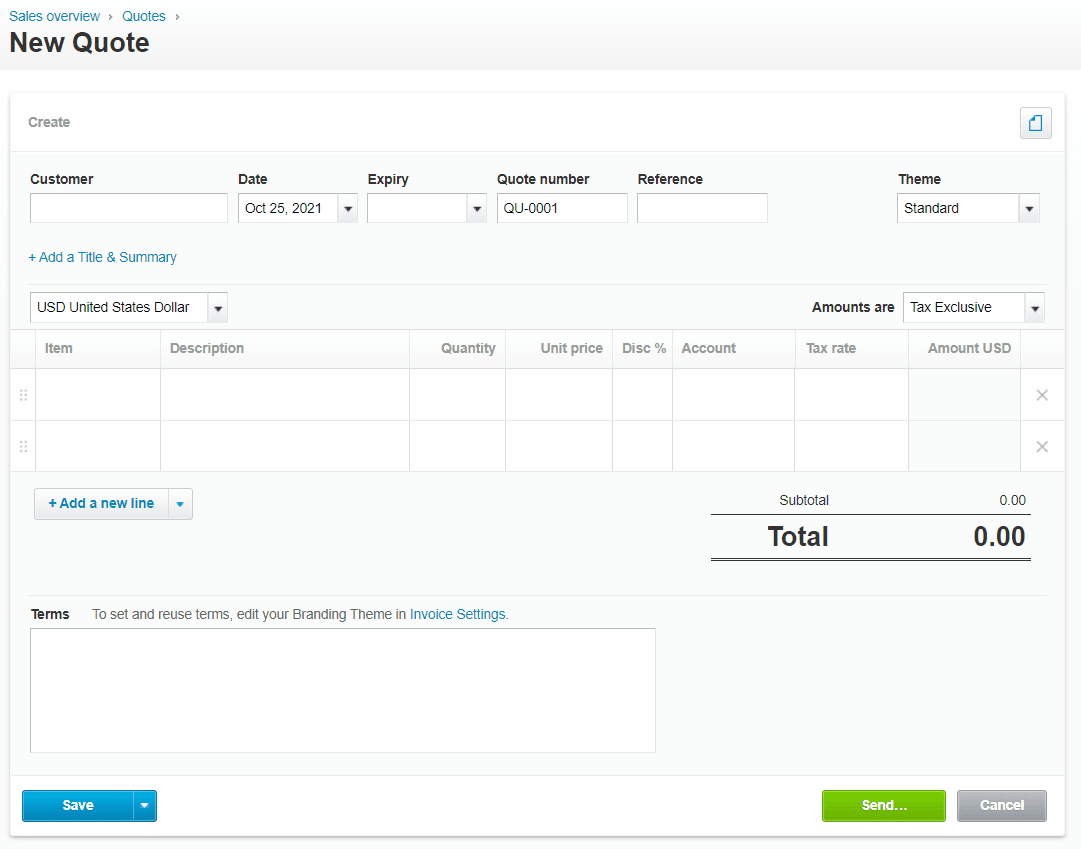

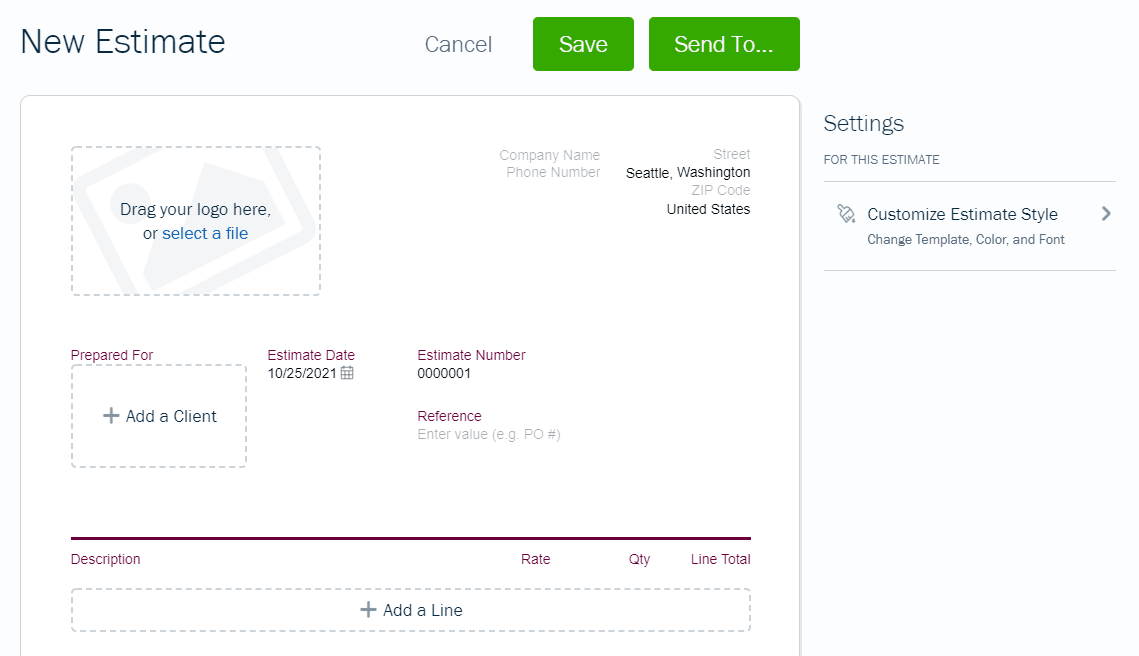

Quotes and estimates can also be sent out just as easily as invoices and you get the same level of customization as you do with invoices.

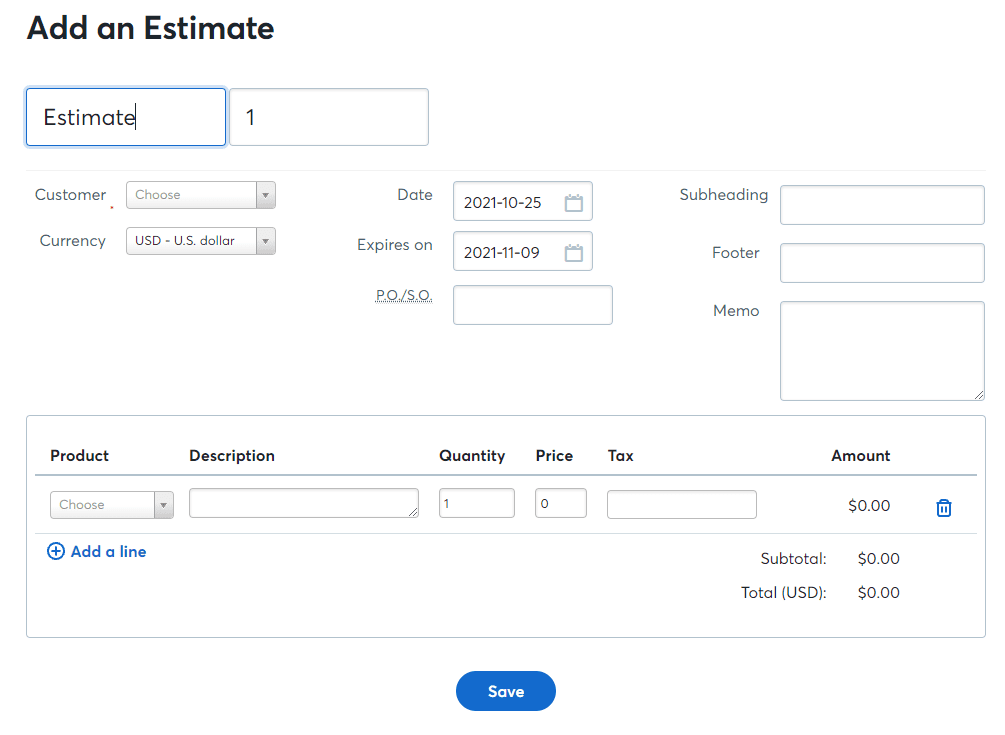

It’s easy to whip any of those up by just filling out the fields available. Take a look as how easy it is to fill out an estimate:

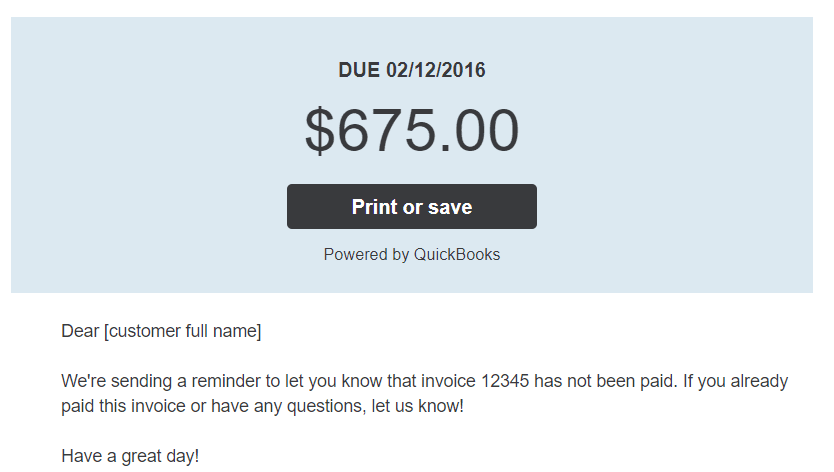

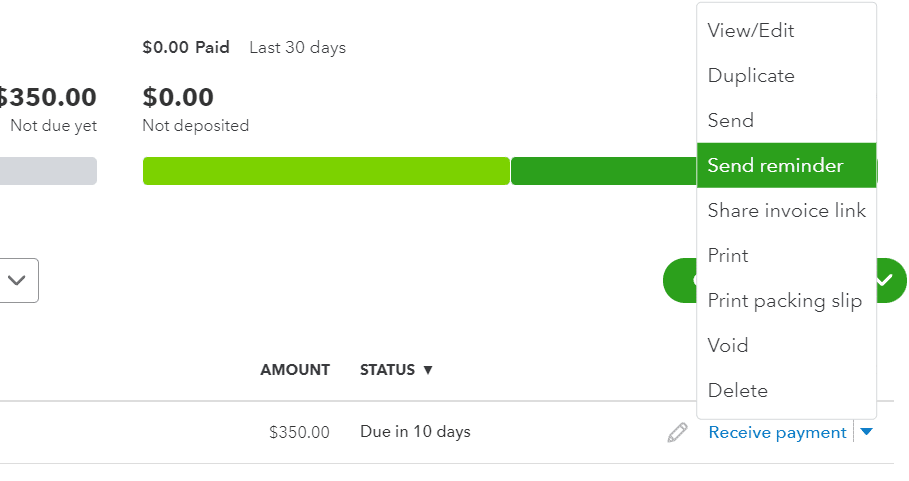

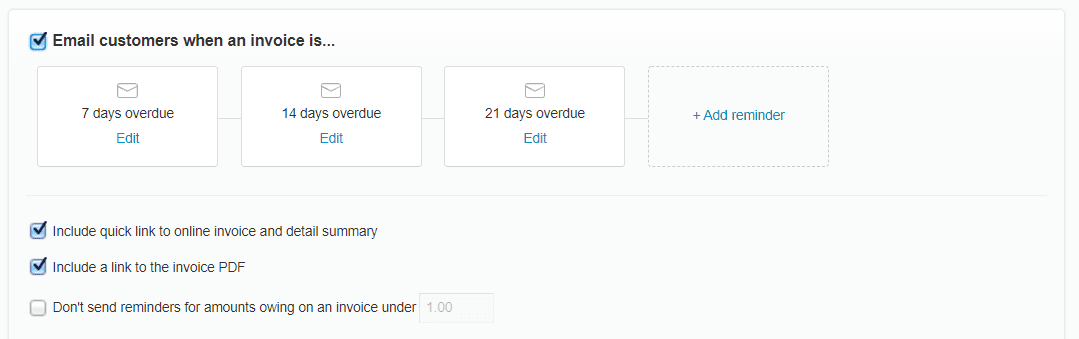

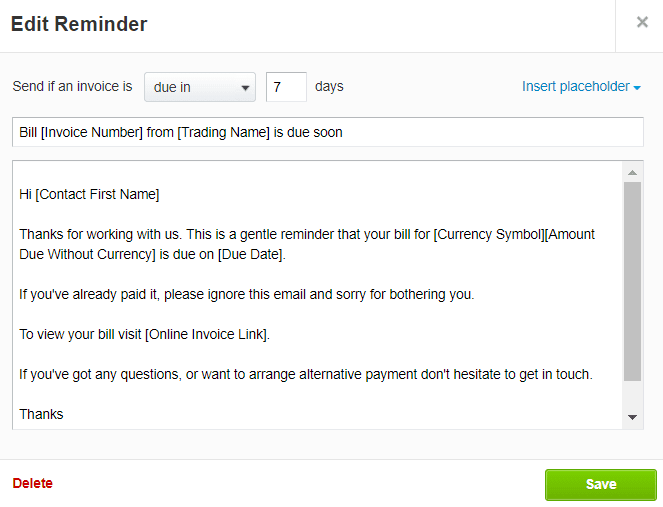

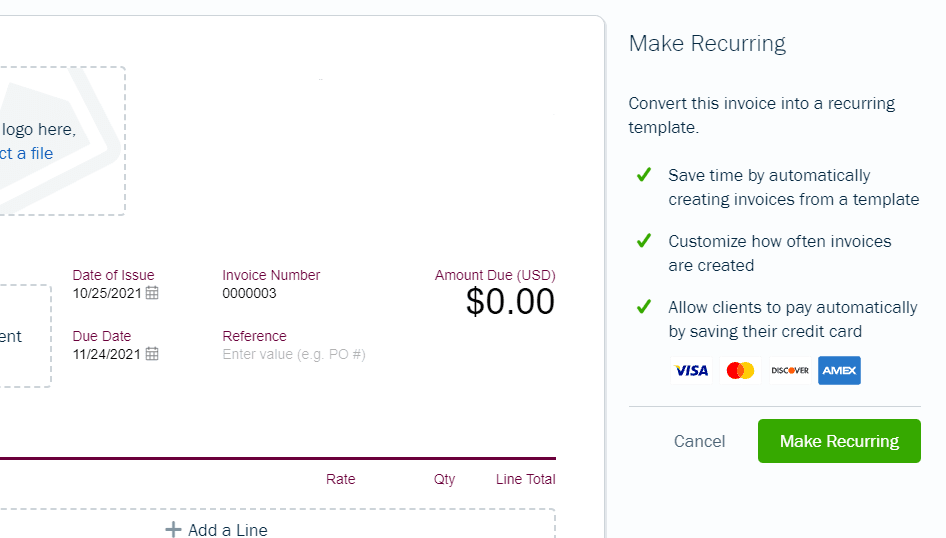

After you win that client, sending invoice reminders automatically is a breeze.

You can set up automated emails before the payment is due and on the due date, plus you’re also allotted one late payment reminder per invoice.

And if you do need to send another reminder manually, it’s simple.

Best of all, there’s no limit on the number of invoices, quotes, and estimates you can send.

With QuickBooks Online, billing and invoicing will be on autopilot for you, giving you a much needed break from the monthly appointments you set for yourself to do it on your own.

Pricing: 1/5 – Now when you look at all you get, you have to understand why QuickBooks Online is one of the priciest option on the list.

For signing up for the entry-level plan, you have two options. You can either get a 90% discount for the first three months—making your initial rate $3.50 per month—or you can do a 30-day free trial.

With the former, you’ll pay $325.50 for the full year with those discounted three months. A second year will run you a flat $35 per month for a total of $420, making two years of service cost $745.50.

If you opt for the free trial, you’ll end up paying the full $420 for each of years one and two.

Whether it costs you $745.50 or $840, it’s a bit higher than the two-year average across all the providers we tested of $580.

But you just get so much for the price, even on this basic plan. The feature list is nearly endless and we didn’t even go into all the add-ons you can use.

QuickBooks Online blows the rest of the providers we tested out of the water. If you can see the value you’ll get from this software, get started on your free trial or discounted first three months today.

#2 – Zoho Books — The Best for Service Providers Who Want Custom Reporting

Zoho Books

Best for Service-Based Businesses

Get unparalleled insight into your service-based business with the deep reporting from Zoho Books. Supported by a great mobile app and robust invoicing features, this software is a match made in heaven for any operation doing work in the field for clients.

Overall: 2.9/5

Zoho Books helps you run your business to suit every client you have and gives you the best reporting features of anyone on this list.

For starters, each client gets access to a private portal that lets them sign in, view upcoming invoices, pay bills, schedule services, and get in touch with you. That lets you add a level of custom service you can’t get from other accounting software providers.

And you’ll get the most feature-rich reporting available—above and beyond even the most expensive provider on this list. Analyzing your business becomes dead simple.

Let’s dive deeper into our scorecard:

- Ease of use: 2.5/5

- Syncing and reconciliation: 1/5

- Visibility into your books: 4/5

- Mobile app: 4/5

- Invoicing and billing: 4/5

- Pricing: 2/5

Ease of use: 2/5 – Zoho Books has a bit of a learning curve. But the software is really good at stopping you from making costly mistakes, which we’ll touch on in a bit.

The first time you log in, there’s a short tour showing you where to find things.

It’s not as robust of a guided process as our top pick, but you’re also not left figuring everything out on your own.

There’s a four-step checklist that covers a broad range of settings and automatically checks items off as you complete them.

But it is missing essential steps like importing customers and adding items and services.

There are a ton of features, which is a plus. But it can be overwhelming and the language used to explain things is filled with jargon you might not be familiar with. So, if anything, take your time getting your feet wet.

The user environment is not as simple as other providers. The interface is a bit clunky and it doesn’t do a good job of teaching you how to use it after setup is complete.

That applies especially to the lack of tooltips in the platform. You don’t get any additional detail on what you’re supposed to do and what you’re able to do in forms, sections, and tasks. Not the worst, but definitely not the best.

What Zoho Books does really well, though, is providing error and discrepancy warnings. It won’t let you change dollar amounts at all for transactions pulled from your bank, so you can’t really mess things up.

Even if you split or itemize a transaction, you can’t save it unless the numbers add up, which stops you from running into issues later.

You also can’t finish reconciling accounts until they add up. You’ll get an error popup message if you try.

Zoho Books also gives you easy bulk exporting options. Batch expenses up to 25 at a time and select any or all to export.

The biggest thing missing from this exporting process is not having a way to include attachments such as invoices or receipts.

It’s also easy to get in touch with customer support via live chat. Just keep in mind they are only available between 9 a.m. and 9 p.m. Eastern. But email support is there when live chat isn’t.

You also get a broad support number you’re able to call between Monday and Friday and access to community forums for tips and peer advice.

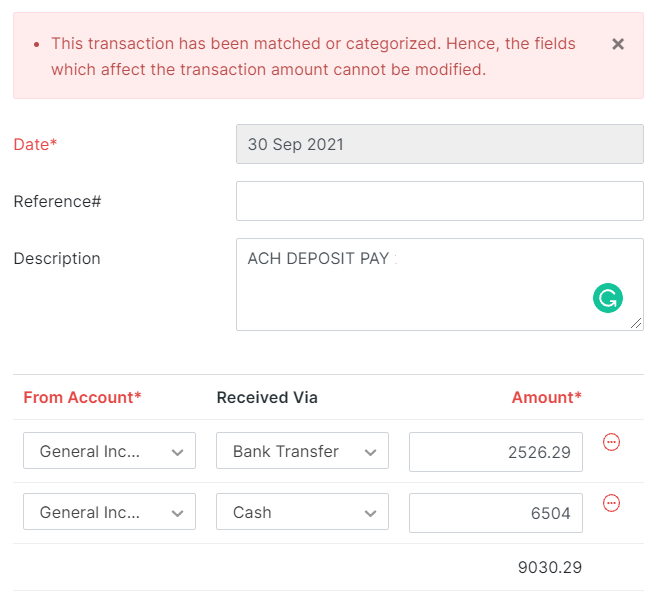

Syncing and reconciliation: 1/5 – You can sync your accounts and reconcile your books with Zoho, but there are a few time-saving features you miss out on.

For starters, there is no AI assistance for categorizing imported transactions. The software won’t learn the types of keywords you use or organize your transactions automatically.

But, you can create custom category rules for expenses, income, and transfers.

That way, you can have the software categorize expenses as they meet criteria you set, like in the example below we set up for web hosting charges.

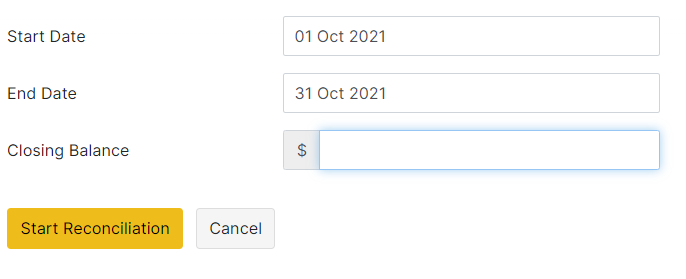

After categorizing transactions, you have to reconcile them with your accounts yourself. Enter a starting balance, ending balance, start date, and ending date.

There are other providers on this list that offer this feature, so you’re able to sync everything up with the click of a button. But, in our research, we found that having to do separate reconciliation was not much of a deal breaker.

Two other things we’d like to see added to Zoho Books’ entry-level plan is bulk transaction editing and receipt scanning with automatic data extraction. The former is available on higher-tier Zoho Books plans and the scanning comes as an extra add-on.

So, if not having these features is a non-starter for you, Zoho Books’ entry-level plan won’t be a good fit.

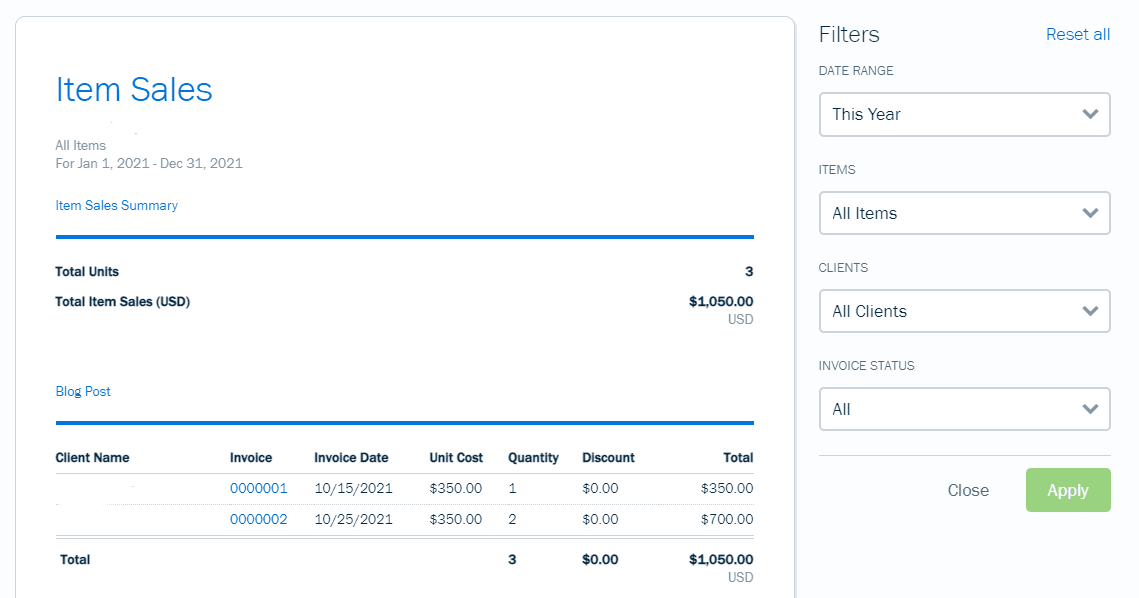

Visibility into your books: 4/5 – Zoho Books offers just as much customization as our top overall pick, you just won’t get as much help along and guidance.

Add custom transaction tags to easily create simplified views of what transactions go where. You can create these at any time.

Tags like this really help with customizing your reports, tailoring them to the services you offer. Plus, they help make searching through your books a breeze.

What you can customize changes depending on the report, but it’s easy to tweak and change the layout to what you need.

Zoho Book’s prebuilt reports are exceptional. They give you 73 different types with the entry-level plan.

The sales by salesperson report, for example, will let you keep an eye on your team’s performance segmented by individuals.

Whether you have an accountant or bookkeeper or just live looking at the details closely on your own, these reports and their flexibility come in really handy.

In the case of the former, it’s simple enough to invite your financial professional onto your Zoho Books account.

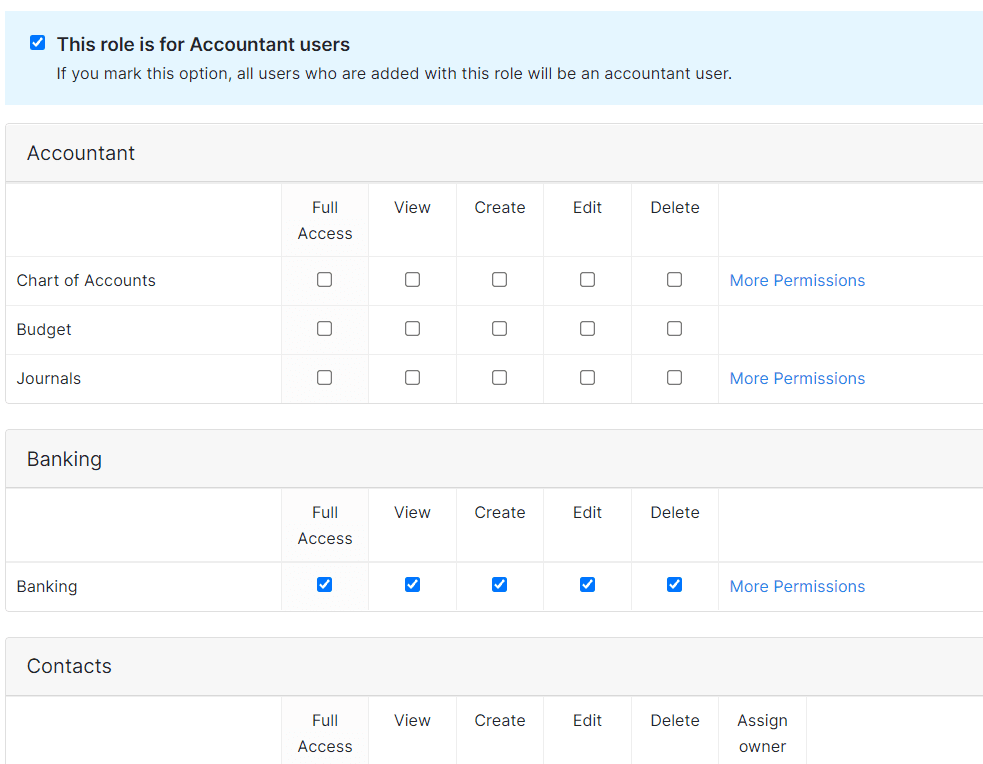

Plus, you get granular permission control for users both within and outside your organization.

This is all a boon for service providers. Being able to have over 70 ready-to-use reports at your disposal and extra layers of customization for each means there will no longer be any mystery to your finances.

Mobile app: 4/5 – Zoho Books’s mobile app tied for second place on the list. It does all of the same things our top pick does, but is missing automatic mileage tracking.

And, you have to close the app entirely to get it to sync up with changes you made in a web browser. That can get pretty annoying, but it’s a relatively minor issue.

Here’s a full rundown of what you can do with the mobile app:

- Categorize transactions

- Set up products and services

- Create quotes

- Upload receipts

- Manage your bills

- View overall financial health and trends

- View reports

The navigation and interface will be familiar to most people comfortable with mobile apps and devices.

It’s functional and easy on the eyes. You can also change the theme of the app and set different colors.

You can get a clear look into your financial health whenever you want on your mobile device. See cash flow, income, and expense reports while you’re on the move.

All in all, it’s a solid mobile app and one that will treat your service-based business well whether you’re in the office or out in the field.

Invoicing and billing: 4/5 – Here’s the area where Zoho Books makes the best case for service providers.

Included in the entry-level plan are 1099 contractor management, sales tax tracking, custom fields, and granular user controls.

You also get 10 different payment gateways and a private client portal for your customers. They can see their bills, ask you questions, and much more. You can even accept cash with an offline payment option.

Bill management is only available on higher-tier plans. So, you can’t factor in planned company expenses as easily on the entry-level Zoho Books plan.

However, its invoicing capability is incredible. You can send up to 5,000 per year, utilizing 17 different templates.

All are professionally designed so you’re not dealing with templates from the last decade. You can customize page size, orientation, and margins, plus choose from 12 different fonts. There also are a few prebuilt color schemes too.

Zoho lets you add files to invoices, too. And, you can even assign invoices to a salesperson, feeding information from the invoice and its status to your custom reporting. Zoho Books is the only software on our list that allows for that. It makes performance reports, for one example, super easy.

It just gets better. You’re allowed to send an unlimited number of quotes and estimates. Then, when your customer accepts your offer, you can automatically turn the estimate into an invoice.

The same goes for turning one invoice into a recurring invoice. You can do it with just the click of a button.

Need automated payment reminders? No problem. Three emails are set up for you automatically—just enable them and they’ll go out on schedule.

Billing and invoicing is a huge part of accounting software and Zoho Books doesn’t disappoint.

We found all the features available extremely helpful.

Pricing: 2/5 – Zoho Books is the third most expensive option, but is cheaper over two years then our best for most choice.

You start with a 14-day free trial to make sure it works for you. After your trial, you pay $20 per month. The total for two years is $480, a bit lower than our list-wide average two-year cost of $580.

But that’s just for monthly billing. If you want to save $5 per month, you can go with the annual plan, making your yearly cost $180. That brings the two-year cost a lot closer to our average.

Zoho is just one of two providers that gives you the ability to save by opting for a yearly plan.

There is a free forever version, as well. But it’s severely basic, not even allowing you to connect your bank account or credit cards. It’s also limited to businesses that make less than $50,000 per year.

If you run a service-based business, Zoho is a great choice. You get a private dashboard for your customers, insightful reporting with dozens of prebuilt options, just about every feature you could need from accounting software, and a fantastic mobile app.

If you want unrivaled visibility into your business while giving your customers a level of service that is unexpected and refreshing, grab your free 14-day trial of Zoho Books now.

#3 – Xero — The Best for Essential Features at a Low Price

Xero

Best for the Essentials for Cheap

Get everything you need to simplify business finances in one place. Includes receipt capture and storage, up to 20 monthly invoices, monthly bill tracking, and the ability to connect your bank account to eliminate manual entries.

Overall: 2.8/5

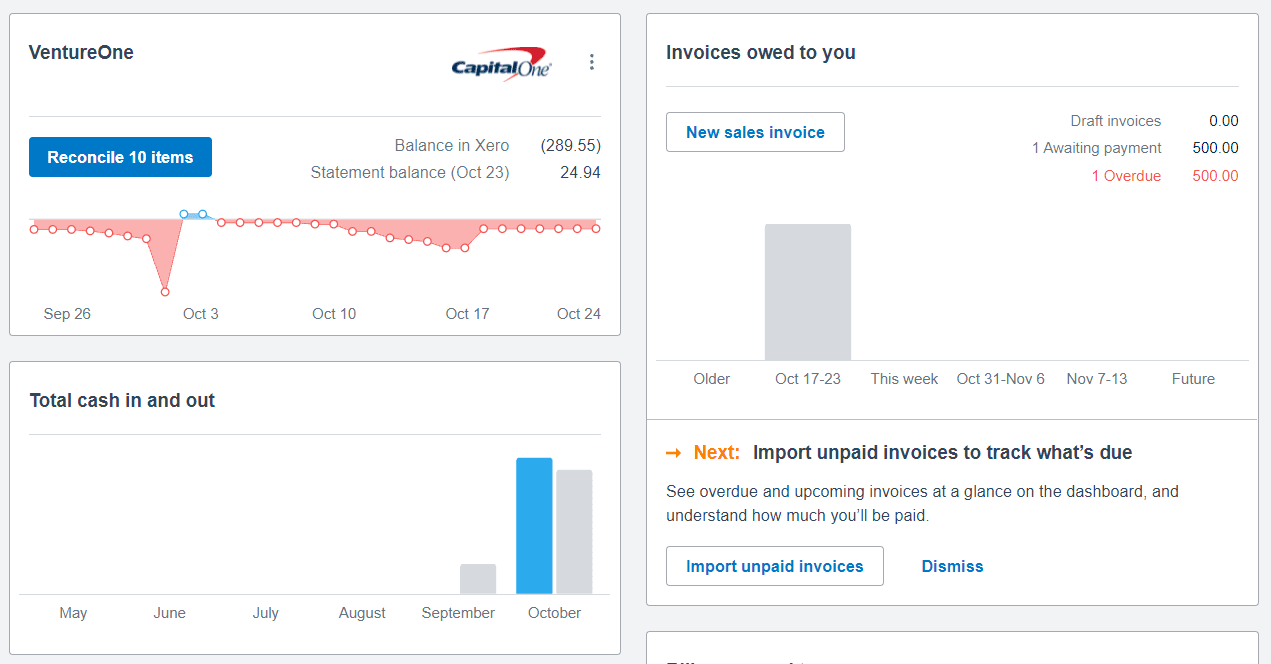

Xero simplifies accounting software, giving you the basics needed to manage your small business finances.

Track and organize things without spending a ton of extra time on accounting. It’s great if you don’t have a lot of hyper-specific needs and you’re not looking to spend a fortune on software.

Xero’s low price is made even more appealing by the fact that you can add your entire team at no extra charge.

Let’s see the other areas Xero does well in:

- Ease of use: 2.5/5

- Syncing and reconciliation: 3/5

- Visibility into your books: 2.5/5

- Mobile app: 2.5/5

- Invoicing and billing: 3/5

- Pricing: 2/5

Ease of use: 2.5/5 – Xero landed right in the middle of the pack for ease of use.

The software has a good onboarding process with a handy setup dashboard that covers all the things you need to do.

You’re walked through connecting your account, getting your invoices ready, and working out your income and expense tracking. You can even set up employee payments and time tracking.

When you’re done configuring everything, you’re taken to a nice dashboard that gives an overview of your finances.

The interface, however, is not easy to navigate. In fact, we found it to be the second-worst UI on the list.

For us, the horizontal navigation menu was so condensed that it was hard to find what we were looking for.

In our experience, a vertical navigation on the left side is more intuitive. You can expand or collapse menu items to easily get around.

Xero also doesn’t have any discrepancy and error warnings. You can change dollar amounts for transactions from your bank with reckless abandon.

Since other tools alert you or just don’t let you create discrepancies, we find this a bit dangerous.

The major problem is that, once you save it, that erroneous transaction now exists in your software as if it were just fine and dandy.

If you don’t realize what you did, you’ll see balance discrepancies with no idea why.

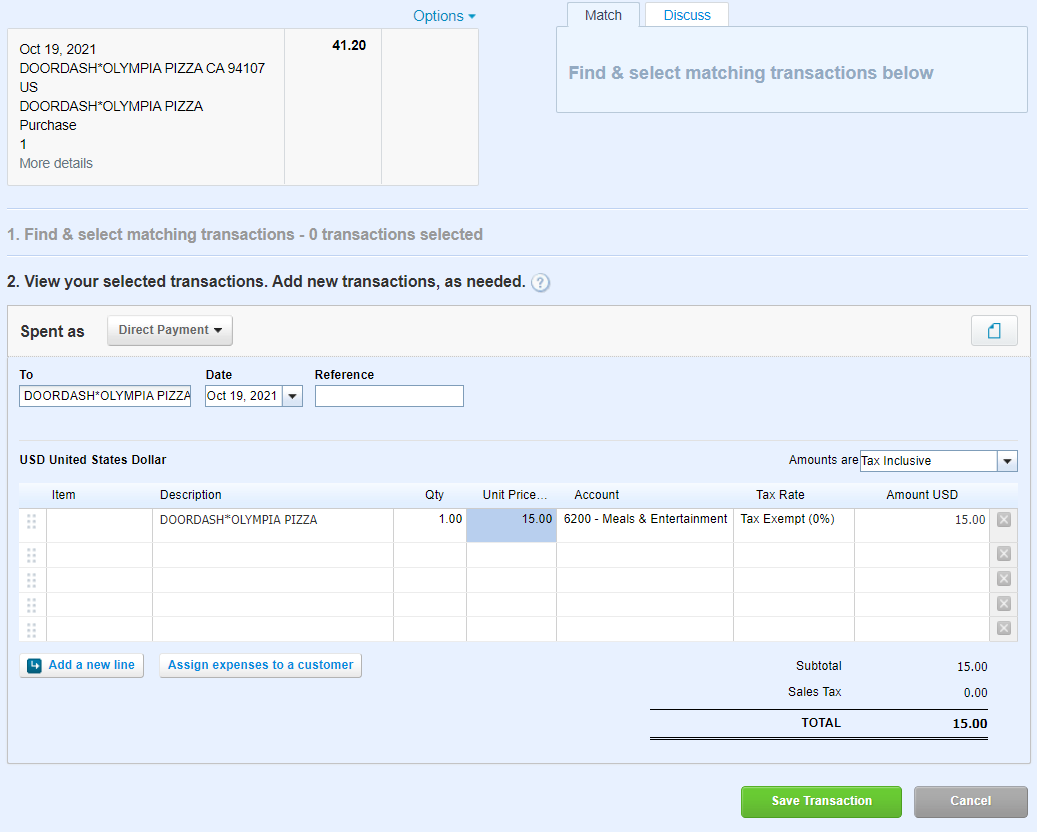

In the screenshot below, we changed the dollar amount of the transaction. At the top, you can see the original transaction is $41.20 but we changed it to $15 down at the bottom in the blue highlighted box.

After this, we attempted to reconcile the transaction and Xero would not let us. But, we were able to reconcile the books entirely, leaving this incorrect transaction floating around, messing up our overall balance.

So you really need to be careful and double- or triple-check your figures.

If you do have questions, it’s easy to contact Xero support. But, first, you have to go to the knowledge base.

If you don’t find your answer there, scrolling down to the bottom allows you to ask to speak with a rep. You can use 24/7 live chat, email, or have someone call you back.

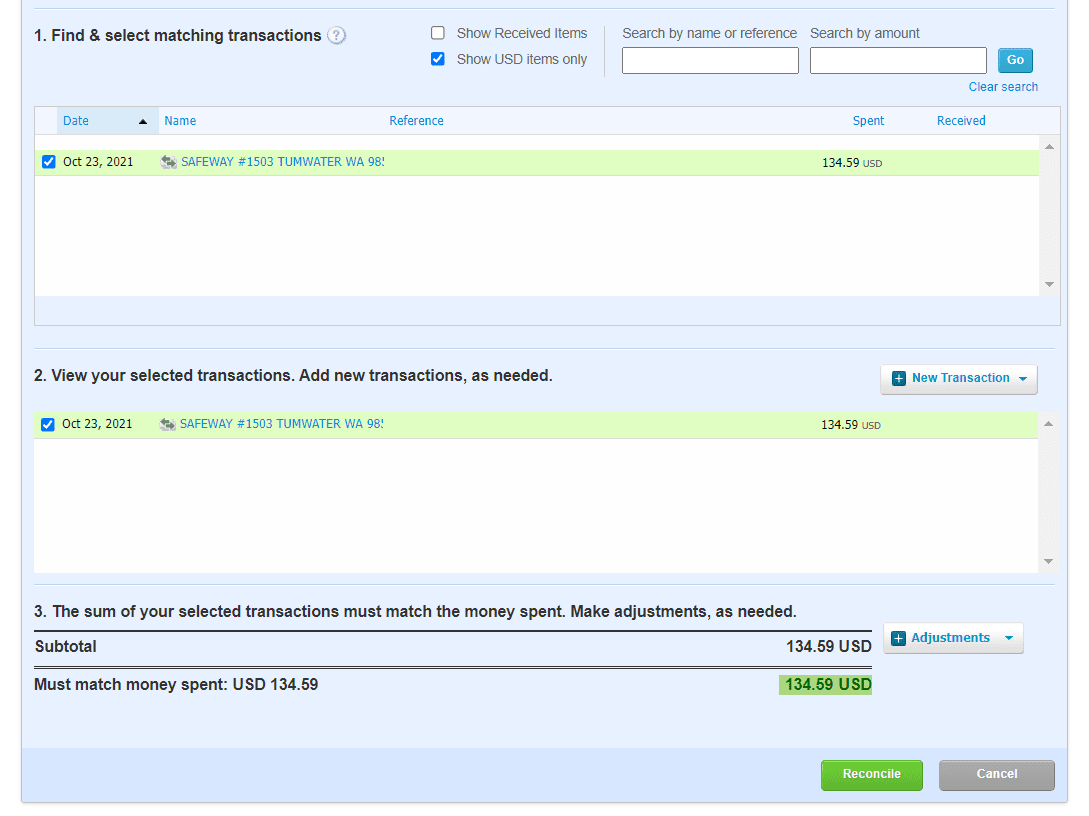

Syncing and reconciliation: 3/5 – Xero does pretty well in this regard, and is tied for the second-best in this category with one other provider on the list.

You can set transaction rules for expenses, income, and transfers, allowing them to be automatically categorized as they come in.

In addition, it only takes two clicks to review, categorize, and reconcile transactions at the same time. You don’t have to navigate to multiple screens.

In the screenshot below, you’ll see the first step was creating the transaction within Xero and matching it to the bank record that was automatically pulled from our bank account.

The second step was making sure the dollar amounts matched up. Since they did, we were able to reconcile it right then and there.

Cool, huh?

With Xero, you can also automatically extract data from your scanned receipts. Xero has a free receipt scanning app which you can download.

When we tested it, things worked great. We were able to review the data it pulled and add the correct expense category before accepting it into our official books.

Unfortunately, you don’t get bulk transaction editing with Xero’s affordable entry-level plan. But the next paid tier up offers this feature, if you’re interested.

Visibility into your books: 2.5/5 – Xero offers some customization, though not as much as the previous providers reviewed. You can’t use custom tags for transactions, for one.

Sadly, you don’t get a walk through of how reports work, either. But you do get a wealth of pre-built reports to use.

Remember, we are dealing with simple, easy, small business-focused software.

It doesn’t mean you can’t customize your reports—it’s just not as robust.

Only about half of the reports you can run with Xero are customizable. With the others, all you can do is basic filtering.

They may not be flashy or flexible, but they absolutely get the job done for general accounting needs.

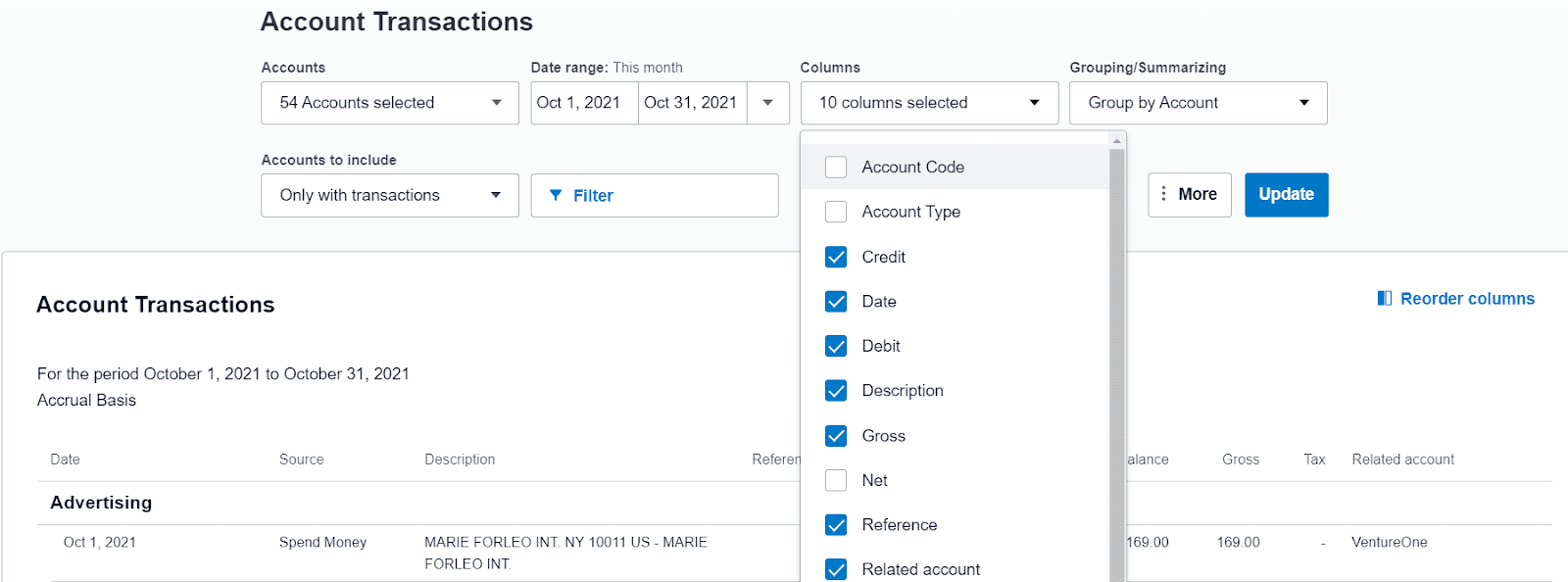

The ones you can tweak allow you to customize what information is displayed, such as choosing from 15 different data columns for your account transaction reports. And you can save these custom reports for later or repeat use.

In all, you get 55 prebuilt reports to use.

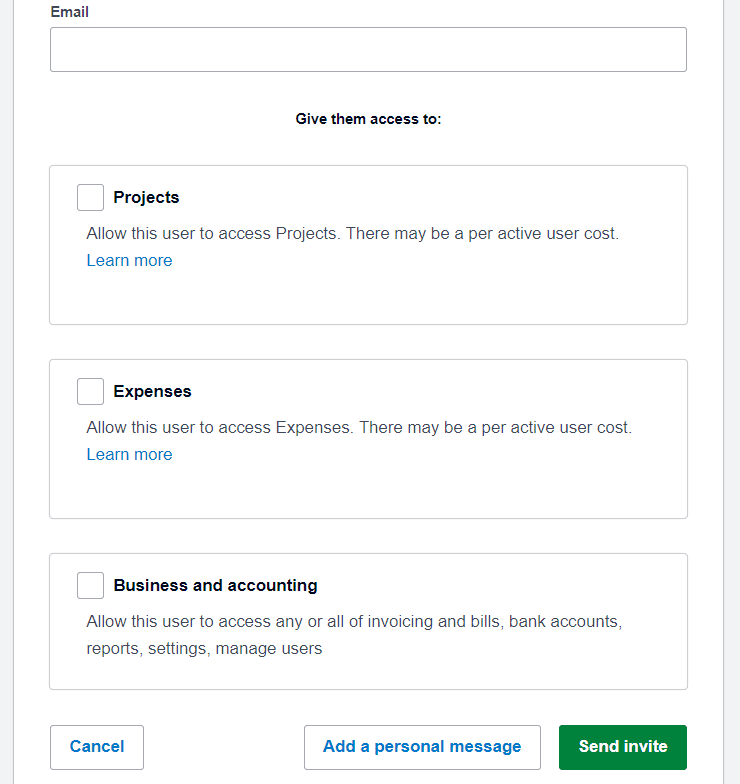

You also have the capability to add accountants or bookkeepers to your Xero account.

As a small business owner, you probably want your fingerprints on everything when first starting out. But Xero gives you the option to take a step back and let others take the reins easily.

Xero gives you solid visibility into your business’s bottom line, especially for the affordable price.

Mobile app: 2.5/5 – Xero’s mobile app is underwhelming. It’s missing several features we tested for.

Even worse, you’ll also need to have at least two or three apps to do everything you want to on your phone, which isn’t ideal.

There are five different apps with different functions: Accounting, Verify, Projects, Me, and Expenses.

We think Xero wanted to make each app very simple to use. Unfortunately, it just clutters up your phone.

Two of the apps are required: Accounting, which is the main app for your essentials like invoices, purchase orders, quotes, bills, and reconciliation, and Verify, which is for two-factor authentication.

Projects is, like it sounds, for everything project management and task-related. That includes helping with quotes, invoices, time and expense tracking, and job profitability.

Xero Me is the employee-facing app for self-service time tracking.

Expenses helps you with capturing costs, connecting receipts with transactions, monitoring spending, mileage tracking, and more.

Without one single app that does it all, it can be overwhelming. But, there are solid benefits to unlock. For the Xero Accounting app, we found we were able to:

- Categorize transactions

- Create quotes

- Upload receipts

- Manage bills

- Sync automatically with web browser actions

The app doesn’t automatically track your mileage, but there is a map feature. It lets you enter a start location and an end location and automatically calculates the miles driven.

It does make categorizing your transactions easier to do on your phone than on the desktop app, though.

Analyzing your financial health is very limited. You can only view cash in and out and the app does the math on your profit margin for you. That’s it.

The app experience isn’t the worst. You just have to jump through some additional hoops to get things done on mobile.

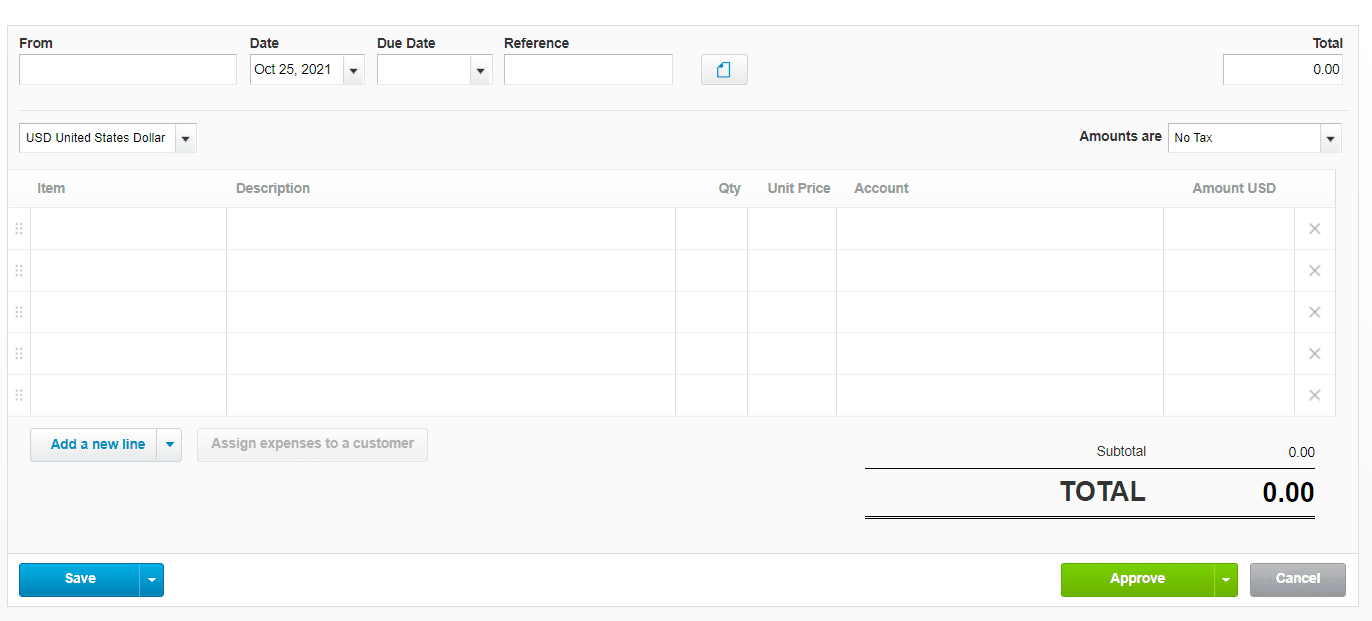

Invoicing and billing: 3/5 – Xero doesn’t allow for much customization for invoices and billing.

All invoices are plain black and white and the only thing you can change is the data and how fields are labeled.

But it works just fine for a small business with basic billing and invoicing needs. You can send out 20 invoices and estimates per month on the entry-level plan. On higher tiers, you’re allowed an unlimited number.

When you want to send out a quote, here’s what the form builder looks like:

Xero’s entry-level plan is also limited to five bills per month. Add your expenses into the form and, as they come in, you can see your totals for each as well as the full total.

That’s perfect when you don’t have tons of different bills coming in. It keeps things organized on your end so you don’t ever get overwhelmed.

You can turn any invoice into a recurring one and even control how often you send them out.

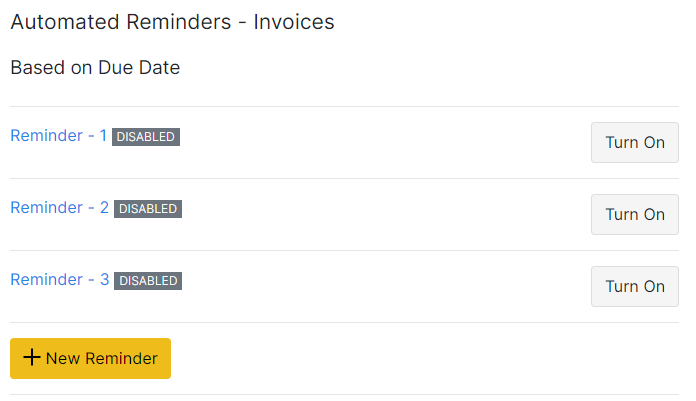

If you don’t want to set up recurring payments, you can set up reminders for your clients.

It’s simple, just go to Settings, click on Reminders, and then enable payment reminders, setting the schedule either to a certain number of days before or after the due date.

Since reminders are disabled by default. you need to enable them yourself. Then, you can edit the email templates and even restrict reminders to invoices over a certain dollar amount if you want.

Xero does a pretty decent job with billing and invoicing. In fact, they give you simple bill management, when some other more expensive providers make you pay for a higher tier to get it at all.

While limited in terms of customization, this is plenty for a small business owner and will suit your workflow just fine.

Pricing: 2/5 – This is where Xero hits hard. They are the cheapest paid option.

And, with the promotional rate, it’s actually cheaper for the first year than any other provider on the list. It gives you 90% off your first three months, so you’ll pay $6 for the first quarter and then $20 per month for the remaining nine months.

That comes to a first-year total of $186. In year two, you’ll pay $20 per month for the duration for an annual total of $240.

That’s $426 for two years of Xero, a good bit under the list-wide average of $580 over two years.

If you are trying to use accounting software that won’t break the bank and you are an established small business that wants a better way to manage your accounts, Xero gives you more than enough reporting, invoice and billing management, and customer support to help you.

It’s affordable and is the best choice for you if you want straightforward account management software you can trust.

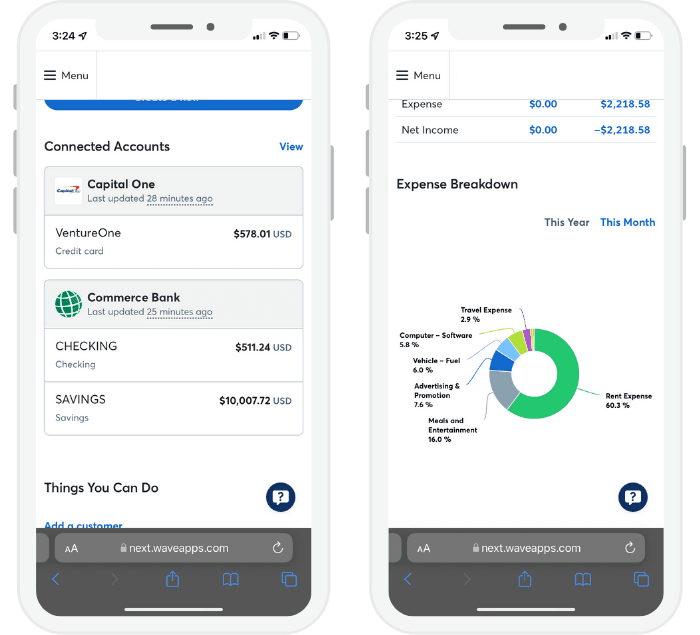

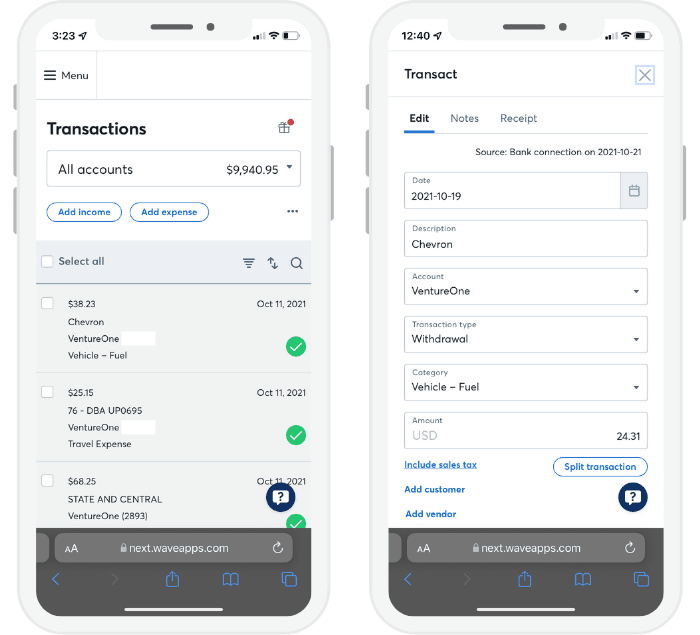

#4 – Wave — The Best for Businesses with No Budget

Wave

Best Free Accounting Software

Strapped for cash but need better insight into your cash flow? Wave is free-forever accounting software that doesn't feel free. Never pay a dime and reap the benefits of a user-friendly and surprisingly powerful platform.

Overall: 2.7/5

Are you strapped for cash but still want a way to manage your finances like a professional?

Wave is the best option. You get a boatload of free resources to help you stay organized when managing your money.

It’s the only fully-functional accounting tool on our list that’s 100% free to use, with no key features that require higher tiers. As an added bonus, it has the best invoicing and billing functionality we’ve tested.

Let’s walk you through the details:

- Ease of use: 2.5/5

- Syncing and reconciliation: 3/5

- Visibility into your books: 2/5

- Mobile app: 1/5

- Invoicing and billing: 5/5

- Pricing: 5/5

Ease of use: 2.5/5 – Wave is easy enough to get started with for a totally free platform.

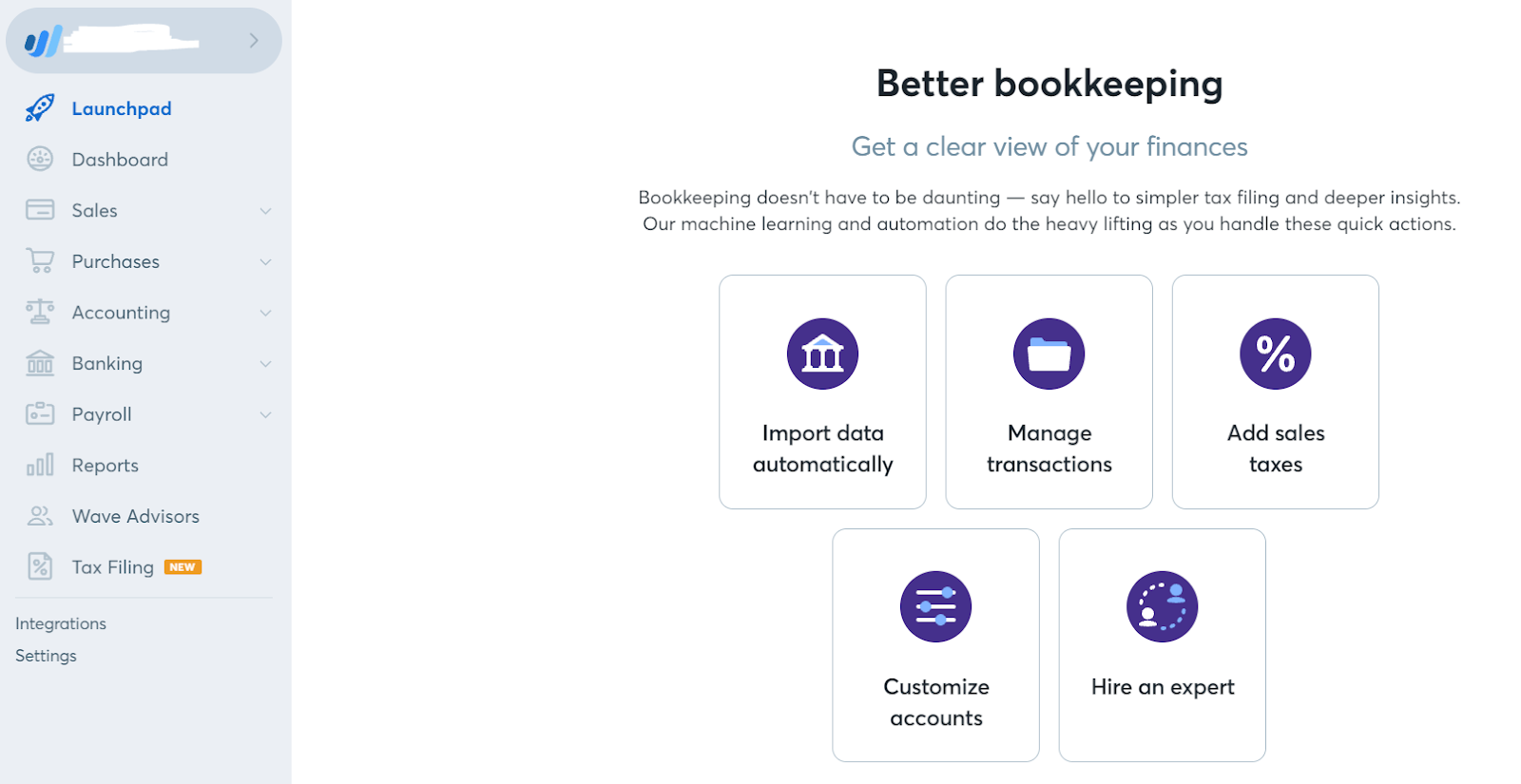

They have a helpful Launchpad area that lets you choose where to start and tailors the getting started guide to match.

There are three options: invoicing, bookkeeping, or payroll.

For example, say you want to get started with bookkeeping.

There are five tasks. You can easily navigate to each area by clicking on it. The steps are useful but are not clear on what you already completed, so you have to pay close attention.

You can come back to this screen by clicking Launchpad in the left menu. You can also go back to the three main options and switch gears any time.

Wave does a good job, too, of teaching you how to use the software over time. It has very little technical jargon and includes clear feature explanations and quick tips.

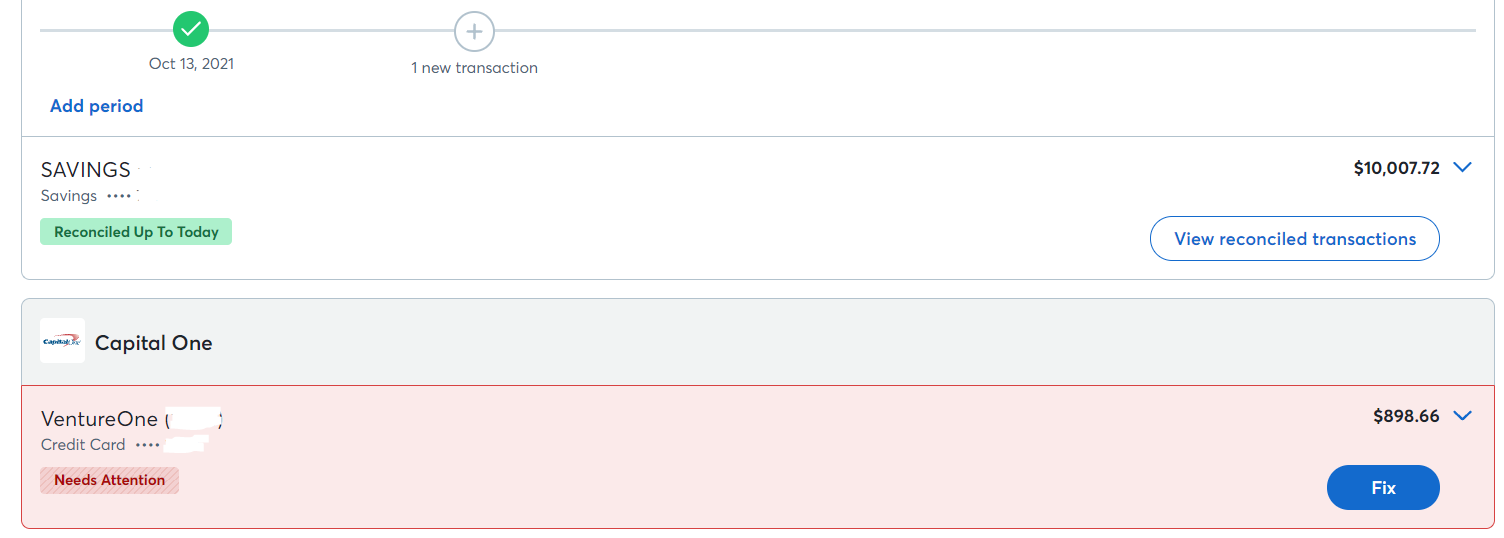

However, Wave doesn’t do the best job at stopping you from making mistakes or providing error notifications.

You can easily change dollar amounts of transactions, even ones pulled from your bank. You just need to double check them, since you can make changes that might not be accurate to your overall ledger.

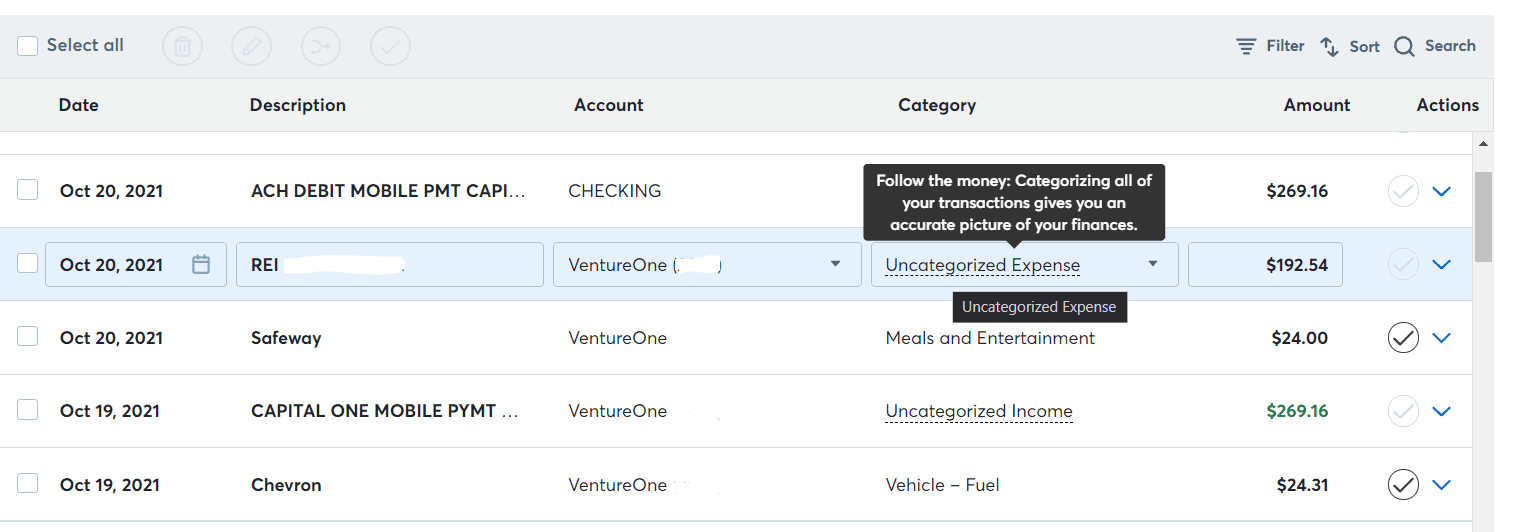

Here’s an example. The first transaction in the following image is one we manually changed the dollar amount on.

It’s exactly 37 dollars higher than what the transaction originally was.

There’s nothing telling us that that transaction’s been changed manually. No notification stopped us or warned us when we did it.

While it does let you know there’s a $37 discrepancy right at the top, it doesn’t tell you which transaction is causing the problem.

Keep that in mind as you make adjustments.

You do get a warning on the overall view of your accounts, but it’s not precise nor is it automatic once you make a manual adjustment.

It’s also not easy to get in touch with Wave’s customer support. In fact, there is no support if you only use Wave for accounting. That’s partially how they keep the software free.

If you use Wave to process payments, pay for a Wave advisor, or purchase the payroll package, you’ll get Monday-Friday support from 9 a.m. to 5 p.m. Eastern. Paying for an advisor will cost you $229 for an hour of coaching with 30 days of email support.

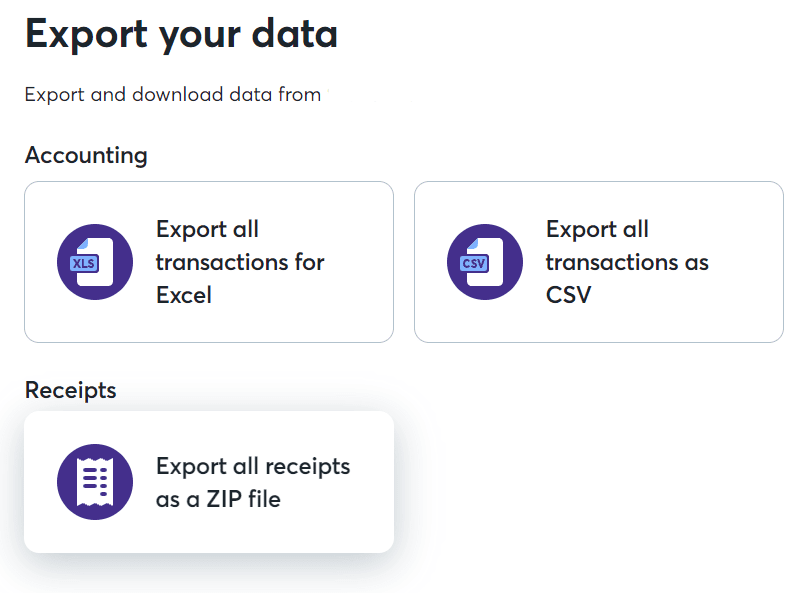

If you’re looking for exporting, you don’t have many options. You can only bulk export receipts attached to expenses.

You will find some flexibility is required, as this is a free tool. But you will get tons of benefits in other areas. And, honestly, we found the overall user experience to be a bit easier than the score leads on.

Even though you don’t have all the features, moving around the interface and setting Wave up was simple enough.

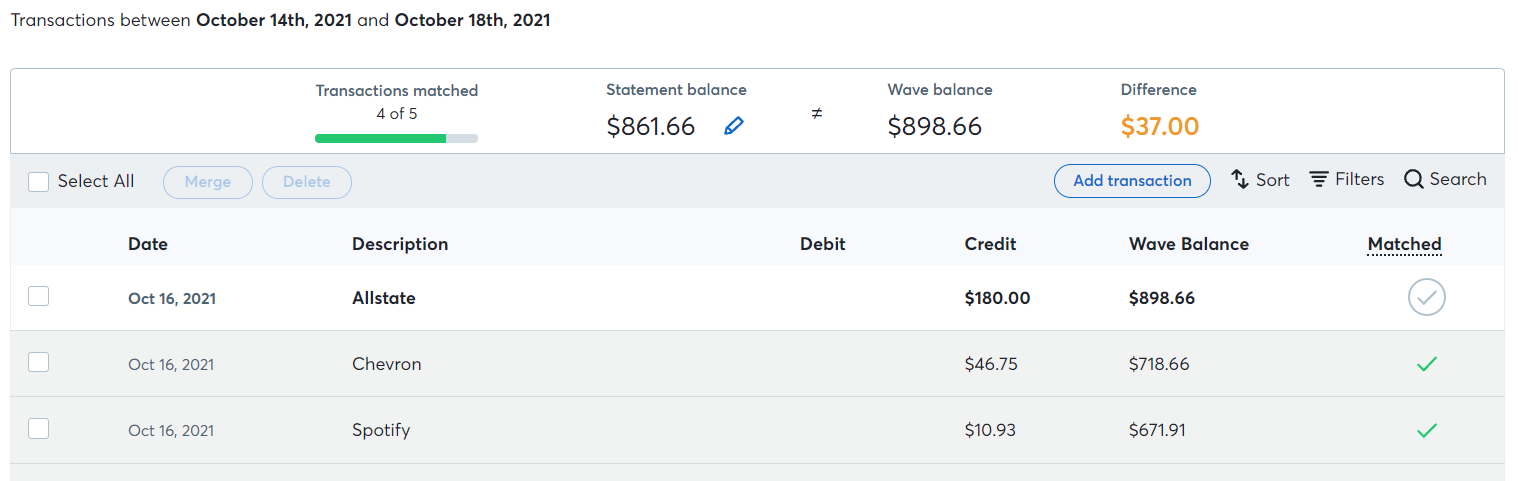

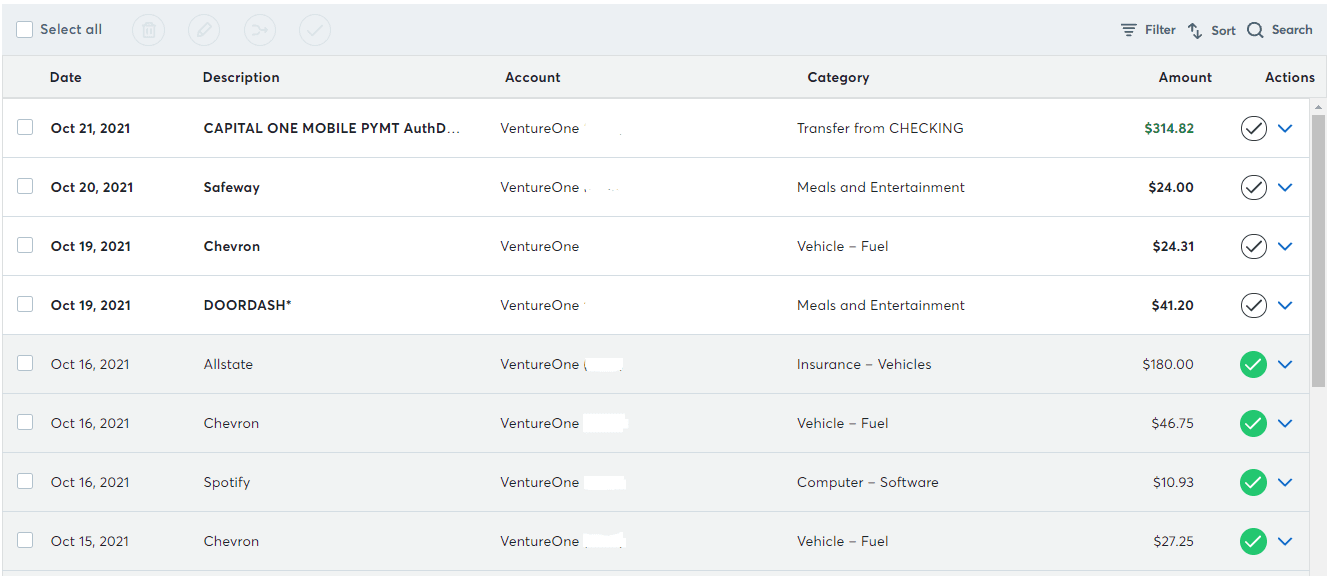

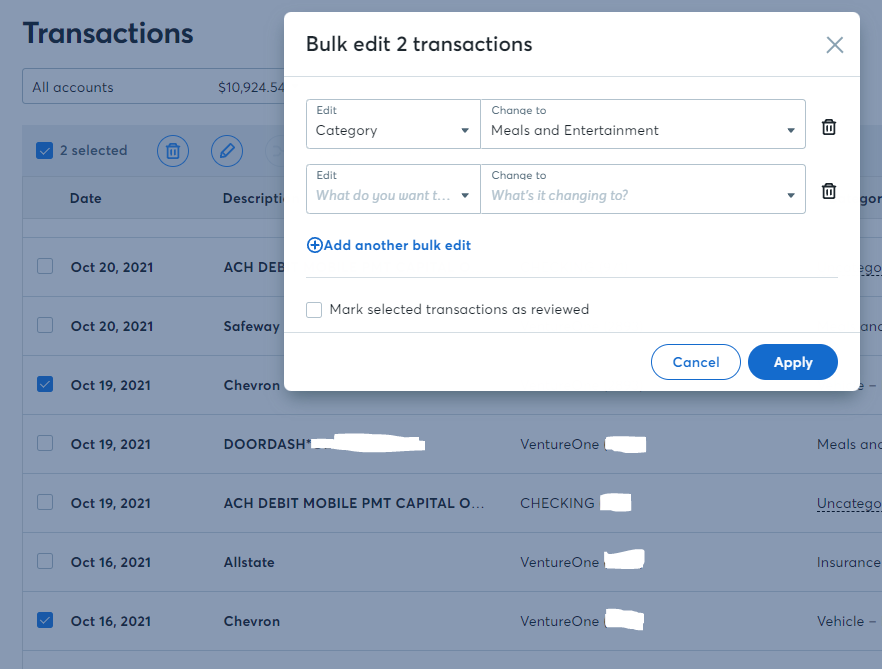

Syncing and reconciliation: 3/5 – Wave ties for second place for this category. You get smart categorization and bulk editing, and the software lets you categorize and reconcile transactions at the same time—a feature not offered on some other provider’s paid entry-level plans.

You don’t have to do an extra step and reconcile your accounts separately after setting up your categories for transactions. That’s a big time saver that also prevents errors.

Wave is only one of three providers that uses AI to categorize your transactions. The software uses machine learning to understand your transactions and automatically sort and tag them for you.

This is yet another feature some paid providers on this list don’t have. And you get it free.

You can also review and edit transactions in bulk, which is a huge feature for free accounting software.

Wave makes this basic. You can bulk edit, confirm, or delete transactions, including removing sales tax and assigning transactions to a specific account. That will save you loads of time and mistakes compared to having to manually do it.

Something we’d like to see is the ability to scan receipts and extract the data. Though it’s not included, it’s a small feature you may be able to do without since you’re not paying anything for the software.

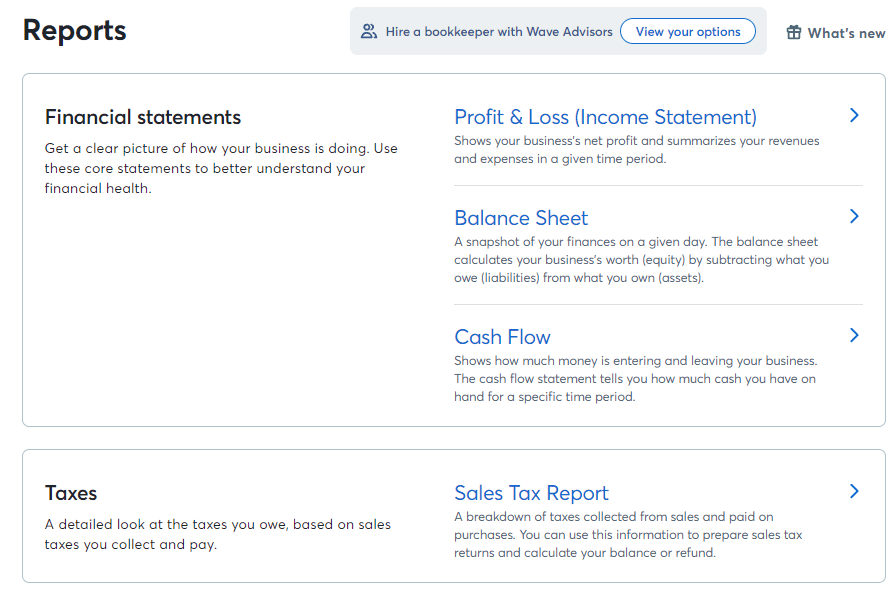

Visibility into your books: 2/5 – Reporting is a major part of managing your businesses finances. And though you don’t get all the extra perks of a paid provider, Wave holds its own here.

Basic reports are available, but you can’t use custom tags or customize the data displayed in them. That’s fair, since Wave focuses more on ease and simplicity rather than customization and depth.

The interface does a great job of explaining what reports are and what kinds of info you can get from them before opening them up. Beginners don’t have to worry about doing a bunch of self-education outside the software.

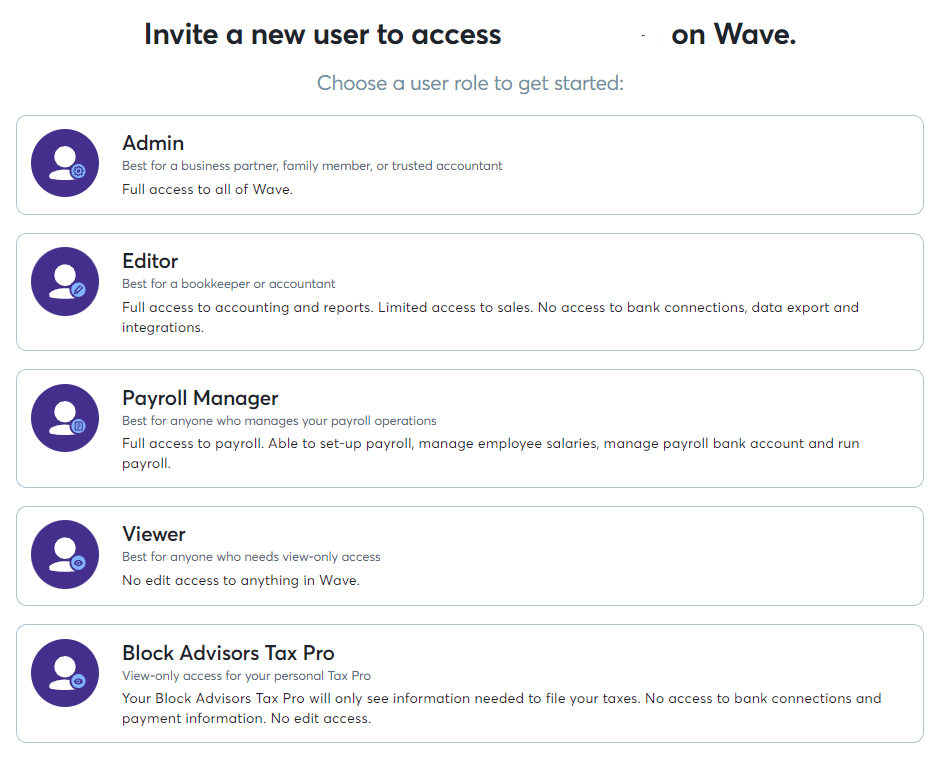

If you invite a financial specialist onto your Wave account, you can set access rules from five different levels.

Plus you’re not limited in the number of users who can be on your Wave plan. Add as many users as you want.

Mobile app: 1/5 – Wave can do better here, that’s for sure. For one, Wave doesn’t offer a dedicated app, only a portal for mobile browser access.

We found some elements worked fine within a mobile browser. But others were not adapted to fit our screen, resulting in horizontal scrolling and having to zoom in really far to see things.

Not pleasant.

Out of what we tested for, Wave only ticked two out of the 10 items we feel are important to mobile friendly accounting software. You can set up products and services, which is a nice benefit.

And, since you’re going through your mobile web browser instead of an app, there’s no issues with changes you make on mobile syncing with your desktop view of Wave and vice versa.

But you have no reporting options and you can’t track mileage or create any quotes.

Think about this. You’re out with a friend, a potential opportunity presents itself to quote and pitch them. They are finally interested. You can sign them up right then and there. But, you don’t have an app to make a quote for them in the moment and send them a hard estimate.

Sure, you can give them a quote tomorrow in the morning when you’re in the office. But what if they change their mind? Your window is lost.

Having a solid mobile app is important. You pretty much have your hands tied if you’re not attached to the desktop.

When you login on a mobile browser, you’ll see the following on your home screen:

You can view invoices and transactions and Wave’s mobile portal seems to do alright consistently displaying these on mobile devices. It’s just limited in the information you can see at a glance.

So, while decently functional on mobile, Wave falls short in some big areas of managing your finances while on the go.

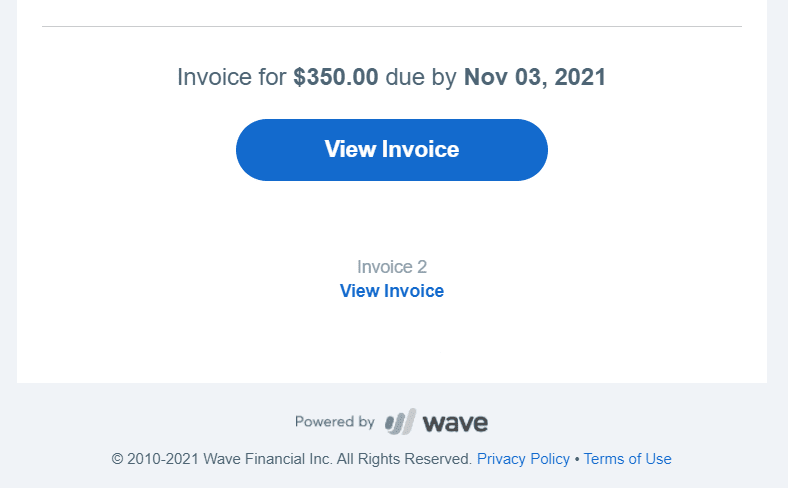

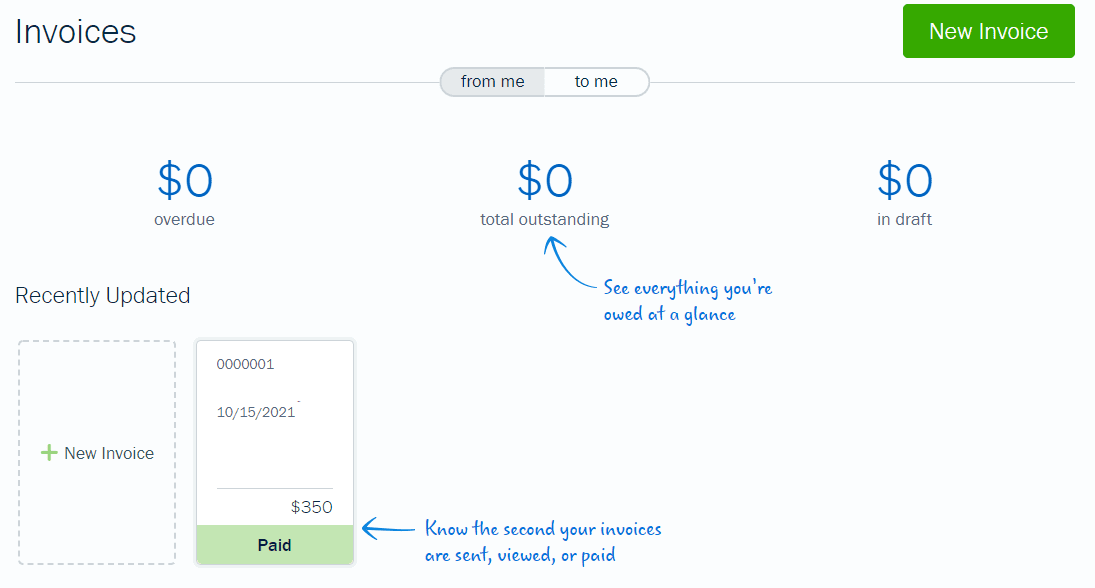

Invoicing and billing: 5/5 – Wave makes up for what it lacks in its mobile app and reporting capabilities with the best invoicing and billing features out of all the products we tested.

One thing to keep in mind is that when you send out all of your invoices, emails, and estimates, Wave will have its branding on them.

Here’s an example.

With that said—it’s not obnoxious, right? And well worth it for a free and useful piece of accounting software.

Plus, Wave gives you highly customizable invoices and no limits on how many you can send.

There are three templates to choose from.

You can then upload a logo and choose accent colors with custom hex codes.

Once you have your branded invoice, you can customize titles, subheadings, labels, footers, and notes, while also choosing which columns appear on your invoices.

And while you get stuck with some of Wave’s branding and inflexibility, you can still partially white-label your invoices. So, you won’t look like an amateur delivering invoices via Wave, since you can add some of your branding.

Whatever settings you choose will apply to all invoices, so you can’t choose different templates for individual invoices. You’re stuck with the one visual style, so make it count.

You also can send out unlimited quotes and estimates to your clients. And you don’t have to design those, either. Wave clonea the same style as your invoices.

Send recurring bills or retainers, as well.

What’s nice, too, is that you can enable payment processing to accept online payments for your invoices. Get paid without lifting a finger, they like to say.

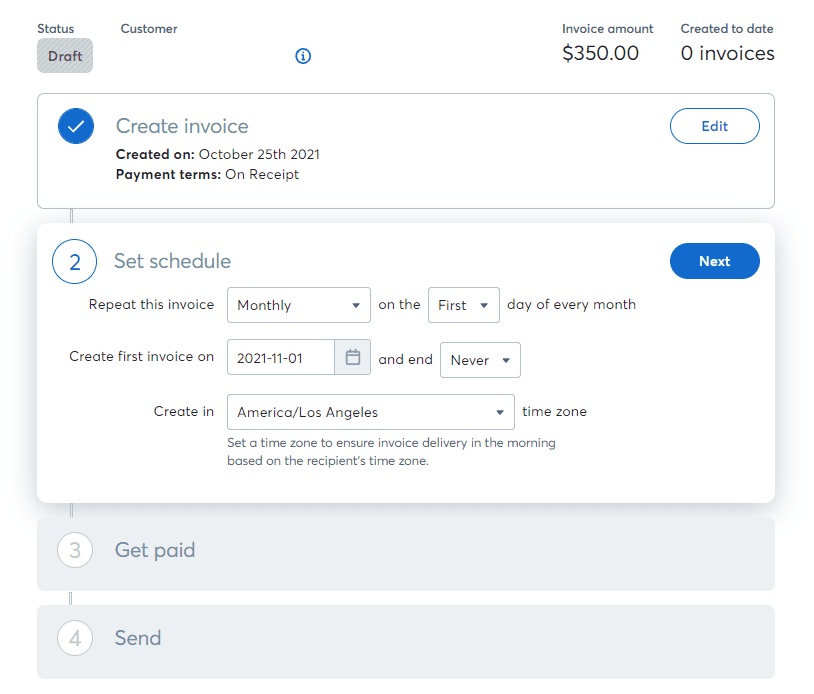

After you enter all the information needed, you’ll be able to set your schedule and you’re done.

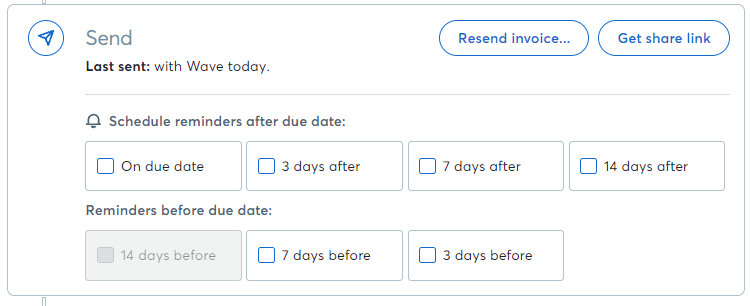

You can even set up automatic payment and overdue reminders. All your billing is on autopilot, like when you sit down to see what’s on Netflix.

Managing your incoming bills can be a time suck. Sometimes, so many things are happening, you can easily lose track.

Wave is the only option on our list that gives away unlimited bill management. Yeah, that’s a big deal.

It’s handy for keeping track of upcoming expenses that haven’t gone through your bank yet. And the software also helps you keep track of items or services you’ve purchased from different vendors.

Something you’d normally pay for is handed over willingly from Wave at no cost to you, giving you even more value and helping you manage your business with ease.

Pricing: 5/5 – So, we’ve built Wave up a lot as a totally free option. That’s no joke—you get all the benefits of accounting software for zilch.

Wave’s accounting software is 100% free forever. No pricing tiers at all.

Of course, you don’t get customer support included, but you get all the features we mentioned above and then some. Plus, there are a ton of add-ons that are available.

That said, if you’re ready to level up, Wave also offers a Pro plan for just $16 per month. With it, you unlock features like automated bank connections, recurring billing, and priority customer support. All are designed to save you even more time and hassle.

No matter which version you go with, Wave’s intuitive interface and step-by-step guidance make it easy to stay on top of your finances.

You can use Wave as a new business owner or entrepreneur and make managing your business finances point-and-click simple.

And, you get incredible billing and invoice software. Wave could easily charge for this feature alone.

Wave gives you back loads of time, plus you get step by step instructions on how to use it all.

Look, if you’ve been struggling to manage your accounts, have been losing track of what needs to be paid and when, or are having a tough time remembering who to bill, sign up for Wave today. It’s the only free accounting software that doesn’t feel free.

#5 – FreshBooks — The Best for Freelancers Who Want to Get Paid Faster

FreshBooks

Best for Freelancers

From time tracking, expense tracking, taxes, and invoices, FreshBooks comes with everything you need as a freelancer or solopreneur. If you're ready to simplify your finances, it's definitely the way to go. There is plenty of room to grow alongside your list of clients.

Overall: 2.6/5

If we could show you an accounting software that’s tailored to your freelancing business and gives you easy invoicing benefits to get paid faster, would you be interested?

FreshBooks does this and so much more.

They give you tons of features that remove the hassle of getting paid. Plus, easily track your finances, stay ahead for tax time, organize receipts, and manage invoices with elegant simplicity.

With only five billable clients on the entry-level plan, it’s perfect if you’re a freelancer or just testing the waters with accounting software.

Keep reading to find out how FreshBooks keeps things organized and easy for your business.

- Ease of use: 2/5

- Syncing and reconciliation: 2.5/5

- Visibility into your books: 1/5

- Mobile app: 4/5

- Invoicing and billing: 3.5/5

- Pricing: 2/5

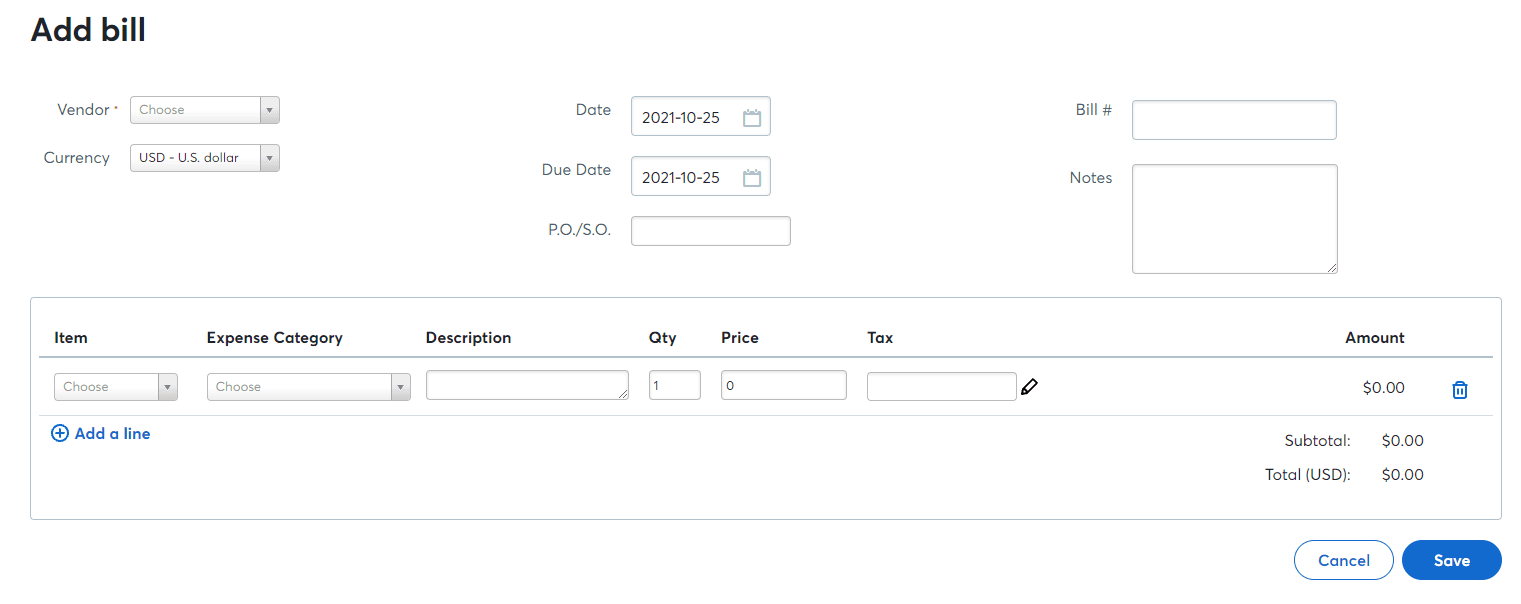

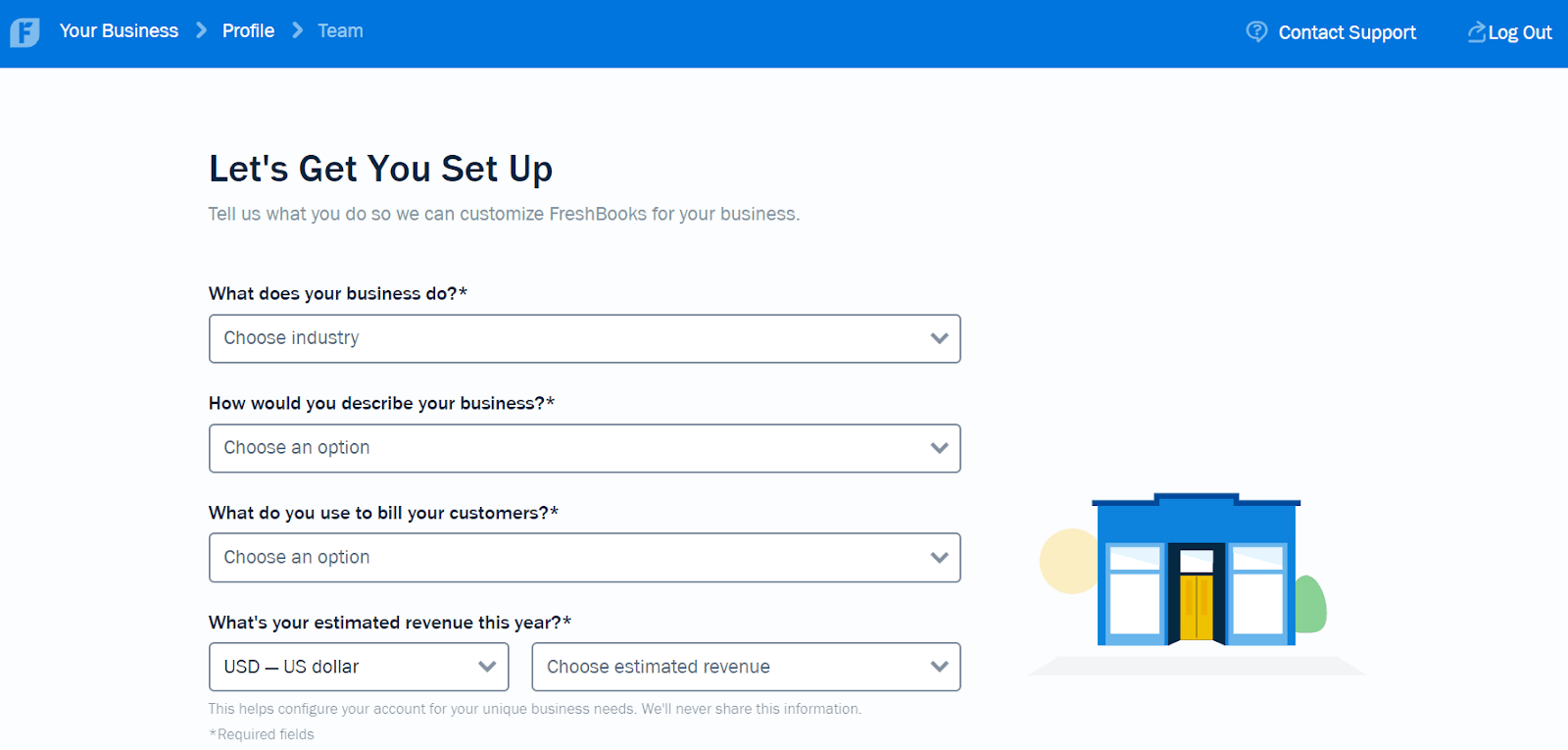

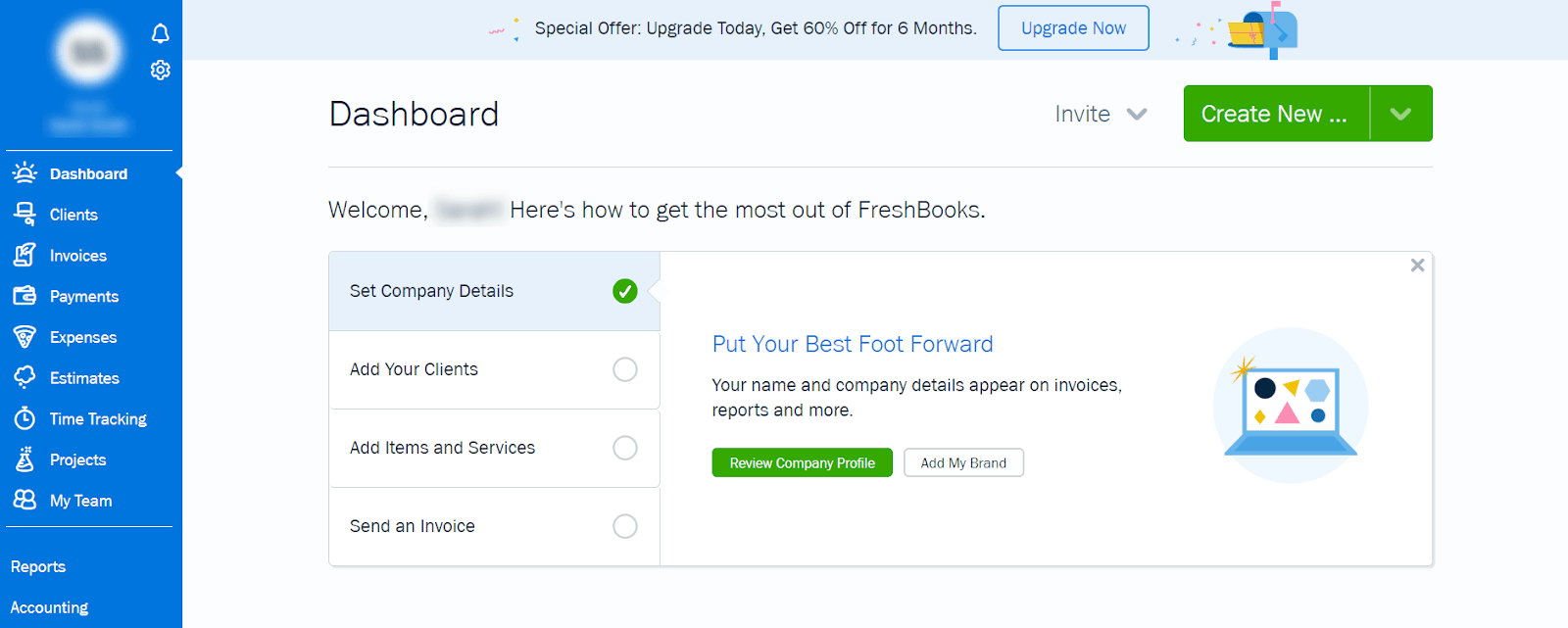

Ease of use: 2/5 – Getting set up is all but elementary. Just enter your email and a password, verify your email address, then fill out a short form about your business, industry, annual revenue, and your client billing method.

Last, add your basic business info and the number of employees you have, and you’re ready to go.

Here’s what it looks like the first time you login to your account:

FreshBooks is all about focusing on invoicing rather than every accounting function under the sun.

So it’s pretty straightforward. There’s an easy checklist to get you going.

The interface is clean, bright, and has a colorful design.

Everything is written in plain English and FreshBooks does a great job of showing you how to use the software over time as you move forward, without overwhelming you or leaving you guessing.

Every screen has helpful tips that explain everything:

The pages don’t overwhelm you with information, it’s always as straightforward as possible.

Which is nice if this is your first time trying this kind of software out.

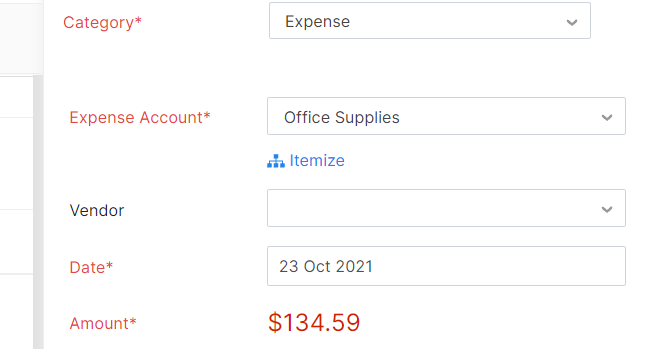

However, you need to focus on manually entering data, because there isn’t much error detection. That can cause issues later if you edit individual expenses.

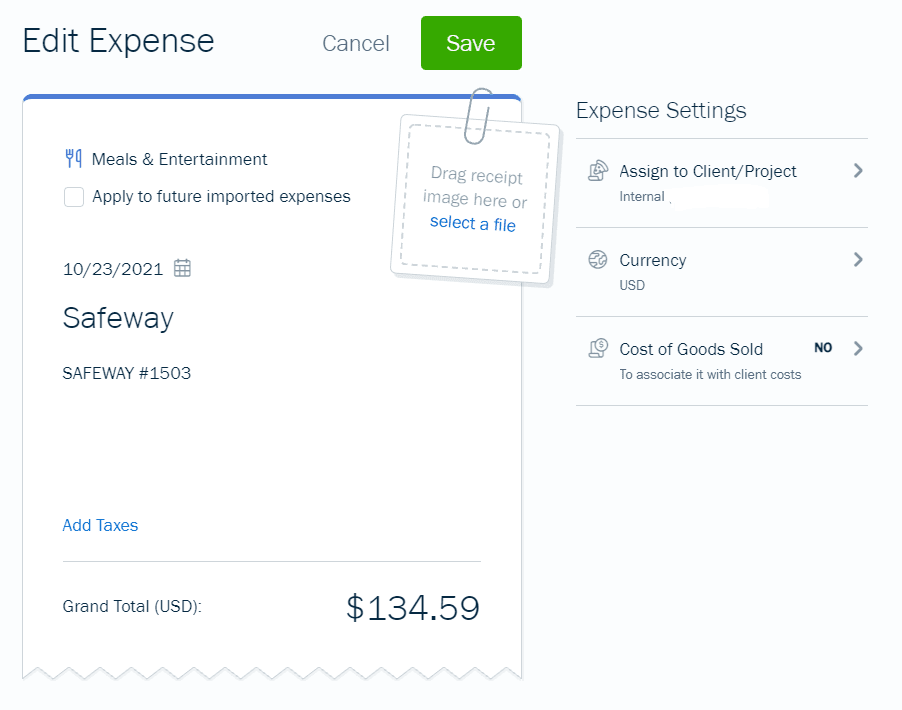

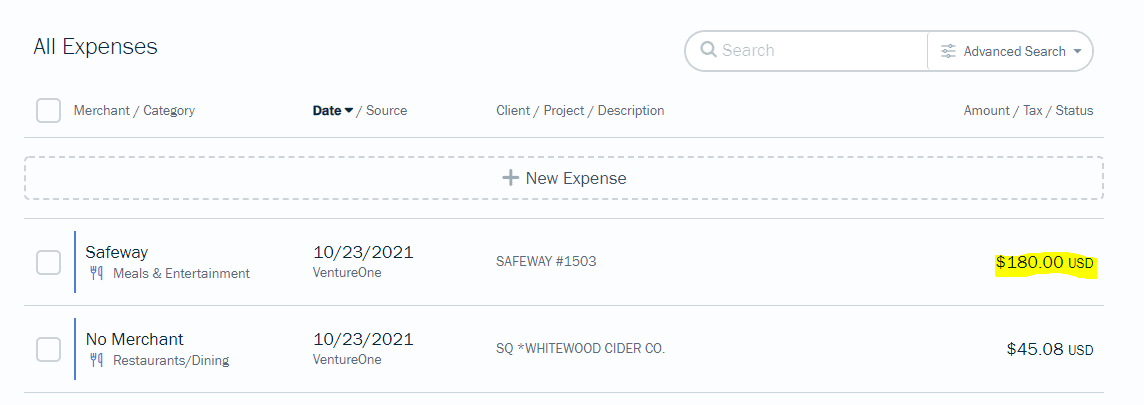

The screenshot below gives you an idea of what we mean.

We changed the dollar amount from $134.59 to $180 and did not receive any warning at all.

Since other software doesn’t let you change dollar amounts or alerts you not to change things unless you know what you’re doing, we feel like this is severely lacking in FreshBooks.

With no alert about the discrepancy, it’s just there until you find it and either change this dollar amount back to what it should be or delete it.

If you’re not sure what you’re doing, you may not realize that the accounts are not matching.

So be careful and make sure things add up if you decide to change dollar amounts manually.

This becomes even more important because there is no live chat to get immediate help to answer your questions or any option for requesting a call back.

There is a broad level of support that allows you to call or email. But you won’t get the tailored customer service rep that is trained to handle your request like with other providers. And you won’t be assured that a rep who answers your call will have all the information about your issue beforehand.

They also have a help center with guides to walk you through common problems.

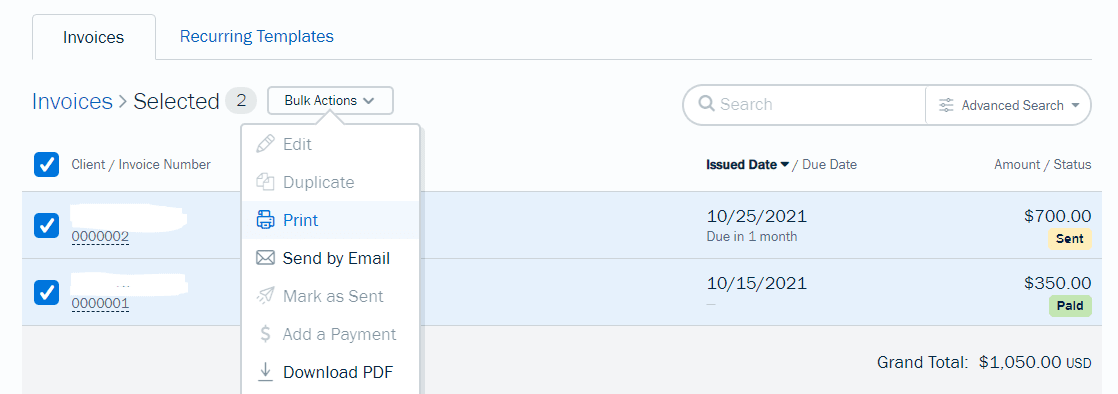

When it comes to downloading your invoices or receipts, you can do it in bulk.

It’s one of only two tools on our list that give you an easy way to bulk download documents for different types of transactions.

All you have to do is select all the transactions you want to download, go to the bulk actions drop down menu, and select Download PDF.

You can download each one as an individual PDF file or print to save them all as a single PDF.

But, if you want to export all of your receipts, you’ll have to contact FreshBooks to ask them to compress all your receipts into a ZIP file and email it to you when it’s ready.

Syncing and reconciliation: 2.5/5 – Now, for syncing and reconciliation, FreshBooks’ entry-level plan came in second-to-last place.

They do have smart categorization for transactions.

It looks for keywords related to different types of expenses and makes sure all of your transactions are easily organized without you doing any manual work.

The following were all automatically categorized when we tested the software:

FreshBooks does not offer reconciliation at all, however. If you need this, you can have it on the next level of paid plan above the entry-level package we tested.

We’d like to point out, though, if you’re just getting started or don’t have a lot of transactions, reconciliation isn’t really a necessity.

It’s not going to take you long to add things up yourself and make sure your transactions match your overall balance.

So there’s nothing wrong with using this plan as a freelancer or solopreneur.

You also have very basic options for creating rules that automatically categorize transactions.

For example, there’s a checkbox you can select if you want to automatically categorize future transactions from the same merchant.

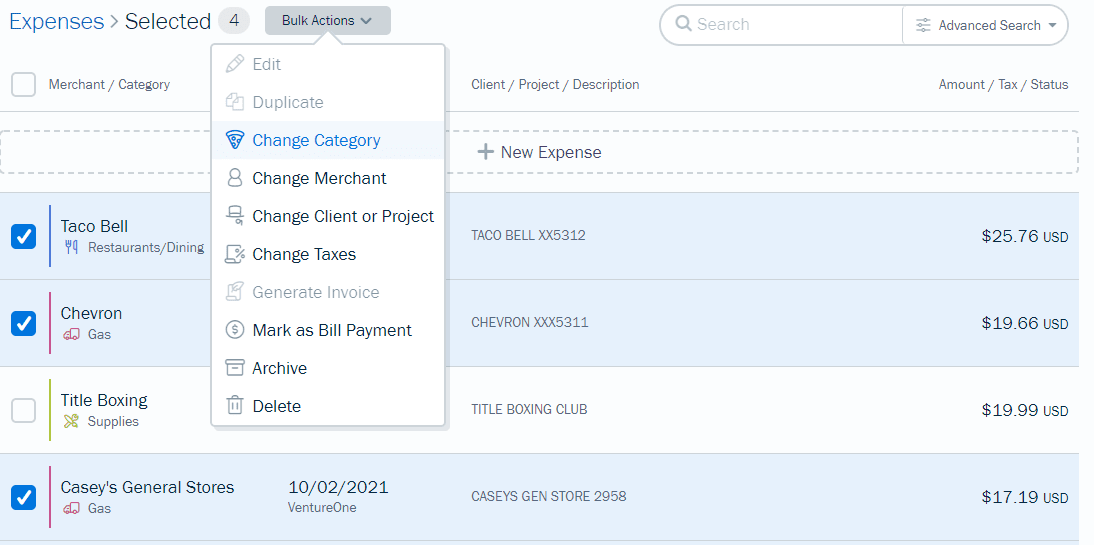

Transfers, income, as well as expenses can all be reviewed, confirmed, and edited in bulk very easily with FreshBooks. You don’t have to manually go through them one by one, which lowers the risk of errors you can make.

Bulk editing options include changing the category, changing the merchant, assigning them to a client or project, and changing the taxes.

You can also bulk archive or delete transactions. It would be nice if you could also automatically scan receipts and extract the data, but that’s missing from the entry-level plan with FreshBooks.

But it’s not the end of the world since you can easily update transaction information without restrictions. Again, just make sure to double-check your work.

Visibility into your books: 1/5 – FreshBooks scores the worst in this category out of all others on this list.

You do get guidance on how to use each report, which is nice. You will have a clear understanding of which reports are for what.

But you’re missing a few standard reports that come with other providers, like a general ledger of your company’s total financial accounts or a trial balance report for ensuring the entries in your bookkeeping system are mathematically correct.

They are available on higher tiers of FreshBooks, just not the entry-level one.

Here’s a screenshot of your reporting options:

There are only a handful of reports that are slightly customizable, so reporting is overall very limited.

FreshBooks is also missing granular reports that freelancers and solopreneurs find useful, like profit and loss by customer, unbilled hours, sales by customer, and estimates by customer.

The only pre-built reports that may be useful are revenue by client and sales by item.

What you can do is filter information on all reports by date, item, client, payment method, or status.

You can’t change how the reports look, how things are labeled, or what other information appears in the header or footer of the report.

Here’s a look at a standard report style you’ll be working with:

So, not a lot of bells and whistles here, but it’s enough for a sole proprietor to get things done.

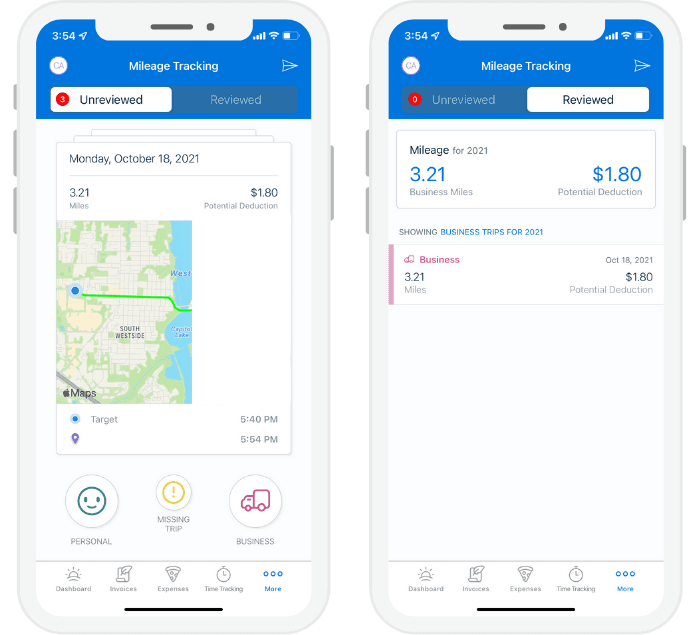

Mobile app: 4/5 – Now, as a freelancer or solopreneur, your living room or local coffee shop might be your office. You might also be doing a ton of business outside, meeting people, kissing babies, and closing deals if you’re lucky.

So, having a mobile app that lets you see how you’re doing on the go is crucial.

FreshBooks delivers here big time.

The only thing you can’t do is add a bill or view reports inside the mobile app.

FreshBooks checks off eight out of ten app related benefits we tested for:

- Automatic mileage tracking

- Categorize transactions

- Set up products and services

- Create quotes

- Upload receipts

- View overall financial health and trends

- Syncs automatically with the web browser

- Only one app required

Some providers require you to download multiple apps to handle different accounting tasks. With FreshBooks, it’s all done in one app, which is great.

Even more important is that some apps make you close them and restart the app to get it to sync up with changes you made on the web version.

With FreshBooks, you don’t have to do that. You can refresh with the app open. No need to shut it down.

Just imagine having to close the app every time you wanted to see if a receipt you added was uploaded..

The FreshBooks app was one of the better ones we tested. There is only one other provider with a higher score.

Not only is it fully functional, it’s also very easy to use and looks great.

Once you login, you’re greeted with an easy-to-read mobile dashboard.

Since you might be logging miles, you need an easy way to manage them. It’s a cinch in this app.

You can see not only your location, but how much of a potential deduction you will receive.

And, when you’re ready to send an invoice, you can edit it with a few taps on your screen.

FreshBooks’ app is a huge win for entrepreneurs and freelancers. It’s easy to use and delivers a ton of key features in a clean interface.

Invoicing and billing: 3.5/5 – FreshBooks puts a lot of focus into invoicing. You can customize your invoices to match your brand, add logos, and color schemes using compatible hex codes, and choose from three different templates.

There’s even the option for a few different font styles.

When creating a new invoice, you can also edit your company information at the top, if there’s anything you do or don’t want to include.

This gives you the freedom to control the look and feel of your invoices.

As we mentioned earlier, you can send an unlimited number of invoices but you can only have five billable clients. If you have more clients than that, you’ll have to upgrade to a higher tier.

But, you can send out unlimited quotes and estimates on all plans. You’re not limited, which gives you the opportunity to market freely and increase your chances of landing that big account.

Any global settings you apply to invoices will transfer over to estimates.

But, if you are feeling extra creative, you can also customize the style of them individually.

Creating an estimate is just like creating an invoice. Once you know how to do one, you know how to create the other.

If you need to send recurring invoices and retainers, you can. However some of the more advanced features are removed, such as automatic email sends. You will be notified a recurring bill is coming but, instead of the software sending it out for you, you will have to click send yourself.

You also can’t customize your email templates on the entry-level plan.

What’s cool, though, is you can turn any bill into a recurring invoice.

Once you make it recurring, you can set the next issue date, decide how often it goes out, and determine when it ends.

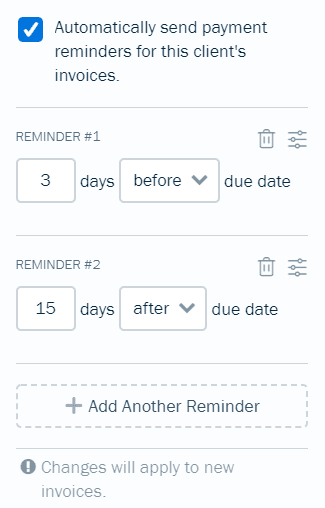

One of the best features offered by FreshBooks is automatic payment reminders.

So, though you have to manually send out recurring payments, your reminders are on autopilot.

This allows you to get paid faster and easier because you are not chasing money. It just shows up when it’s supposed to.

Once you add a client to a new invoice, you’ll have the option to set up automated reminders.

By default, they’re turned on and set to remind clients three days before the due date and 15 days after.

If you want, you can add additional reminders as well and edit the default reminders.

And, when you make changes to one invoice, it’ll automatically update to that reminder schedule for future invoices, taking the extra leg work out of having to go back and change it again each month.

The setup is not hard at all.

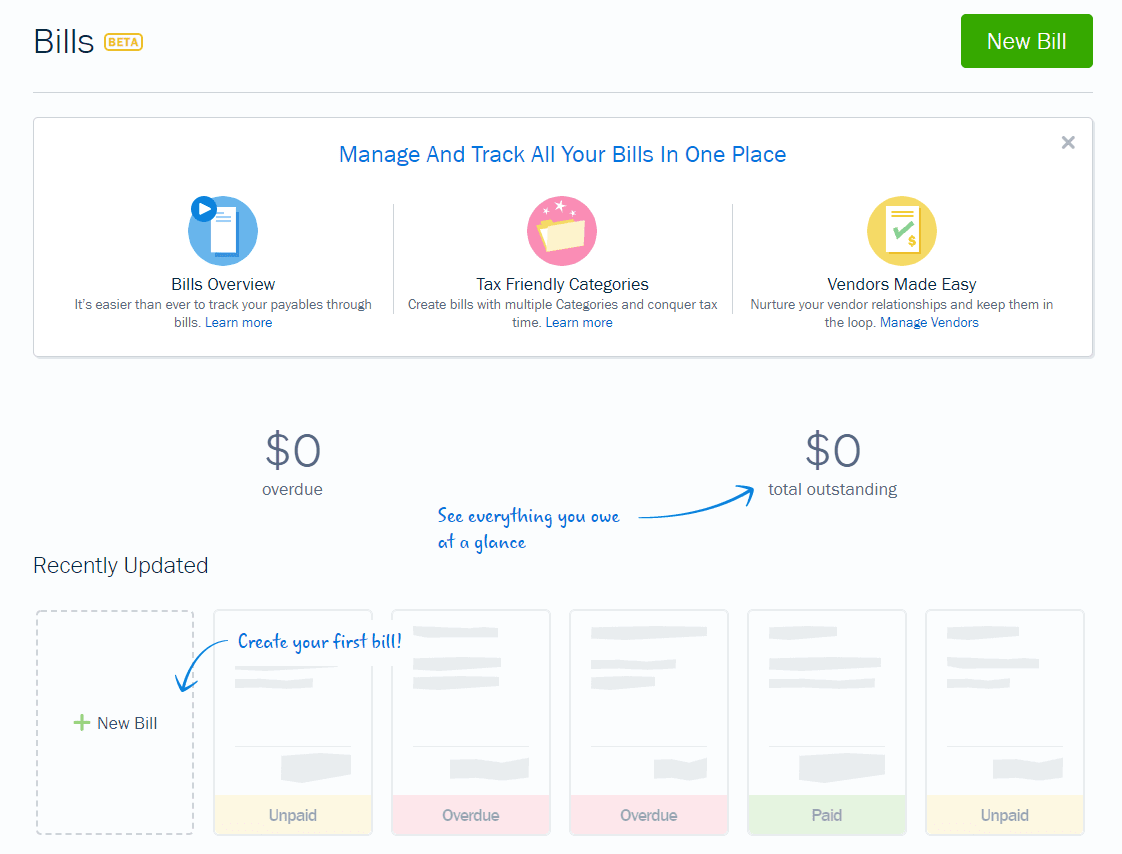

If you want to manage some of your expenses with bill management, that’s possible. At the time of this post, though, this feature is in beta. And it’s only offered during your free trial. After that, you would have to upgrade to the Premium or Select plan.

All in all, FreshBooks does an above average job with invoices and billing, but makes management of them pretty simple.

Get paid faster and keep things organized so you can focus on running your business.

Pricing: 2/5 – FreshBooks comes in smack in the middle for pricing amongst the others on our list.

Instead of a free trial, FreshBooks offers a 30-day money-back guarantee, so you can try it risk-free. Plans start at $2.10 per month with the promotional rate.

You get 90% off your first four months, so you’ll pay $2.10 per month and then $21 per month for the remaining eight months.

That comes to a first-year total of $176.40. In year two, you’ll pay $21 per month for the duration for an annual total of $252.

That’s $428.40 for two years of FreshBooks, a good bit under the list-wide average of $580 over two years.

FreshBooks allows for easy customization of invoices, offers a top-notch mobile app, and is perfect for the busy entrepreneur. The easy invoicing lets you get paid faster and removes the complexities other accounting software adds to the learning curve.

Start reaping the benefits by beginning your free FreshBooks trial today.

#6 – Sage — The best for small businesses that need essential features

Sage Business

Best for Basic Needs

Sage Business delivers basic account features, making it perfect for microbusinesses. Get a solid mobile app and essential tools for a predictable, low monthly rate.

Overall: 1.6/5

Sage is affordable and cloud-based accounting software that makes sense for organizations with fewer than 10 employees.

Amazon suppliers, small consultancies, design firms, and home-based businesses can all benefit from Sage’s accounting software.

That said, Sage’s entry-level plan is about as basic as they come.

You don’t get much, but you get enough to manage your business accounting with very little financial risk.

They do offer many other options on a higher tier, but we didn’t test that plan.

Let’s get into what their entry-level plan does well.

- Ease of use: 0.5/5

- Syncing and reconciliation: 1/5

- Visibility into your books: 1.5/5

- Mobile app: 3/5

- Invoicing and billing: 0/5

- Pricing: 1/5

Ease of use: 0.5/5 – Sage Accounting is hands down the least user-friendly software on our list. We say that because you’re not offered any help when getting started.

When you get started, you enter your name and email to sign up. Then, type in your company name, phone number, and other particulars.

Once you set up your password and confirm your email, you’re sent to the account dashboard.

There is no step-by-step process guiding you after that, like you get with most other providers.

It’s like getting dropped off in a city you don’t know, with no GPS, no map, and being told to just find what you’re looking for.

Sage does send you a getting started guide in your welcome email, but it’s silly to us that you need to look at two different places to learn how to navigate the dashboard.

We found the interface clunky and hard to navigate. They use a horizontal navigation menu at the top which isn’t as intuitive as a vertical layout.

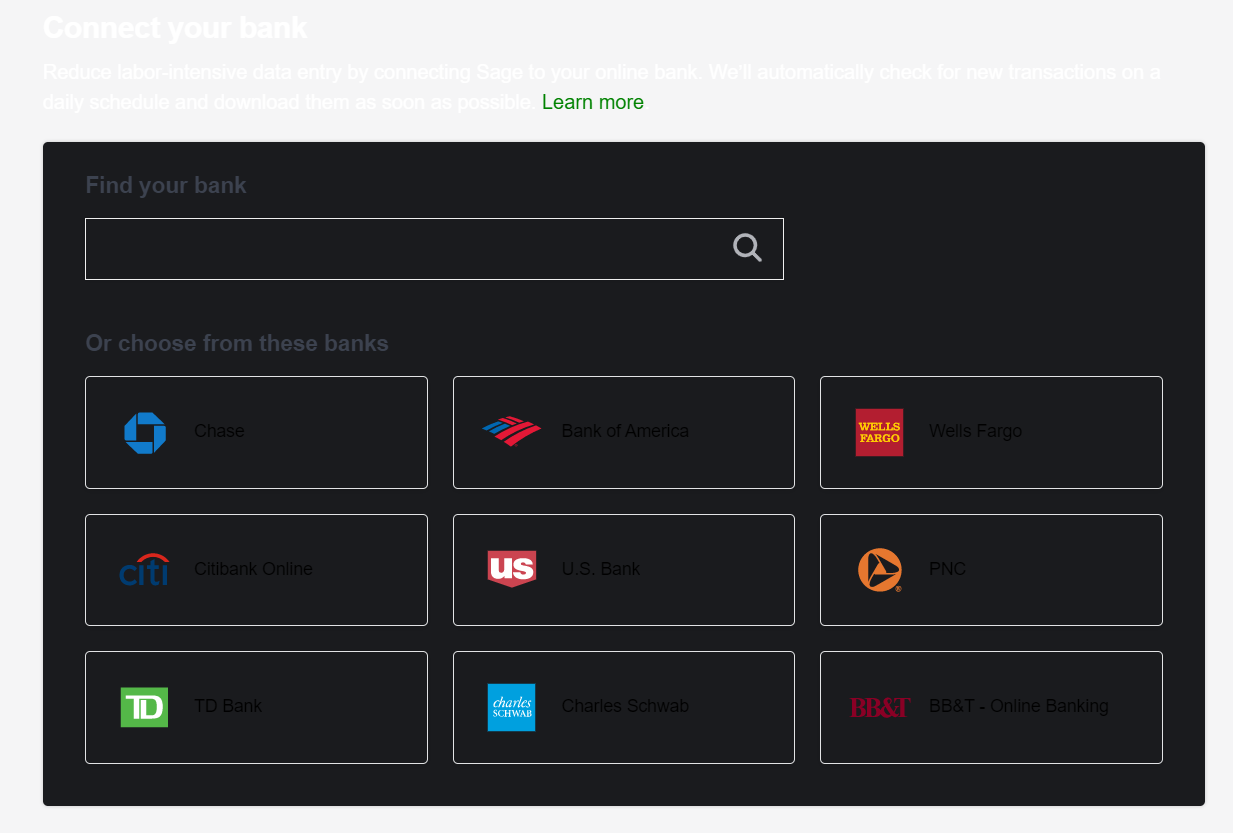

When we went to connect our bank accounts, the screen was barely readable. It could have been a browser issue, so you might not experience this. But this revealed it could be poorly coded software, adding to the overall clunky user interface.

It’s almost impossible to tell what anything on this page says.

If you make a mistake and select the wrong import date (like we did), you have to disconnect the account and start over entirely.

Our set up experience was not as smooth as some other providers we tested.

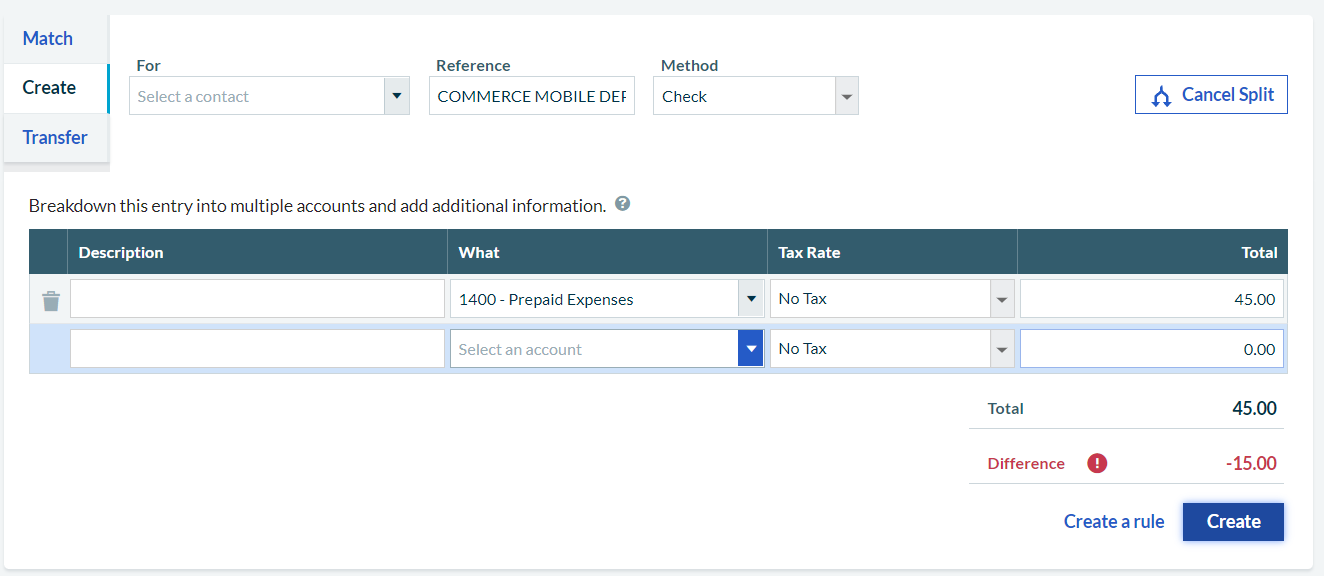

When you’re reviewing and categorizing transactions, the system won’t let you change the dollar amounts of transactions pulled from your bank like with some other providers. So, that’s good. There is no chance to mess them up.

Even if you try to split a transaction between two accounts, Sage shows an error message if things don’t add up how they’re supposed to.

You can’t save the transaction until you fix it. This helps prevent you from making mistakes that’ll cause issues later on.

Overall, Sage does a decent job at stopping you from changing things that will cause mistakes.

If you have questions, the only ways to get help are through the community forum, the knowledge base, or a live question-and-answer chat available from 9 a.m. to 6 p.m. Eastern.

This chat option is not like a common live chat experience when you have one rep that helps you. Instead, you have to fill out a form and choose a time slot that you’ll share with who knows how many other people.

You may not even be able to get your question answered.

It’s almost like sitting in a press conference and fighting with every other reporter to get your question answered.

This takes away from the ease of use big time.

If you’re looking to bulk exporting of transactions it’s not available on Sage’s entry-level plan. You will have to go into each individual transaction and download the attachment.

Syncing and reconciliation: 1/5 – Out of the five things in this category we tested for, the ability to create custom categorization rules is the only time-saving feature you get.

Customize rules for similar transactions that come in. If it’s the same price or from the same company, it can be automatically organized and documented based on the rules you set.

AI categorization is not available, though, plus you can’t categorize and reconcile transactions at the same time.

So after you’ve finished categorizing your transactions, you then have to go to a separate screen to reconcile them to ensure your balances add up.

To start reconciling your accounts, you first have to enter an ending balance as well as the date of that balance.

From there, you can choose which transactions to reconcile.

So, reconciling your accounts requires quite a few steps that can get confusing if you’re not sure what you’re doing.

Sage also is missing out on bulk editing and reviewing, as well as automatic receipt scanning.

However, you can organize your receipts and attach them to transactions with Sage’s entry-level plan.

There’s just no way to automatically pull information from receipts or automatically attach receipts to the right transaction. Which leaves you to manually enter them yourself.

Sage offers an add-on called AutoEntry for $12 per month that does this. If you sign up for Sage’s more expensive plan, you’ll get to try it free for 3 months.

Visibility into your books: 1.5/5 – For reporting, Sage scored next to last.

They are missing a lot of customization features and you can’t use custom tags to organize your transactions.

It feels very basic in comparison to other tools on this list. There are very few reports in the entry-level plan that are useful to business owners and entrepreneurs.

Prebuilt reports like profit and loss by customer or sales by product or service aren’t available either, making it difficult to find or quickly create what you need.

There are only 14 total reports, none of which you can really customize.

Some reports let you sort by contact or amount. More often, most only let you adjust the date range.

It’s not really possible to get a granular look at your business with the reports provided.

But, you do get guidance on how to use them and information about what they deliver, helping you run the right reports the first time.

The software goes a step further by telling you what question you’ll be able to answer by looking at the report.

This gives you a very clear idea of what you’ll find inside.

As you can see, the tooltip in the image gives an explanation of the profit and loss report.

This may seem all bad when it comes to reporting, but it’s not. The bonus of all this is it’s greatly simplified compared to other options on our list. And, since there are so few options and settings to play with, you can focus on the core essentials of your accounting without feeling overwhelmed.

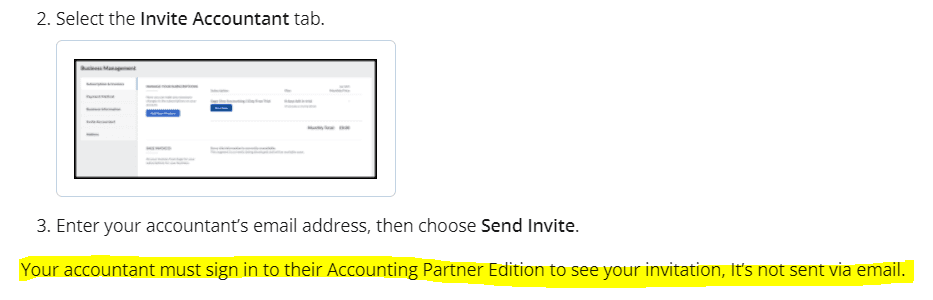

With Sage you can only invite an accountant into your account if they use Sage Accountant Partner Edition. If they don’t use that, you’re out of luck.

Sage is the only software on our list that requires your accountant to sign up for Sage software themselves to be able to get access to your account.

We looked deeper into this and the Accounting Partner Edition is free for accountants to use.

However, that means that your accountant has to sign up for this before they’ll even see your invitation.

Most accountants have software they are comfortable using. If it’s not Sage already, it could be hard to convince them to learn it or switch.

Keep all this in mind if you plan on having an accountant and you want to share access with them through Sage.

It’s worth finding out ahead of time if they are familiar with the software or even want to learn it before committing to a specialist.

Mobile app: 3/5 – Sage meets six out of the 10 requirements we test for in this category.

In the list below the first three are offered on the entry-plan and the last three can be accessed on higher tiers.

- View overall financial health and trends

- Upload receipts

- Only one app required

- Set up products and services

- Create quotes

- Add a bill

Some providers require you to download multiple apps. However, with Sage, it’s all done in one app, which is great.

The mobile app is limited just like the basic entry-level plan. But the interface is not that complicated because of a minimalist design.

Being able to manage your mileage would be a great addition to the entry-level plan.

Same with categorizing transactions. We feel it’d be nice to pop open your phone and list a lunch under “business meetings” on your phone, rather than having to remember it later on.

Viewing reports is also missing from the mobile app. There are not many reports, but having the freedom to review them or walk through what you see with a business partner outside of the office is ideal in our fast-paced world of business.

And, after uploading your receipts from that business meeting, you have to completely shut down the app to sync it with your desktop. It’s not a terrible thing, unless you forget your books are not synced and lose your changes.

You can use the app to keep an eye on expenses, transactions, and also to view your business’s financial health with ease. But some of the features completely missing would make your life a lot easier.

Invoicing and billing: 0/5 – Sage scored the lowest since it doesn’t meet any of the criteria we tested for.

You can’t send quotes or estimates, set up or send recurring invoices or retainers, and there are no automated payment reminders.

However, you can create and send basic invoices with Sage’s entry-level plan. You just don’t have much customization.

The theme for Sage’s entry-level plan is minimal features. It’s meant to be affordable and to give you only the necessities.

If you want to manage bills, you’ll need to upgrade.

On the entry-level plan you get one template you can use for your invoices. The only customization you can make is the logo.

And this is what they look like when sent to a customer:

Sage’s entry-level plan also doesn’t include bill management features. So if you are looking for a plan to help you manage outgoing and regular expenses, the Sage base level plan isn’t for you. It’s best to start at a higher tier or find a better platform that can deliver that feature.

Pricing: 1/5 – Sage 50 starts at $61.92 per month for the Pro Accounting plan, making it one of the more premium options on our list. That’s just over $700 per year, or about $1,400 for two years, putting it well above our list-wide two-year average of $580.

That said, Sage frequently runs introductory discounts, so you may be able to lock in a lower rate for the first year.

The Pro Accounting plan is built for small businesses that want desktop-level performance with the flexibility of cloud-connected features.

You get strong reporting tools, inventory tracking, advanced invoicing, and job costing. Things most basic accounting platforms don’t include. It’s more robust than many entry-level options, and that’s reflected in the pricing.

If you’re looking for power, customization, and serious accounting features without jumping straight into enterprise software, Sage 50 is worth considering.

There’s no free trial, but Sage offers a 60-day money-back guarantee, so you can try it risk-free.

Methodology For Choosing The Best Accounting Software

When looking for an accounting software package that works for your business, we wanted to identify packages that successfully match your needs.

We signed up for free trials of all the different tiers, then set up our credit card, savings account, and checking account to simulate a real small business using the software.

Then, we categorized all of our transactions and reconciled each account to see how the tools work.

This helps you see what it’s like to run your own business with each tool.

You get to see the best benefits of each provider, so you can easily focus on what will make the best impact quickly.

Along the way, we paid close attention to the top five factors of accounting software listed below.

Each category we tested is weighted with a percentage of importance based on our research.

- Ease of use (20%)

- Syncing and reconciliation (20%)

- Visibility into your books (20%)

- Mobile app (20%)

- Invoicing and billing (10%)

- Pricing (10%)

The sections that follow show you in detail how we came to the overall score for each provider.

In the end, this methodology should remove any obstacles you have, giving you a clear path to an easier decision about selecting the best accounting software.

Accounting Software You Can Use In Your Sleep (20%)

Being a business owner or entrepreneur without a background in finance, bookkeeping, or accounting doesn’t mean you shouldn’t be able to confidently manage your books.

Our research uncovered ease of use as a main criterion for small business accounting software.

Having an easy way to keep track of your finances without needing a degree in finance is essential.

We signed up for each provider on this list and read all of the getting started materials to get familiar with the software.

From there, we connected our bank account, credit card, reconciled our books, and paid close attention to the UI and overall ease of use.

We chose five criteria for scoring (one point for each):

- A guided setup process or automated checklist to help you get started

- A beginner-friendly and intuitive interface that leads you in the right direction

- Error and discrepancy warnings that help prevent mistakes

- Ease of getting in touch with the right level of customer support

- Exporting attachments in bulk

We awarded half a point if a provider got part of the way there but didn’t quite stack up to the others on our list.

A guided setup and easy to use interface helps you get comfortable with the new software. But, if you get stuck, it’s important to have a way to get support. So, we also talk about how that works for each provider.

Another thing we found most valuable is having error and discrepancy notifications. WIthout it, you can easily mismanage your books and not know where the mistake happened.

You can end up with unbalanced books and have to spend hours going through transactions to find the mistake. So having error and discrepancy checks built into the platform is a life-saver.

When you can export attachments in bulk, you can save massive amounts of time. The tedious task of going through transactions individually can increase mistakes.

Plus, bulk exporting makes sending proof to the IRS fast and organized if you happen to be audited.

You can attach images and send PDFs of every transaction or individual transactions separately.

As you follow the reviews above, you will see some offer more help and ease-of-use than others.

Sync Your Accounts with No Fuss (20%)

Being able to get your transactions into your accounting software without issue is crucial. Your books should always reconcile consistently and quickly.

Being able to remove human error and do this mind-numbing work in seconds instead of days Is a much sought-after feature of accounting software.

As your business grows and you start leveraging different types of software to run your business, syncing can also mean integrating other business tools as well.

We recommend you make a list of all the places you have accounts and make sure the accounting tools you’re considering have a good enough partnership with your banks and account providers to offer one-click sync.

As you start to automate processes and scale up, you could sync your CRM, your inventory management solution, your project management tools, and your payroll software.

You won’t have to update two separate pieces of software for a customer file, for example. Instead, seamlessly transfer the information to your CRM or payroll software.

The five criteria we chose for scoring are:

- Smart/AI-categorization of imported transactions

- The ability to create custom rules

- You can categorize and reconcile transactions at the same time

- Bulk transaction editing and reviewing

- Automatic receipt scanning with data extraction

Just like with ease-of-use, we awarded half a point if a provider didn’t quite nail the category but offered something close to what we tested for.

Now, you might be thinking what the heck do custom rules have to do with syncing?

Here’s an example to help.

Creating custom rules means you can specifically categorize transactions on autopilot that are the same each month. Like the gas bill for your home.

You can tell the software that if a transaction of a certain amount under a certain name comes in, it will get sorted properly without having to review and categorize it each month.

Another example is bulk transaction editing and reviewing. Some tools require you to edit or confirm transactions individually.

This feature means you don’t have to individually edit each transaction that might need to be adjusted or reviewed. Simply select all the ones you need to look at, group them together, and review or edit them at the same time.

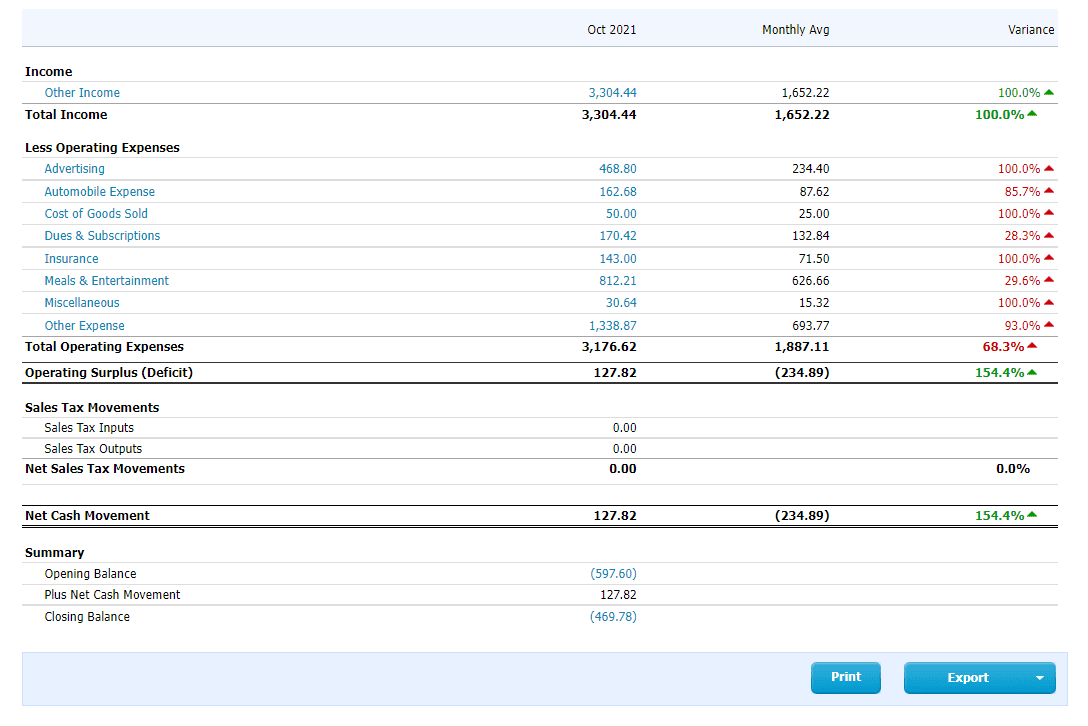

X-Ray Reporting and Visibility Into Your Books (20%)

Reporting helps you make better business decisions, gain clarity into where your money is going, and even help you identify areas where you can cut costs.

If you want to simplify tax season and make it easier on your specialists, reporting should be a priority.

Most of the providers on the list let you see all your books with full transparency and run reports specific to your needs.